当前位置:首页 > 用户服务 > 过刊查询 > 过刊查询中国财政年鉴 > 中国财政年鉴2007年卷 > 中国财政年鉴2007年卷文章 > 正文

当前位置:首页 > 用户服务 > 过刊查询 > 过刊查询中国财政年鉴 > 中国财政年鉴2007年卷 > 中国财政年鉴2007年卷文章 > 正文[大]

[中]

[小]

摘要:

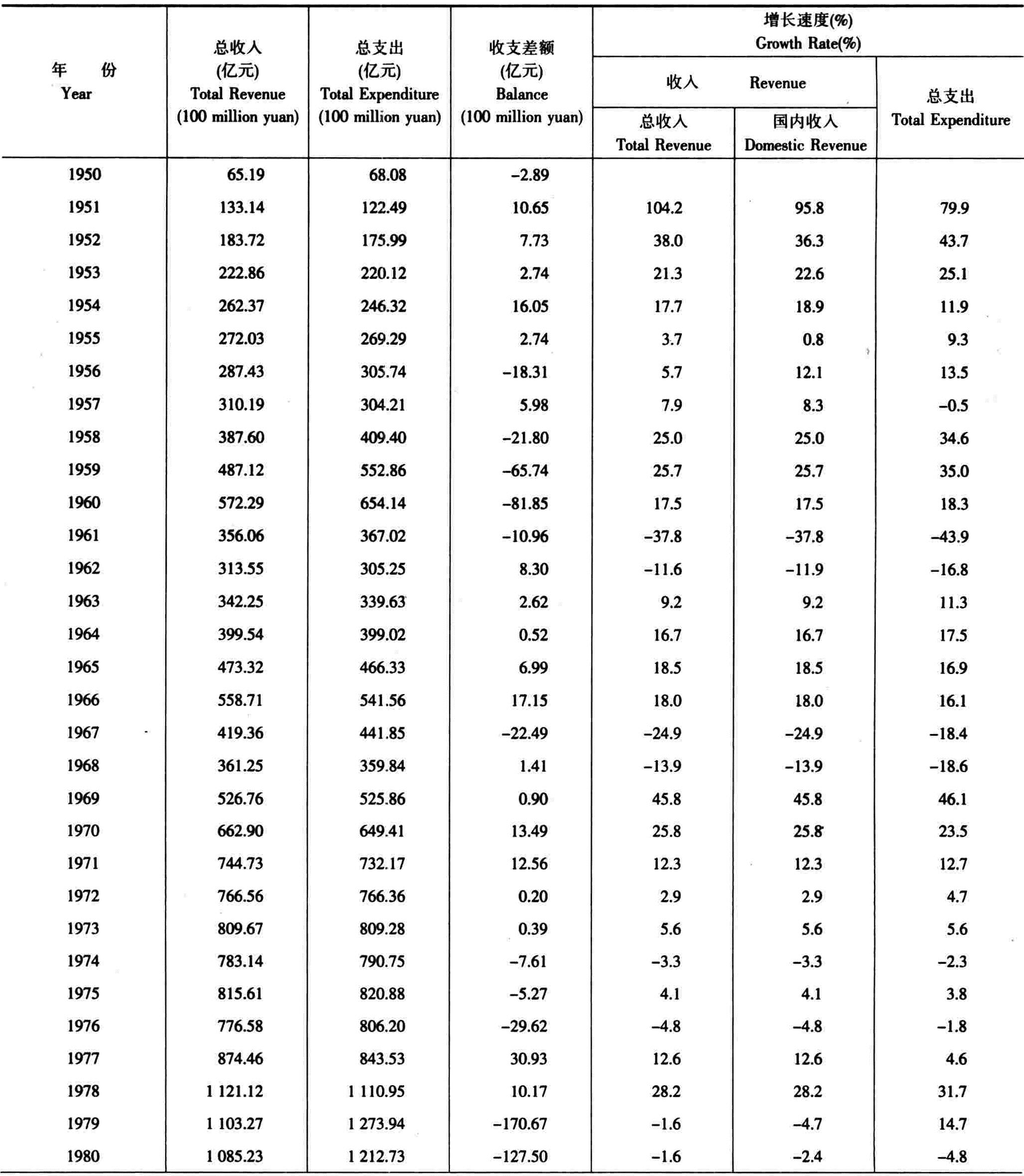

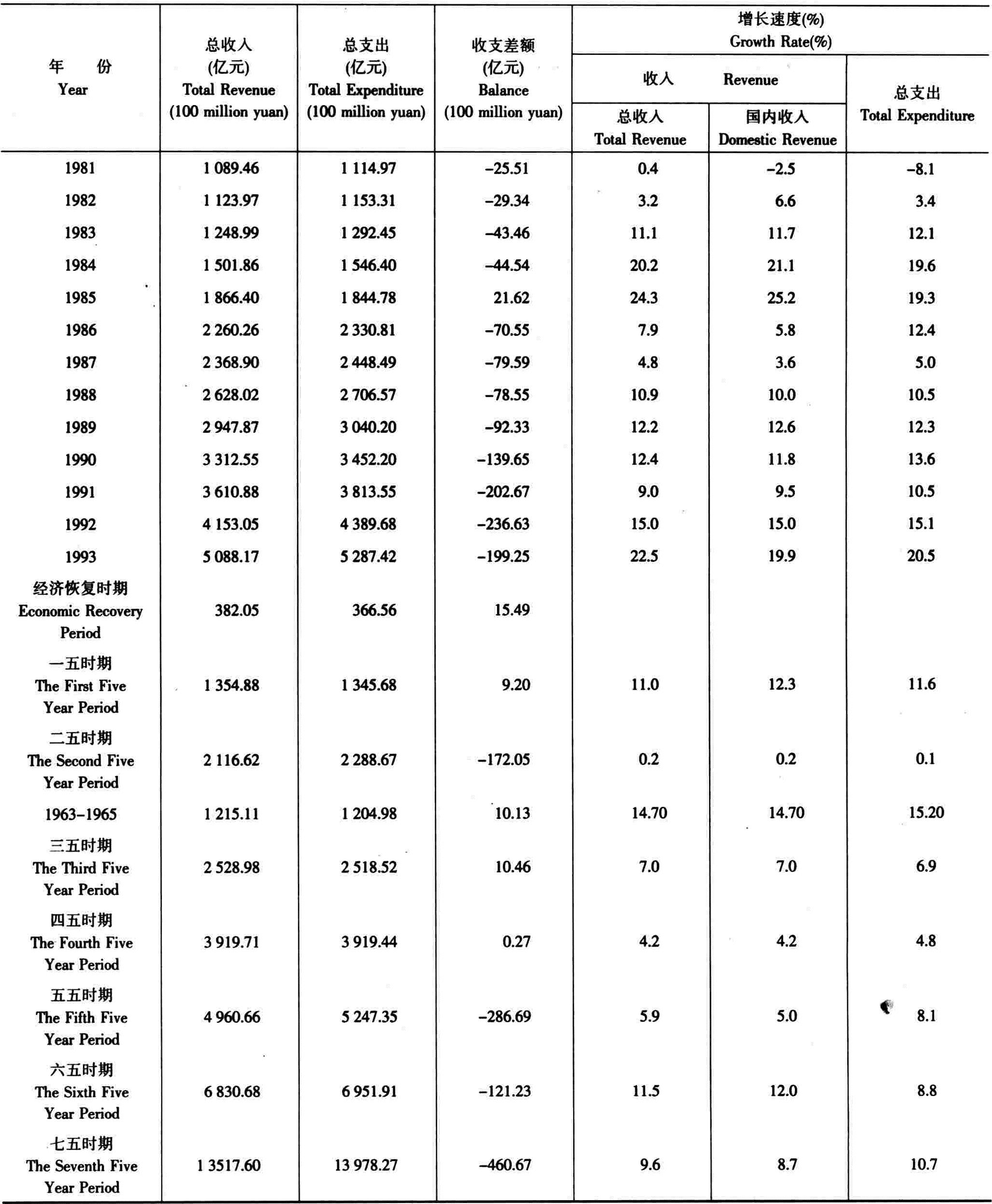

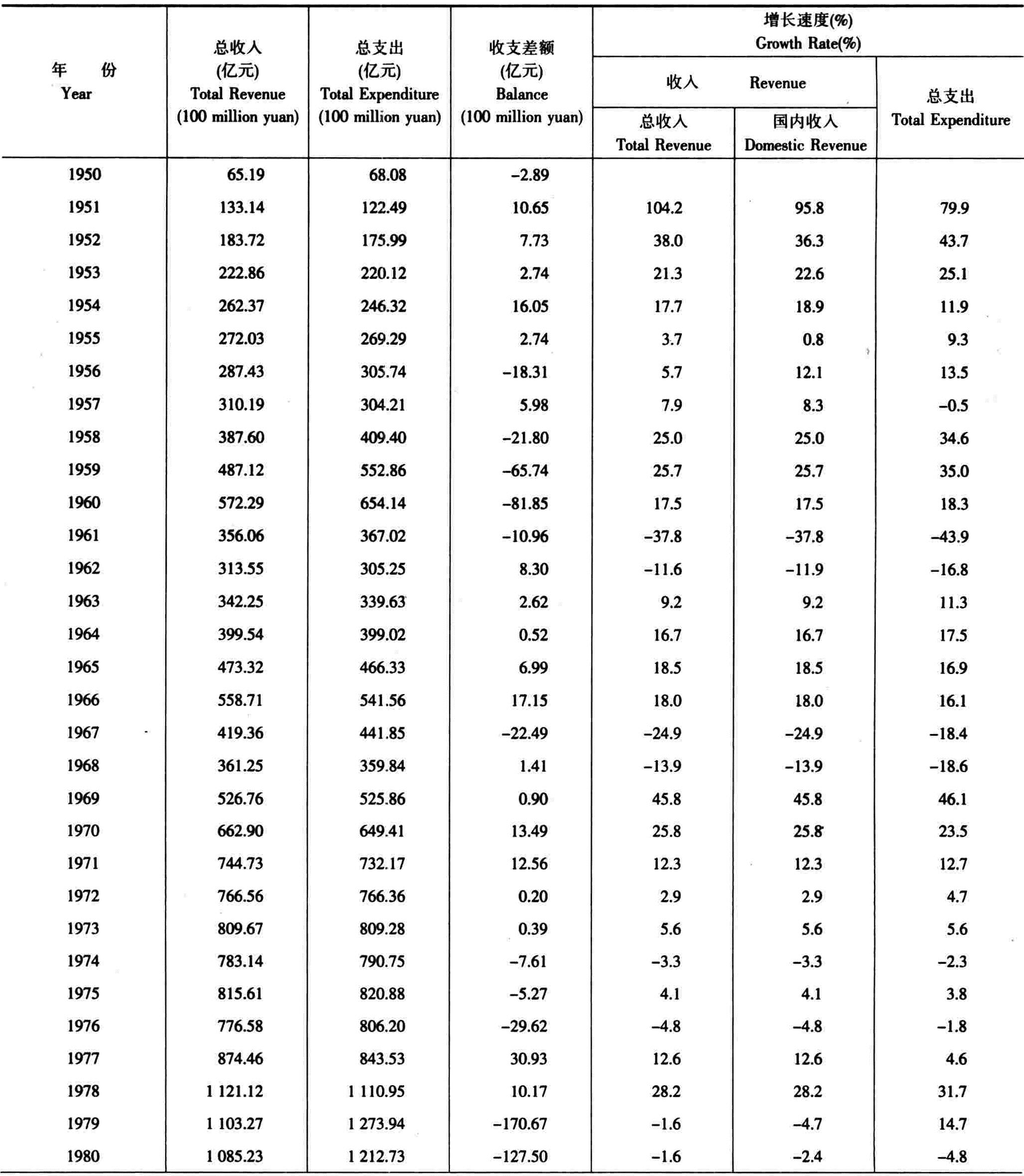

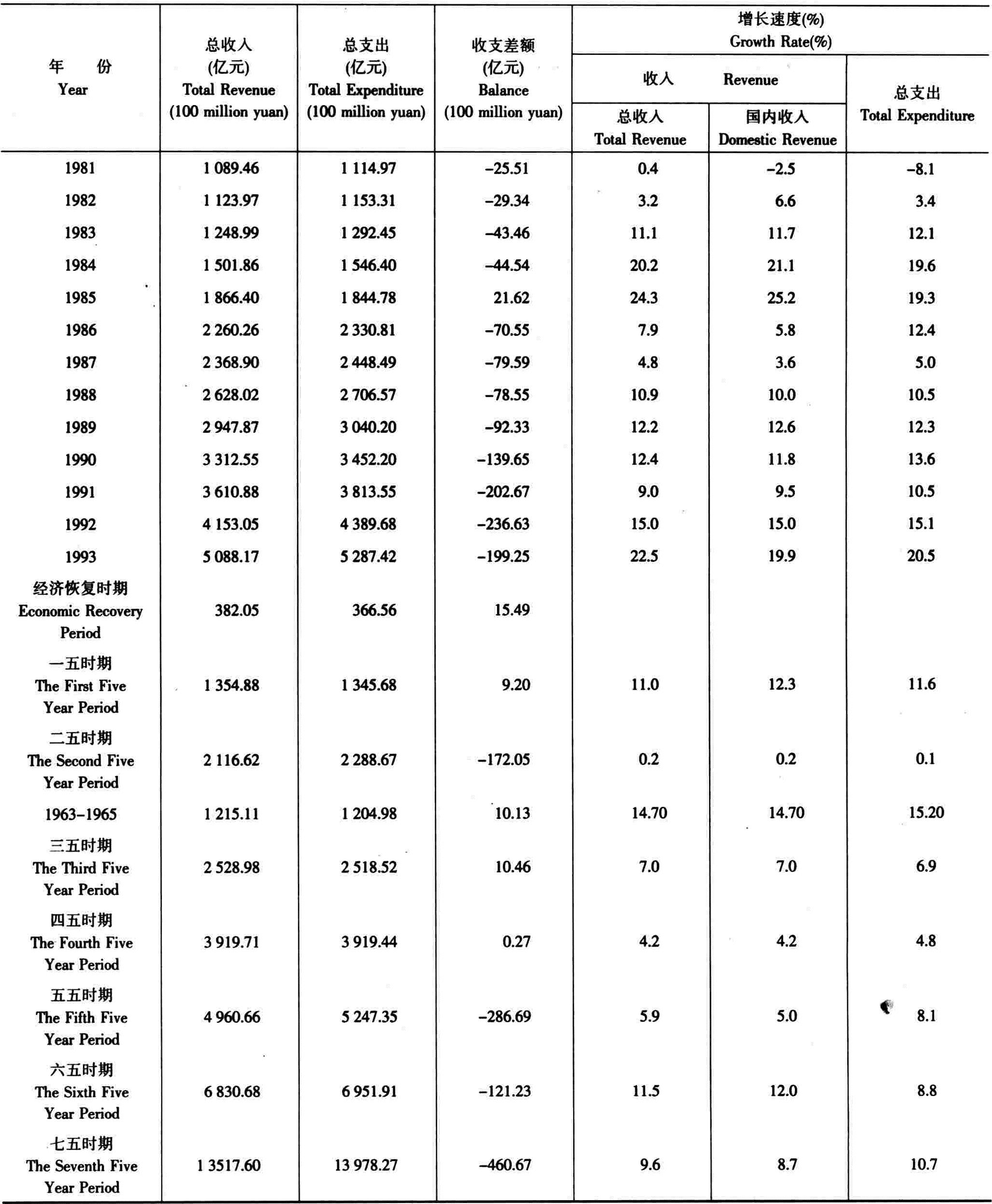

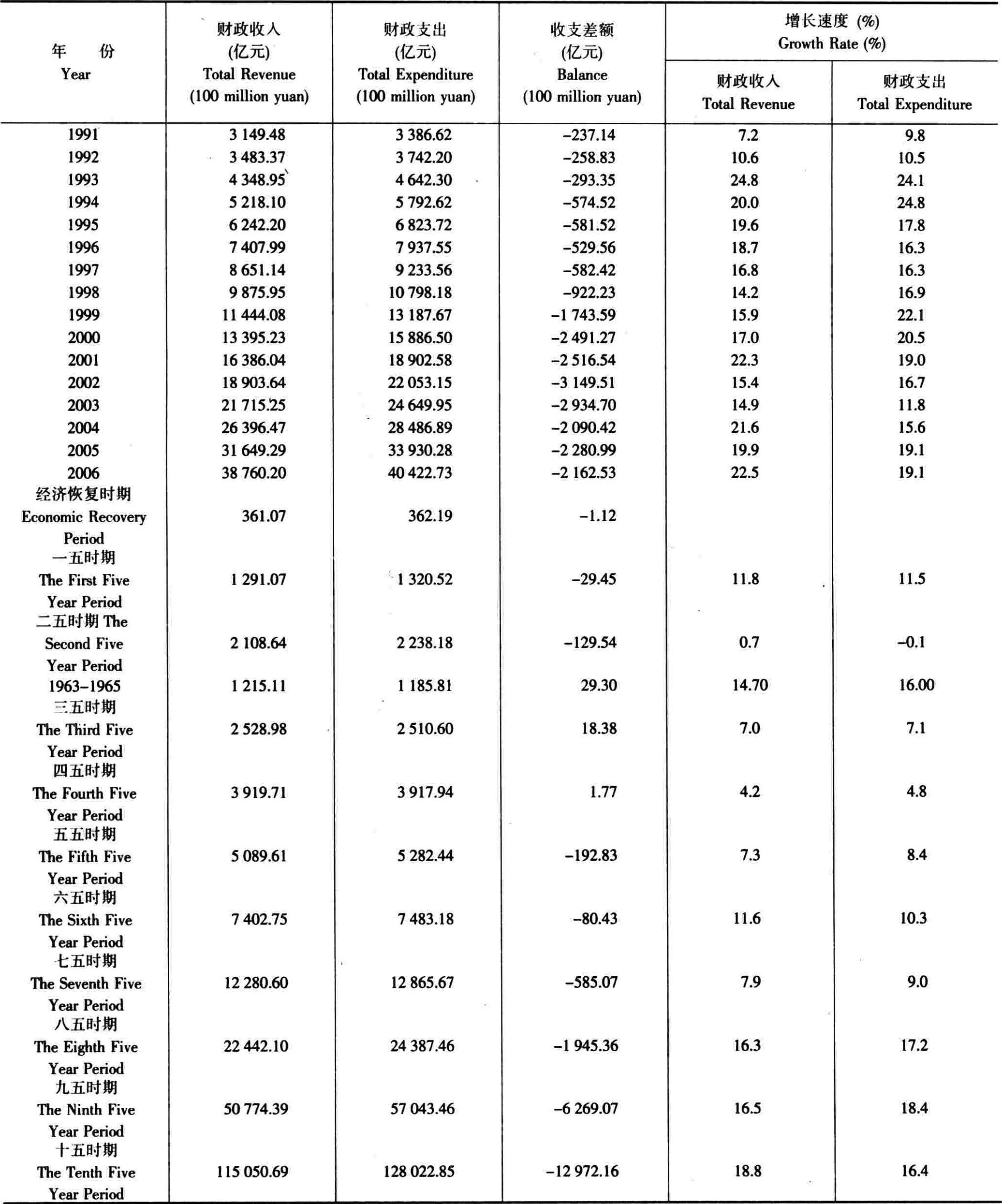

HISTORICAL ANNUAL REVENUES AND EXPENDITURES

国家财政收支总额及增长速度(包括国内外债务部分)

TOTAL BUDGETARY REVENUE AND EXPENDITURE AND THEIR GROWTH RATES(INCLUDING FOREIGN AND DOMESTIC DEBTS)

续表 Continued

注:1.本表总收入包括国内外债务收入,总支出中包括国内外债务还本付息支出和用国外借款安排的基本建设支出。国内收入增长速度是扣除国外借款收入计算的。

2.本表统计的是1994年以前的口径。自1994年起,国家财政收支不包括国内外债务部分,不再沿用此表。

Note:a)Total revenue include foreign and domestic debts revenue,total expenditure include payment for the principal and interest of foreign and do-mestic debts and expenditure for capital construction which is financed by debts....

续表 Continued

注:1.本表总收入包括国内外债务收入,总支出中包括国内外债务还本付息支出和用国外借款安排的基本建设支出。国内收入增长速度是扣除国外借款收入计算的。

2.本表统计的是1994年以前的口径。自1994年起,国家财政收支不包括国内外债务部分,不再沿用此表。

Note:a)Total revenue include foreign and domestic debts revenue,total expenditure include payment for the principal and interest of foreign and do-mestic debts and expenditure for capital construction which is financed by debts....HISTORICAL ANNUAL REVENUES AND EXPENDITURES

国家财政收支总额及增长速度(包括国内外债务部分)

TOTAL BUDGETARY REVENUE AND EXPENDITURE AND THEIR GROWTH RATES(INCLUDING FOREIGN AND DOMESTIC DEBTS)

续表 Continued

注:1.本表总收入包括国内外债务收入,总支出中包括国内外债务还本付息支出和用国外借款安排的基本建设支出。国内收入增长速度是扣除国外借款收入计算的。

2.本表统计的是1994年以前的口径。自1994年起,国家财政收支不包括国内外债务部分,不再沿用此表。

Note:a)Total revenue include foreign and domestic debts revenue,total expenditure include payment for the principal and interest of foreign and do-mestic debts and expenditure for capital construction which is financed by debts.The growth of domestic revenue is calculated by excluding foreign debts revenue.

b)The total revenue and expenditure have excluded the foreign and domestic debts since 1994,so this table wasn’t used any more.

续表 Continued

注:1.本表总收入包括国内外债务收入,总支出中包括国内外债务还本付息支出和用国外借款安排的基本建设支出。国内收入增长速度是扣除国外借款收入计算的。

2.本表统计的是1994年以前的口径。自1994年起,国家财政收支不包括国内外债务部分,不再沿用此表。

Note:a)Total revenue include foreign and domestic debts revenue,total expenditure include payment for the principal and interest of foreign and do-mestic debts and expenditure for capital construction which is financed by debts.The growth of domestic revenue is calculated by excluding foreign debts revenue.

b)The total revenue and expenditure have excluded the foreign and domestic debts since 1994,so this table wasn’t used any more.

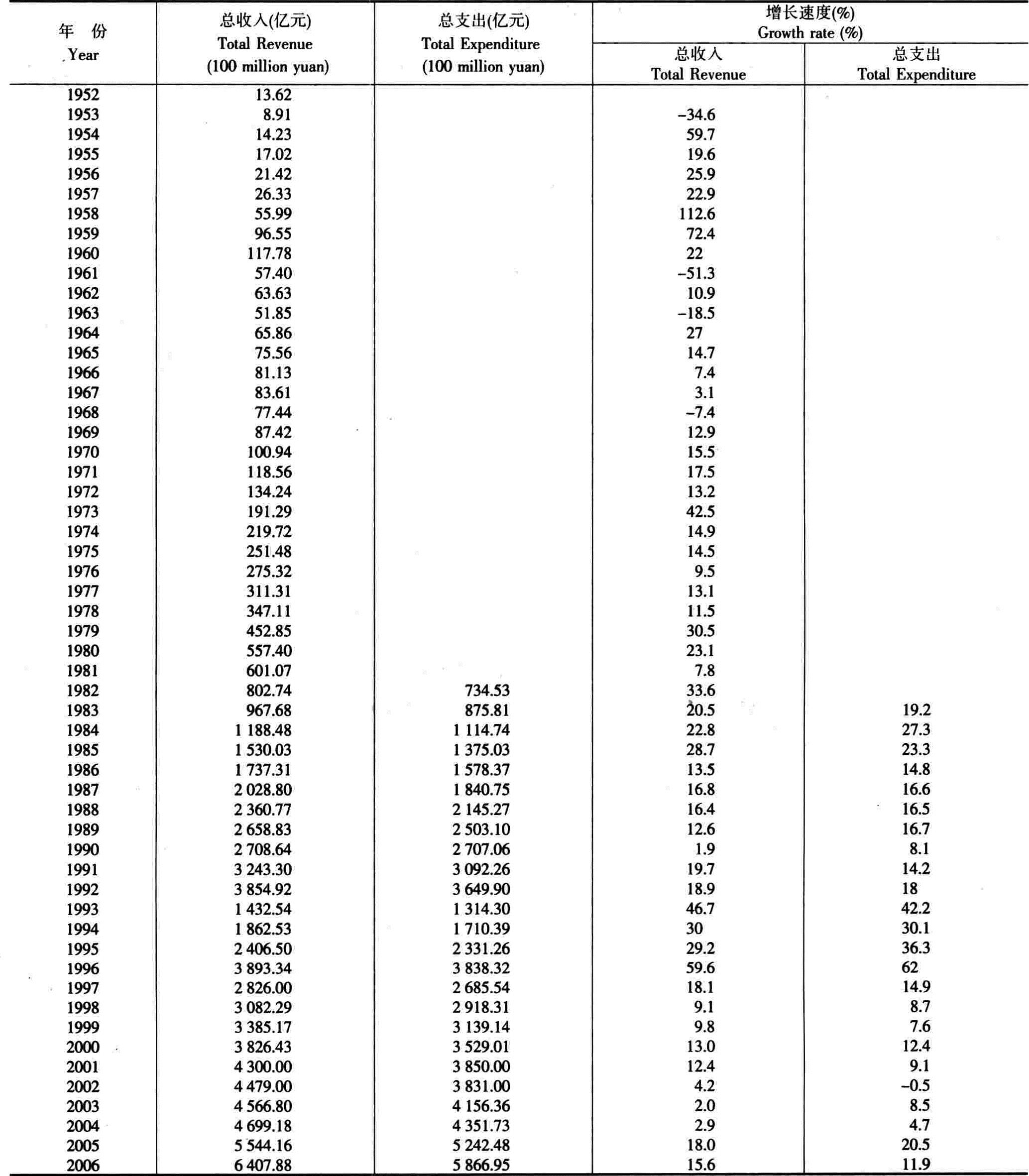

国家财政收支总额及增长速度(不包括国内外债务部分)

TOTAL BUDGETARY REVENUE AND EXPENDITURE AND THEIR GROWTH RATES(NOT INCLUDING FOREIGN AND DOMESTIC DEBTS)

续表 Continued

注:1.在国家财政收支中,价格补贴1985年以前冲减财政收入,1986年以后列为财政支出。为了可比,本表将1985年以前冲减财政收入的价格补贴改列在财政支出中。

2.从2000年起,财政支出中包括国内外债务付息支出。以下各表中涉及财政支出的数据均为此口径。

Note:a)Among budgetary revenue and expenditure,price subsidies were list as negative revenue item prior to 1986,and they have been listed as expenditure since 1986.For the comparison,the price subsidies prior to 1986 are listed as expenditure item in this table.

b)Since 2000,the budgetary expenditure included the payment for interest of foreign and domestic debt,and the budgetary expenditure in other tables below is consistent with this definition.

续表 Continued

注:1.在国家财政收支中,价格补贴1985年以前冲减财政收入,1986年以后列为财政支出。为了可比,本表将1985年以前冲减财政收入的价格补贴改列在财政支出中。

2.从2000年起,财政支出中包括国内外债务付息支出。以下各表中涉及财政支出的数据均为此口径。

Note:a)Among budgetary revenue and expenditure,price subsidies were list as negative revenue item prior to 1986,and they have been listed as expenditure since 1986.For the comparison,the price subsidies prior to 1986 are listed as expenditure item in this table.

b)Since 2000,the budgetary expenditure included the payment for interest of foreign and domestic debt,and the budgetary expenditure in other tables below is consistent with this definition.

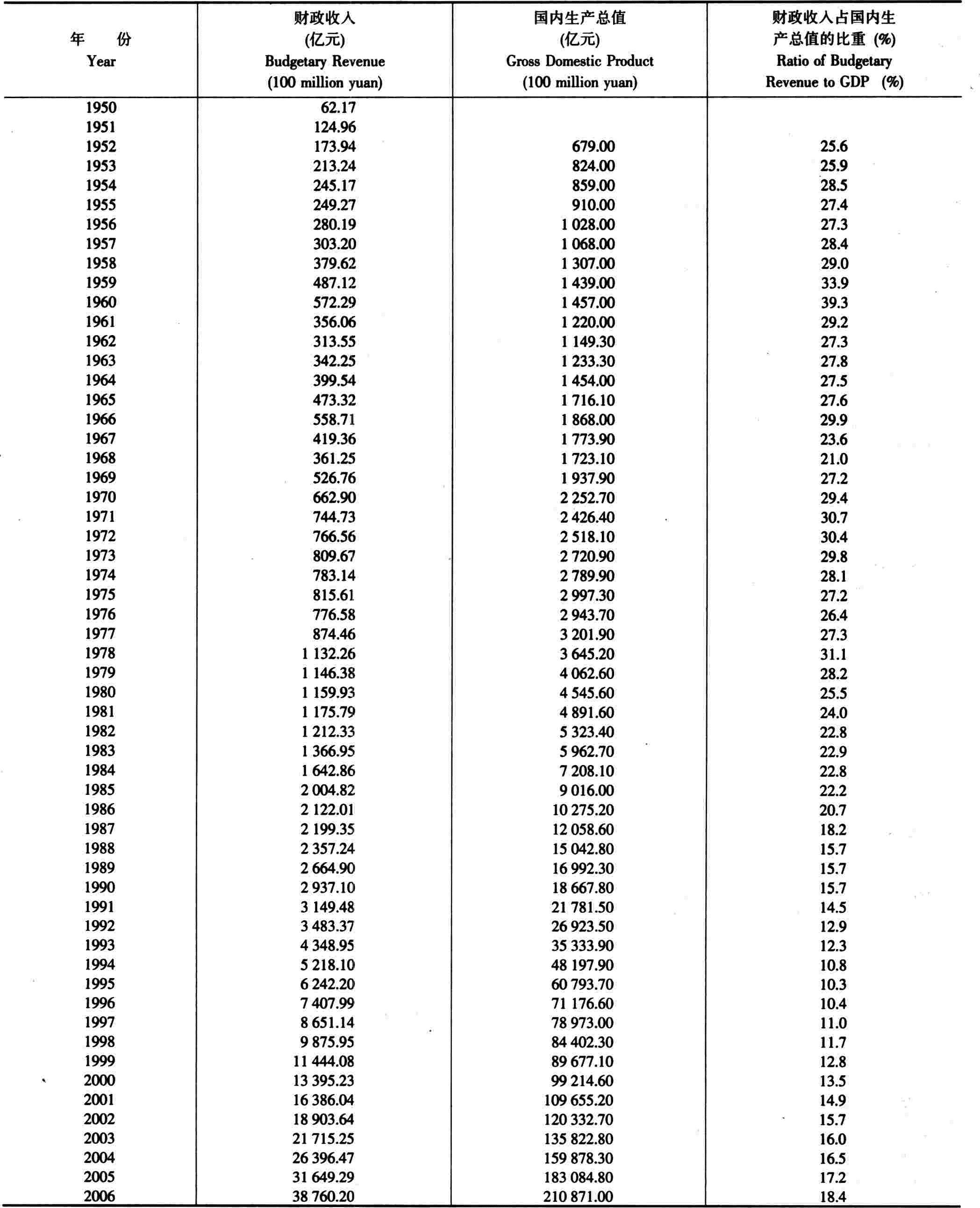

国家财政收入占国内生产总值的比重

RATIO OF BUDGETARY REVENUE TO GROSS DOMESTIC PRODUCT

注:本表财政收入中不包括国内外债务收入。

Note:Budgetary revenue excludes domestic and foreign debts in this table.

注:本表财政收入中不包括国内外债务收入。

Note:Budgetary revenue excludes domestic and foreign debts in this table.

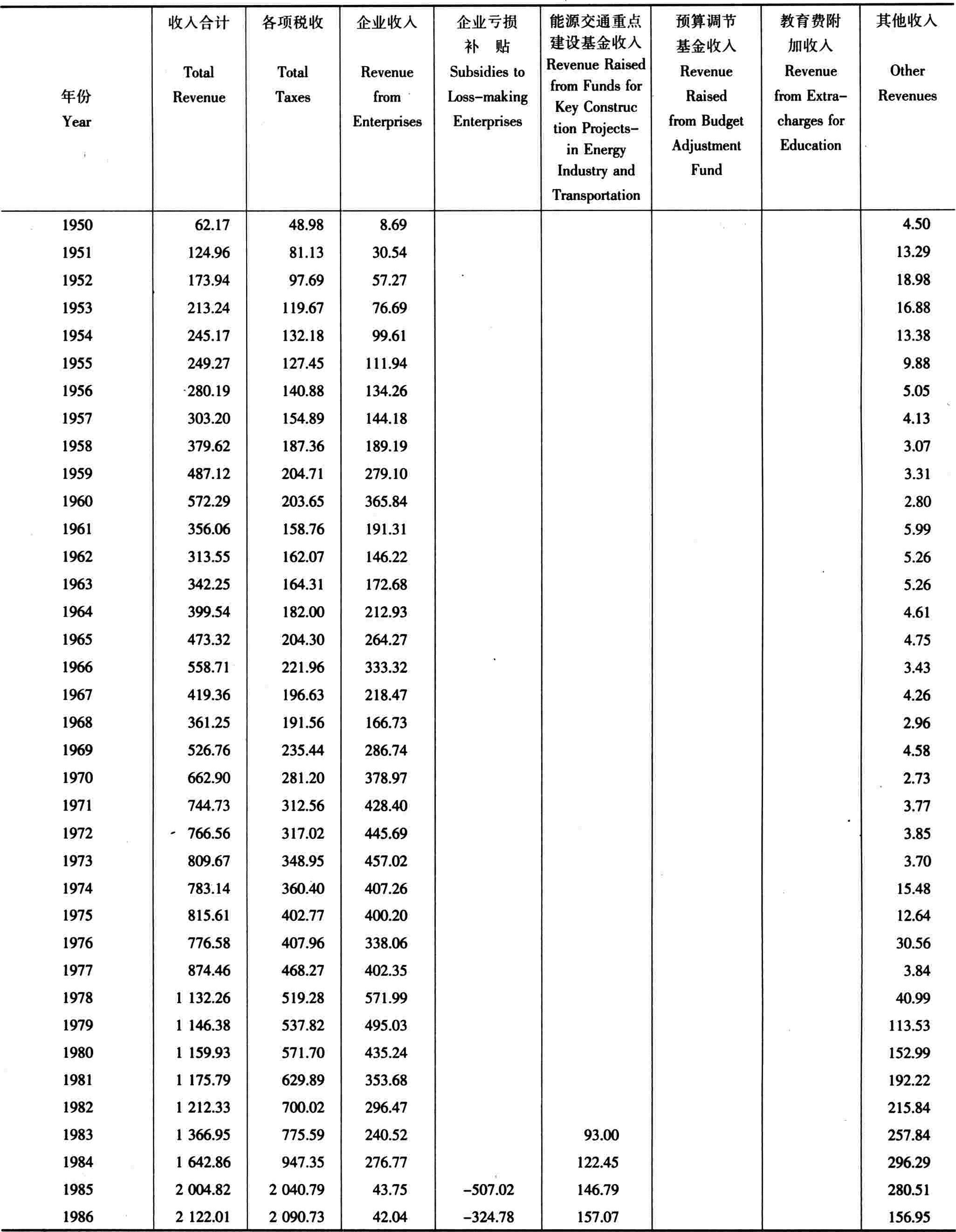

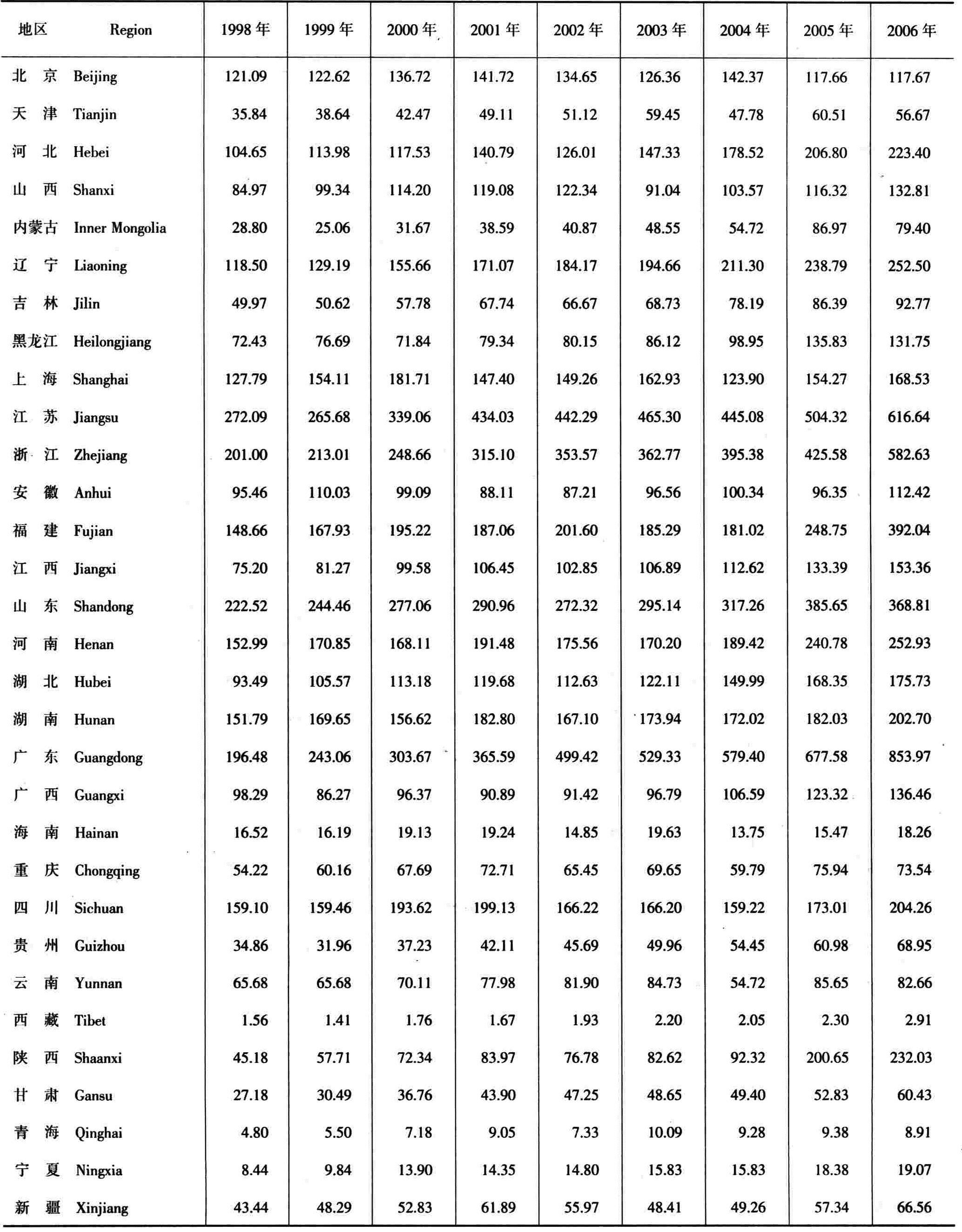

各地区财政收入占国内生产总值的比例

PROPORTION OF BUDGETARY REVENUE OVER GDP BY REGION

单位:% Unit:%

注:本表中各地区财政收入为地方本级收入加上消费税和增值税75%的部分。

Note:The revenue in this table is local level plus consumption tax and75%VAT.

单位:% Unit:%

注:本表中各地区财政收入为地方本级收入加上消费税和增值税75%的部分。

Note:The revenue in this table is local level plus consumption tax and75%VAT.

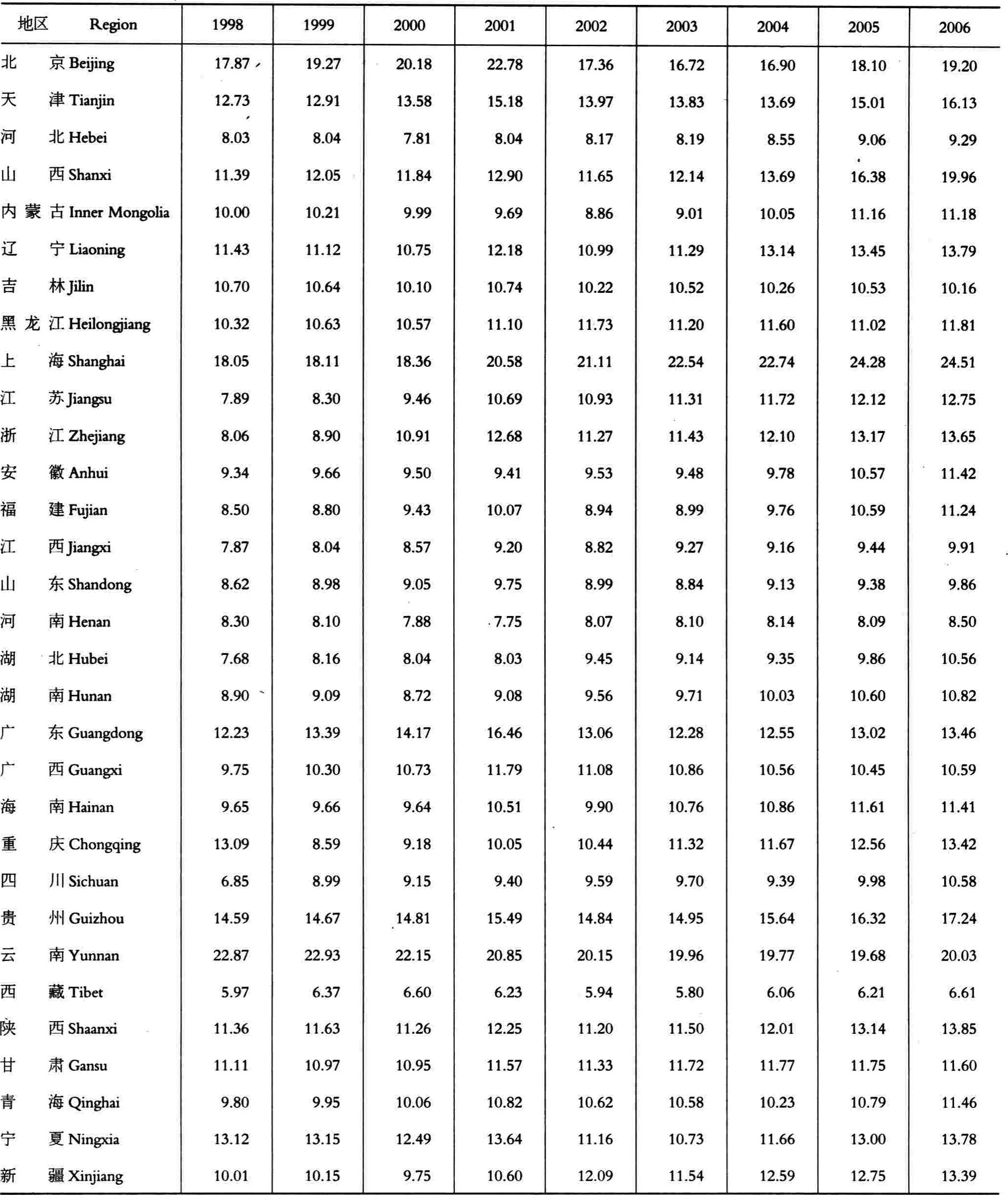

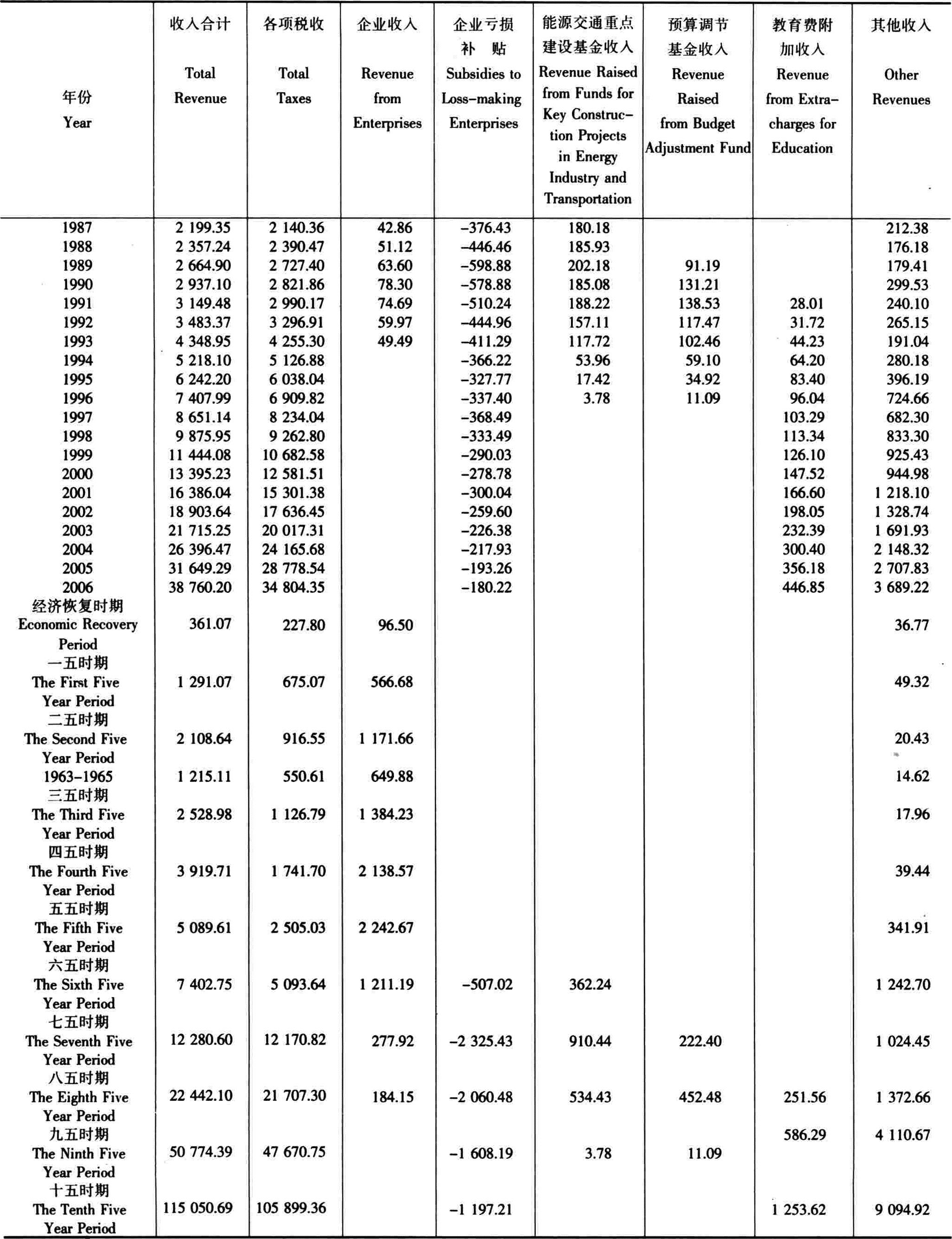

国家财政分项目收入

BUDGETARY REVENUE BY ITEM

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

注:本表财政收入中不包括国内外债务收入。

Note:Budgetary revenue excludes domestic and foreign debts in this table.

续表 Continued

注:本表财政收入中不包括国内外债务收入。

Note:Budgetary revenue excludes domestic and foreign debts in this table.

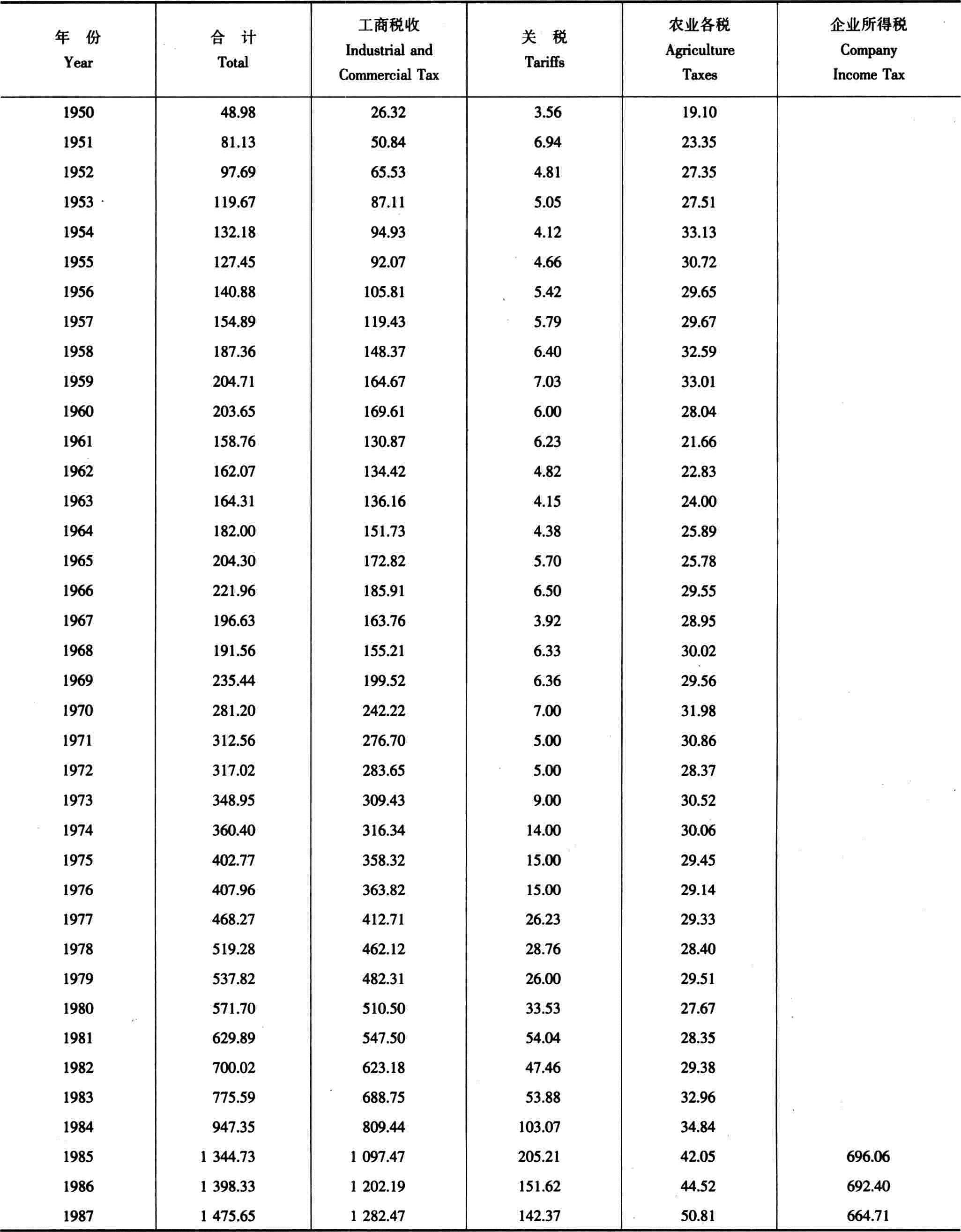

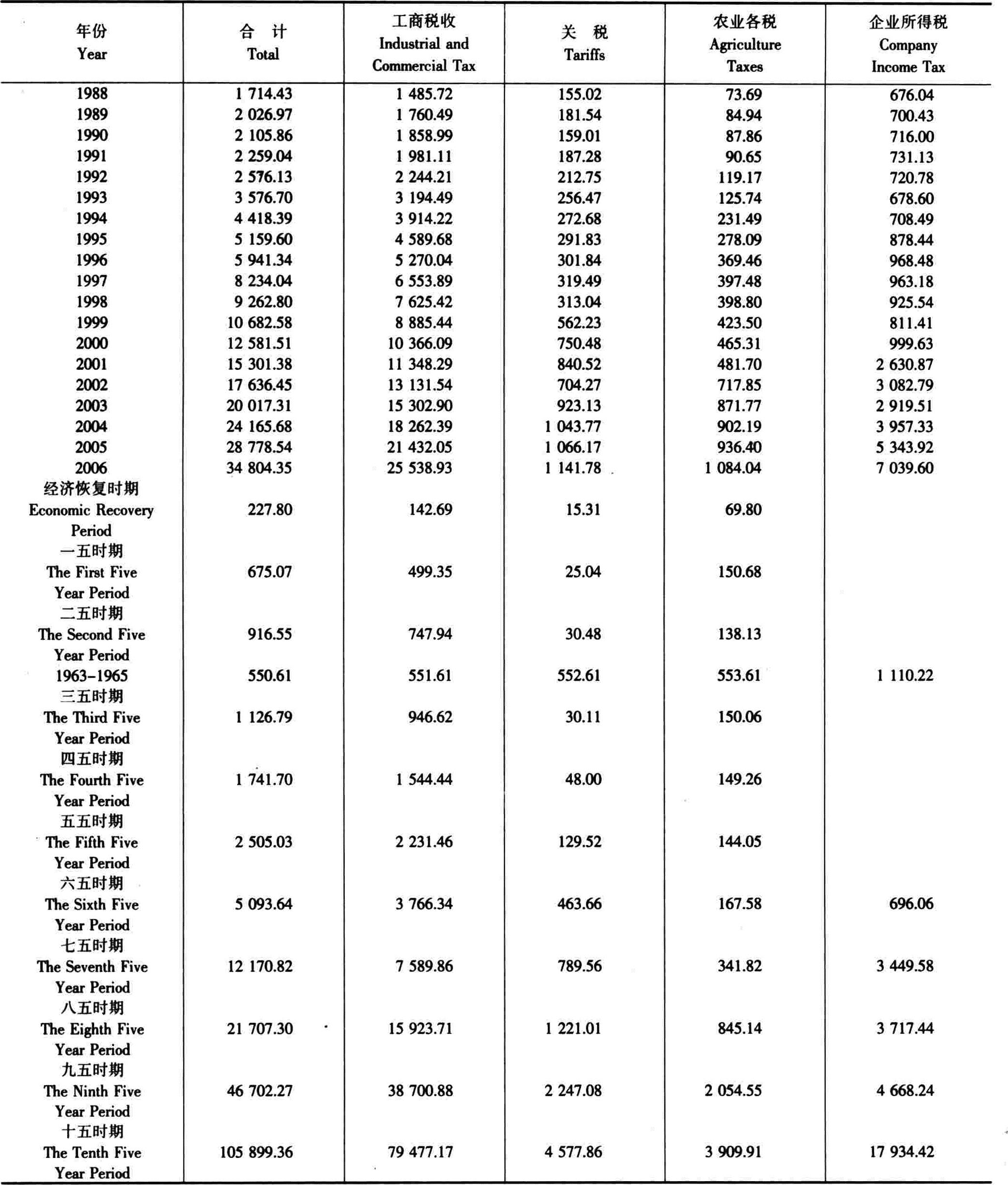

各项税收收入

GOVERNMENT TAXES REVENUE

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

注:1.农业各税包括农业税、牧业税、耕地占用税、农业特产税和契税。

2.企业所得税2001年以前只包括国有及集体企业所得税,从2001年起,企业所得税还包括除国有企业和集体企业外的其他所有制企业所得税,与以前各年不可比。

Note:a)The agriculture taxes include agriculture tax,animal husbandry tax,tax on the use of cultivated land,the taxes on special agriculture and forests product and contract taxes.

b)Before2001,the company income tax only included state-owned and collective-owned enterprises income tax.Since 2001,the company in-come tax also includes the income tax levied on other enterprises except for state-owned and collective-owned enterprises,the figures are not comparable with the previous years.

续表 Continued

注:1.农业各税包括农业税、牧业税、耕地占用税、农业特产税和契税。

2.企业所得税2001年以前只包括国有及集体企业所得税,从2001年起,企业所得税还包括除国有企业和集体企业外的其他所有制企业所得税,与以前各年不可比。

Note:a)The agriculture taxes include agriculture tax,animal husbandry tax,tax on the use of cultivated land,the taxes on special agriculture and forests product and contract taxes.

b)Before2001,the company income tax only included state-owned and collective-owned enterprises income tax.Since 2001,the company in-come tax also includes the income tax levied on other enterprises except for state-owned and collective-owned enterprises,the figures are not comparable with the previous years.

产品税、增值税、营业税和消费税收入

REVENUES FROM PRODUCT TAX,VALUE ADDED TAX,BUSINESS TAX AND CONSUMPTION TAX

单位:亿元 Unit:100 million yuan

注:1.1994年税制改革后,流转税由增值税、消费税和营业税组成,取消产品税。

2.增值税不包括进口产品增值税;消费税不包括进口产品消费税。

Note:a)After1994,the product tax was abolished and the circulating tax is composed of the value added tax,consumption tax and business tax.

b)Value-added tax excludes value-added tax on import.Consumption tax excludes consumption tax on imports.

单位:亿元 Unit:100 million yuan

注:1.1994年税制改革后,流转税由增值税、消费税和营业税组成,取消产品税。

2.增值税不包括进口产品增值税;消费税不包括进口产品消费税。

Note:a)After1994,the product tax was abolished and the circulating tax is composed of the value added tax,consumption tax and business tax.

b)Value-added tax excludes value-added tax on import.Consumption tax excludes consumption tax on imports.

农业主要税收收入

REVENUE FROM TAXES IN AGRICULTURAL SECTOR

单位:亿元 Unit:100 million yuan

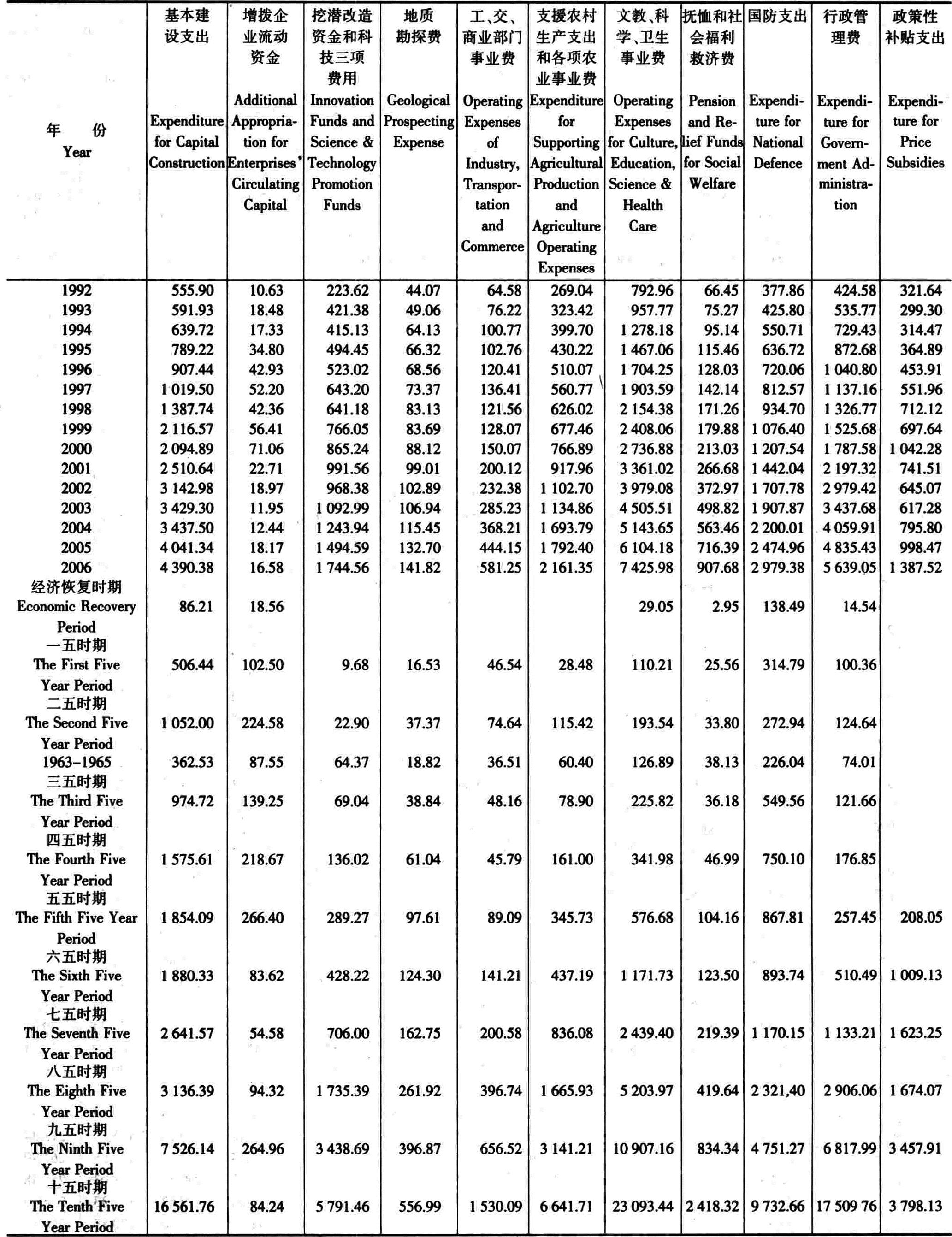

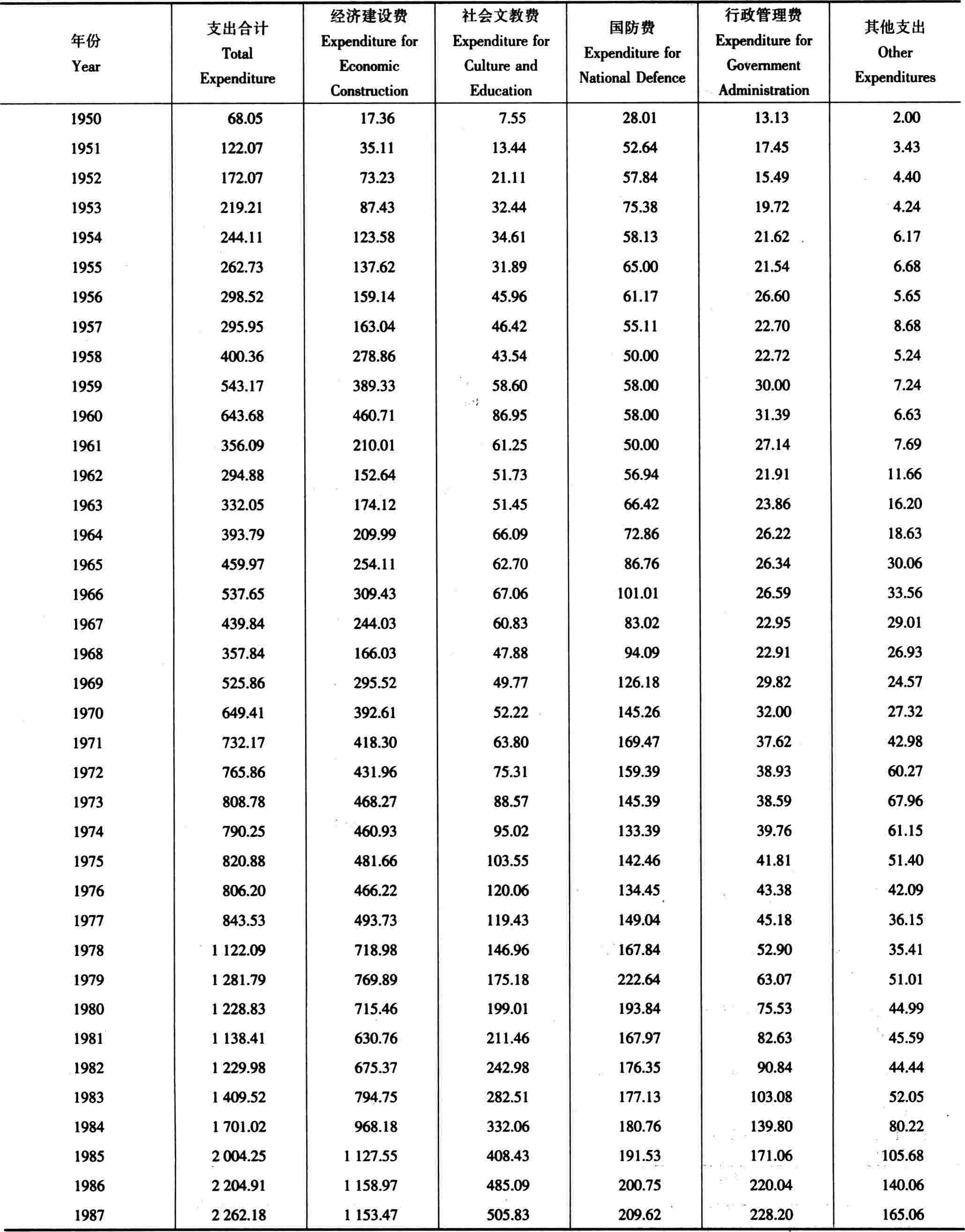

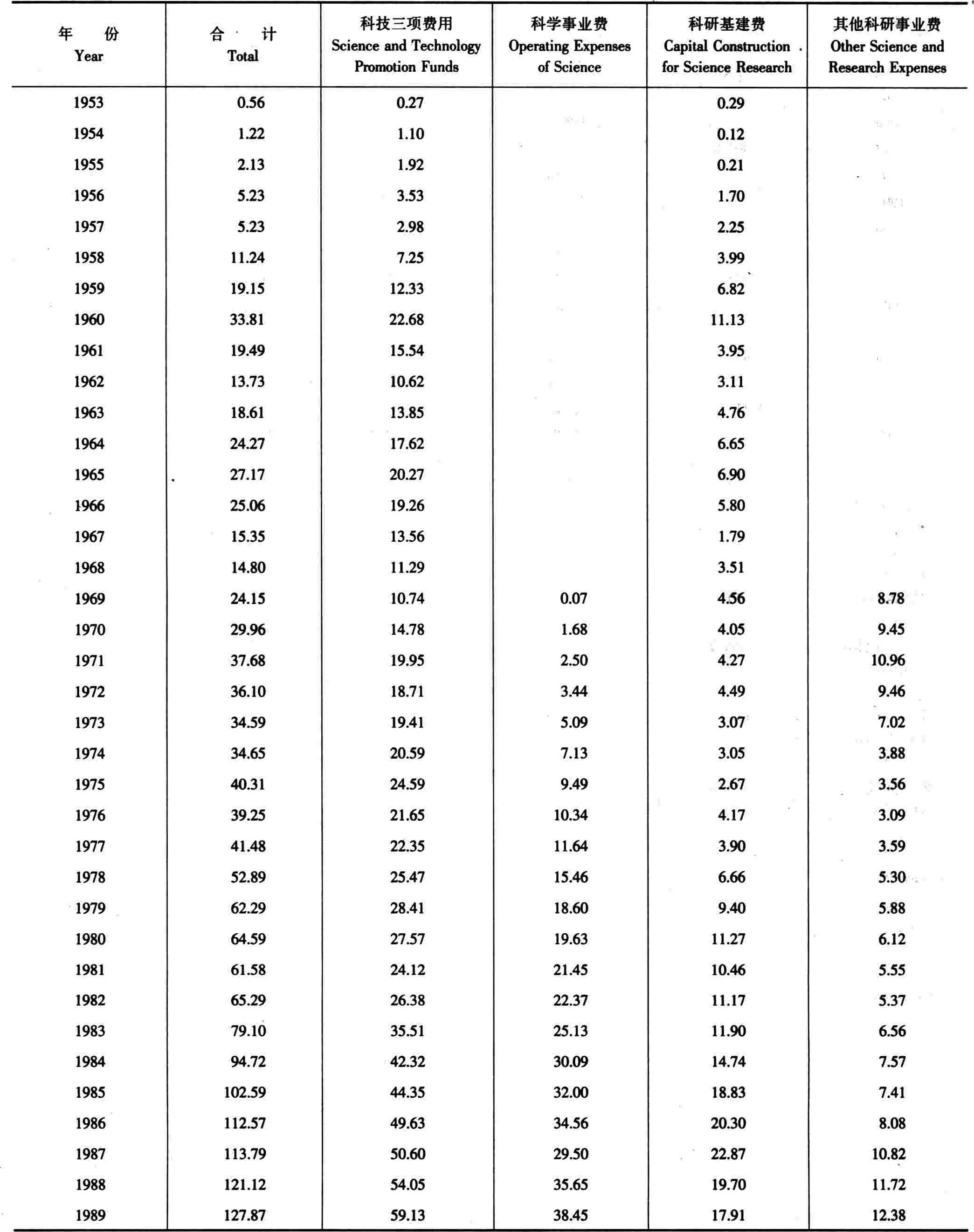

单位:亿元 Unit:100 million yuan国家财政主要支出项目

BUDGETARY EXPENDITURE BY MAIN ITEM

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

注:行政管理费中包括公检法司支出和外交外事支出。

Note:Expenditure for government administration include:expenditure on public security agency,procuratorial work,the court of justice and for foreign affairs.

续表 Continued

注:行政管理费中包括公检法司支出和外交外事支出。

Note:Expenditure for government administration include:expenditure on public security agency,procuratorial work,the court of justice and for foreign affairs.

国家财政按功能性质分类的支出

BUDGETARY EXPENDITURE BY FUNCTION

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

注:本表数字不包括国内外债务还本付息支出和用国外借款收入安排的基本建设支出。

Note:The expenditure for the payment of the principal and interest of domestic and foreign debts and the expenditure for capital construction hanced by foreign loansare excluded in this table

续表 Continued

注:本表数字不包括国内外债务还本付息支出和用国外借款收入安排的基本建设支出。

Note:The expenditure for the payment of the principal and interest of domestic and foreign debts and the expenditure for capital construction hanced by foreign loansare excluded in this table

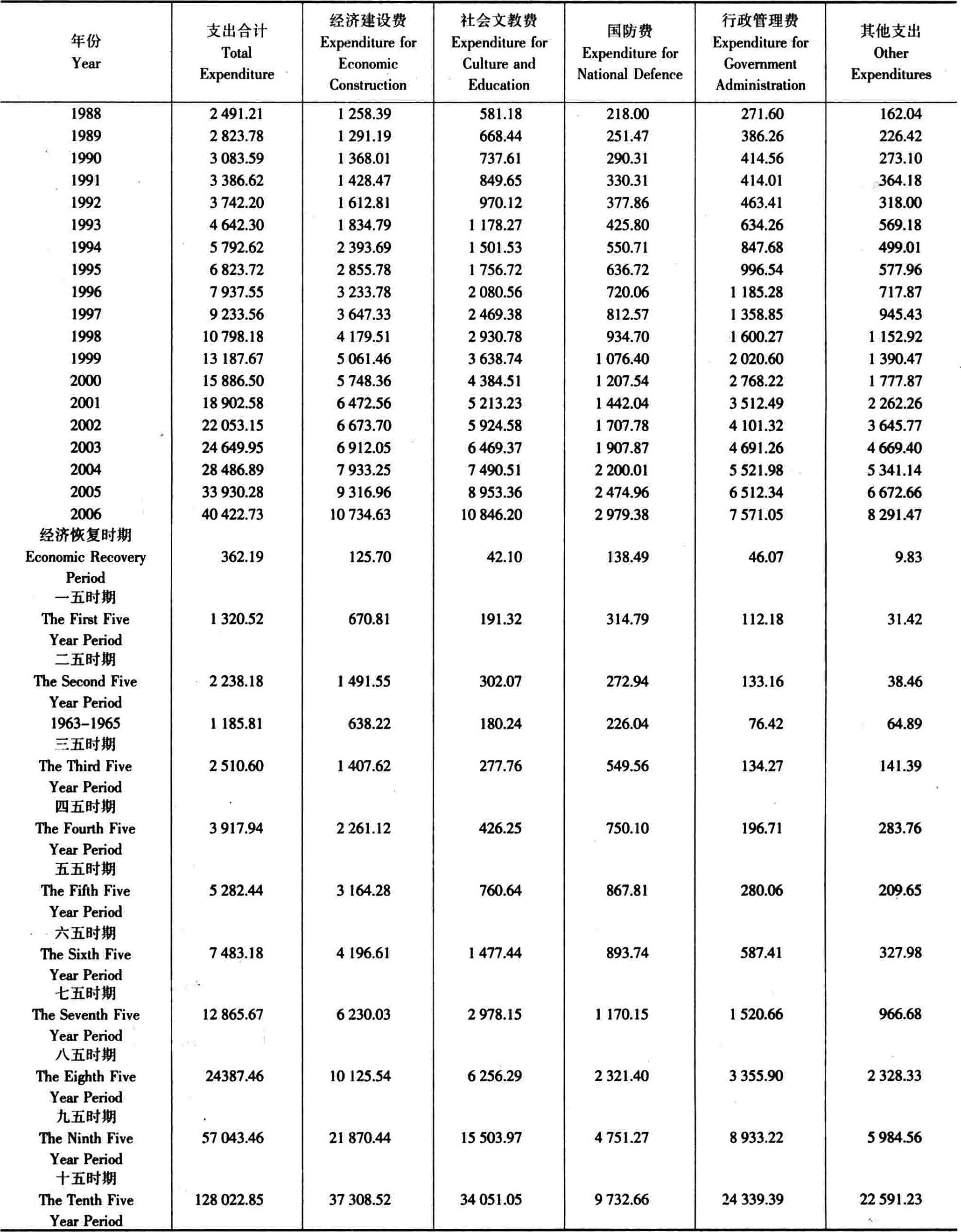

国家财政用于农业的支出

BUDGETARY EXPENDITURE ON AGRICULTURE

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

注:1.从1998年开始,“农业基本建设支出”包括增发国债安排的支出。1999年国家财政用于农业的支出比上年略有减少,主要是增发国债安排的农业基本建设支出减少所致。

2.其他各项包括新型农村合作医疗和补助村民委员会支出等

Note:a)The item“expenditure for agricultural capital construction”has included the expenditure financed by government debt since1998.The expendi-ture for agriculture decreased slightly mainly because the expenditure for agricultural capital construction from the increased national debt decreased in1999.

b)Expenditure for others includes expenditure on the new cooperative medical care,subsidiary to villager’s cpmmittee,etc.

续表 Continued

注:1.从1998年开始,“农业基本建设支出”包括增发国债安排的支出。1999年国家财政用于农业的支出比上年略有减少,主要是增发国债安排的农业基本建设支出减少所致。

2.其他各项包括新型农村合作医疗和补助村民委员会支出等

Note:a)The item“expenditure for agricultural capital construction”has included the expenditure financed by government debt since1998.The expendi-ture for agriculture decreased slightly mainly because the expenditure for agricultural capital construction from the increased national debt decreased in1999.

b)Expenditure for others includes expenditure on the new cooperative medical care,subsidiary to villager’s cpmmittee,etc.

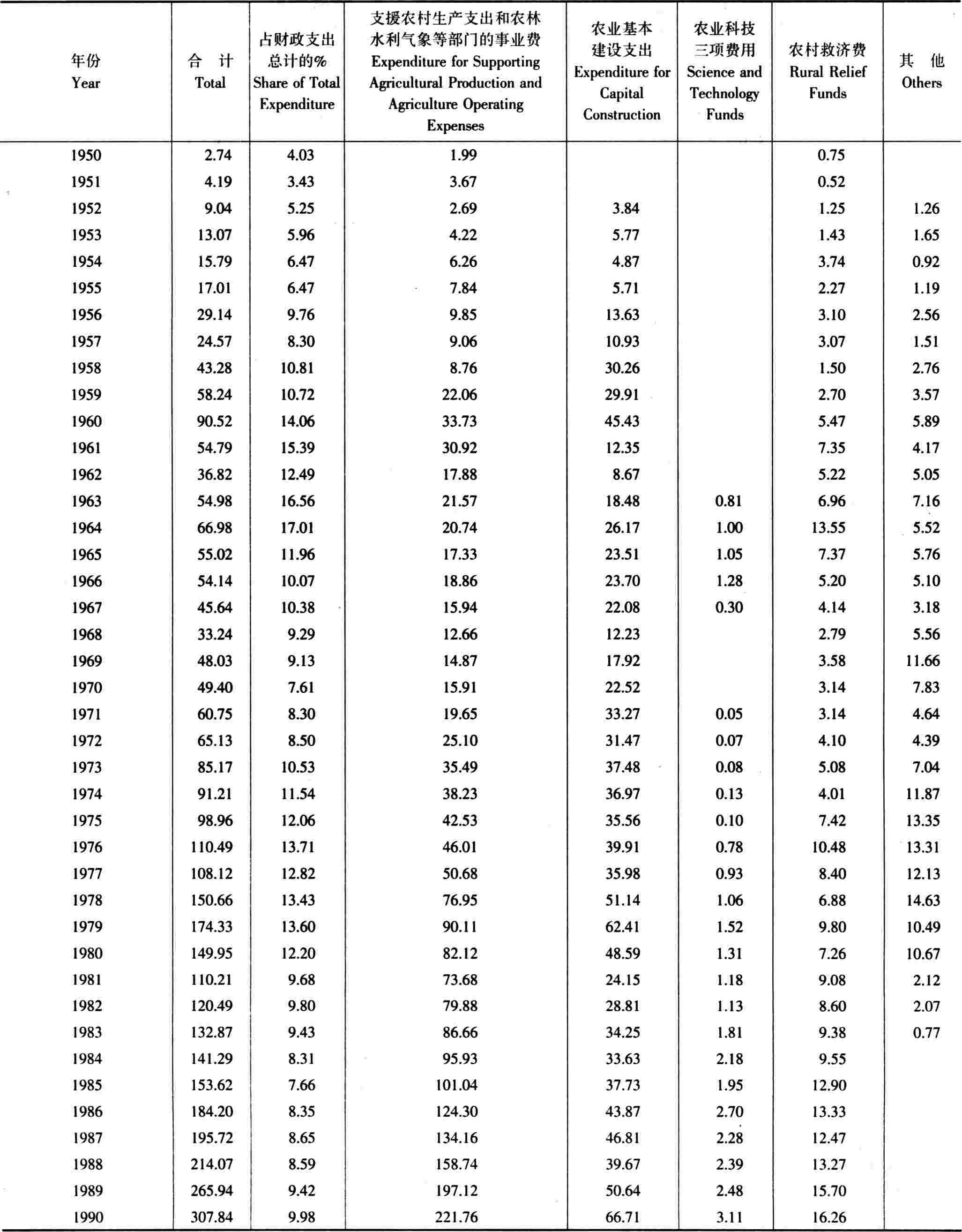

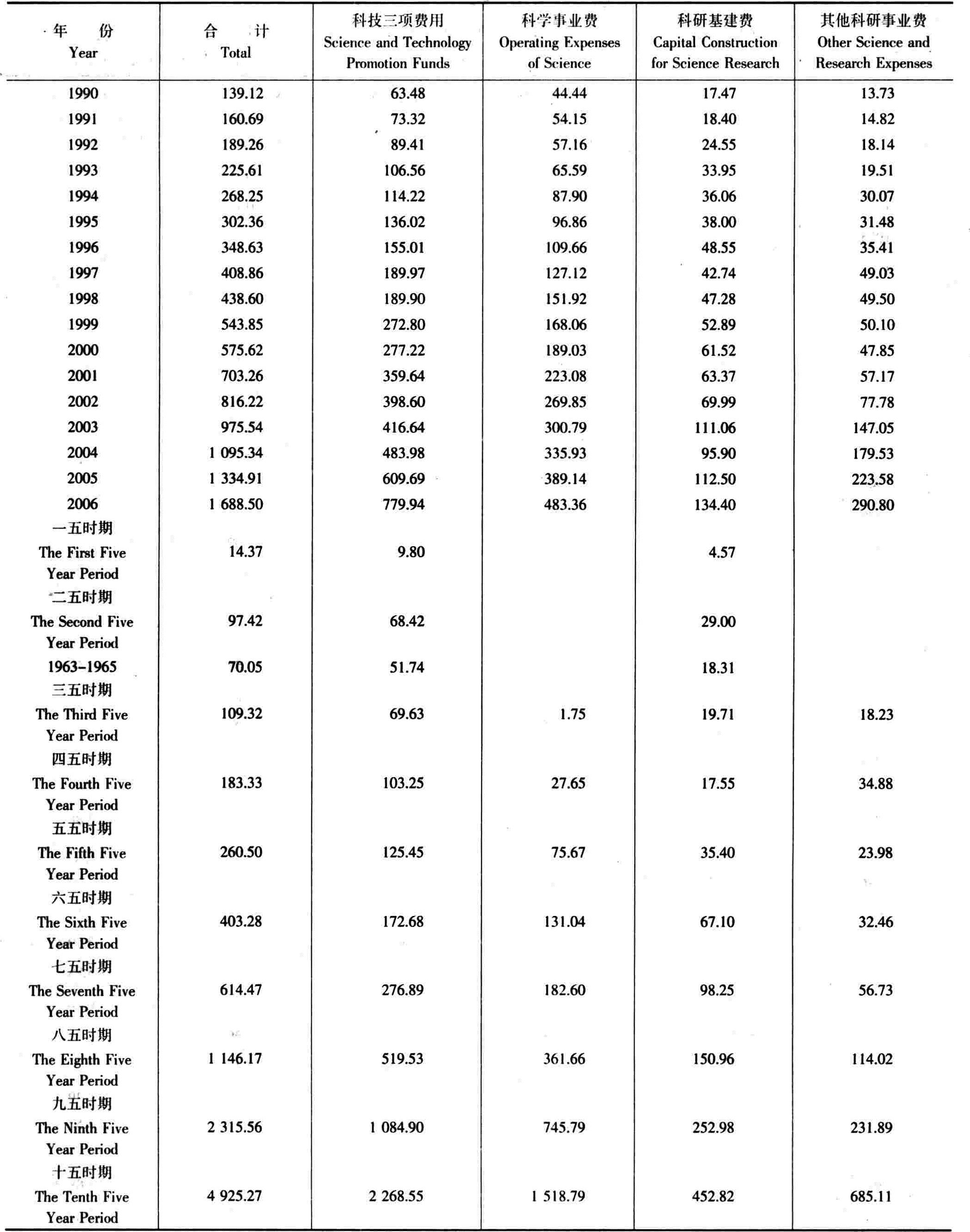

国家财政用于科学研究的支出

BUDGETARY EXPENDITURE ON SCIENCE AND RESEARCH

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

注:1953-1968年“科技三项费用”包括“科学事业费”。

Note:From 1953 to 1968,“Expenditure for science and technology promotion”included“Science operating expense”.

续表 Continued

注:1953-1968年“科技三项费用”包括“科学事业费”。

Note:From 1953 to 1968,“Expenditure for science and technology promotion”included“Science operating expense”.

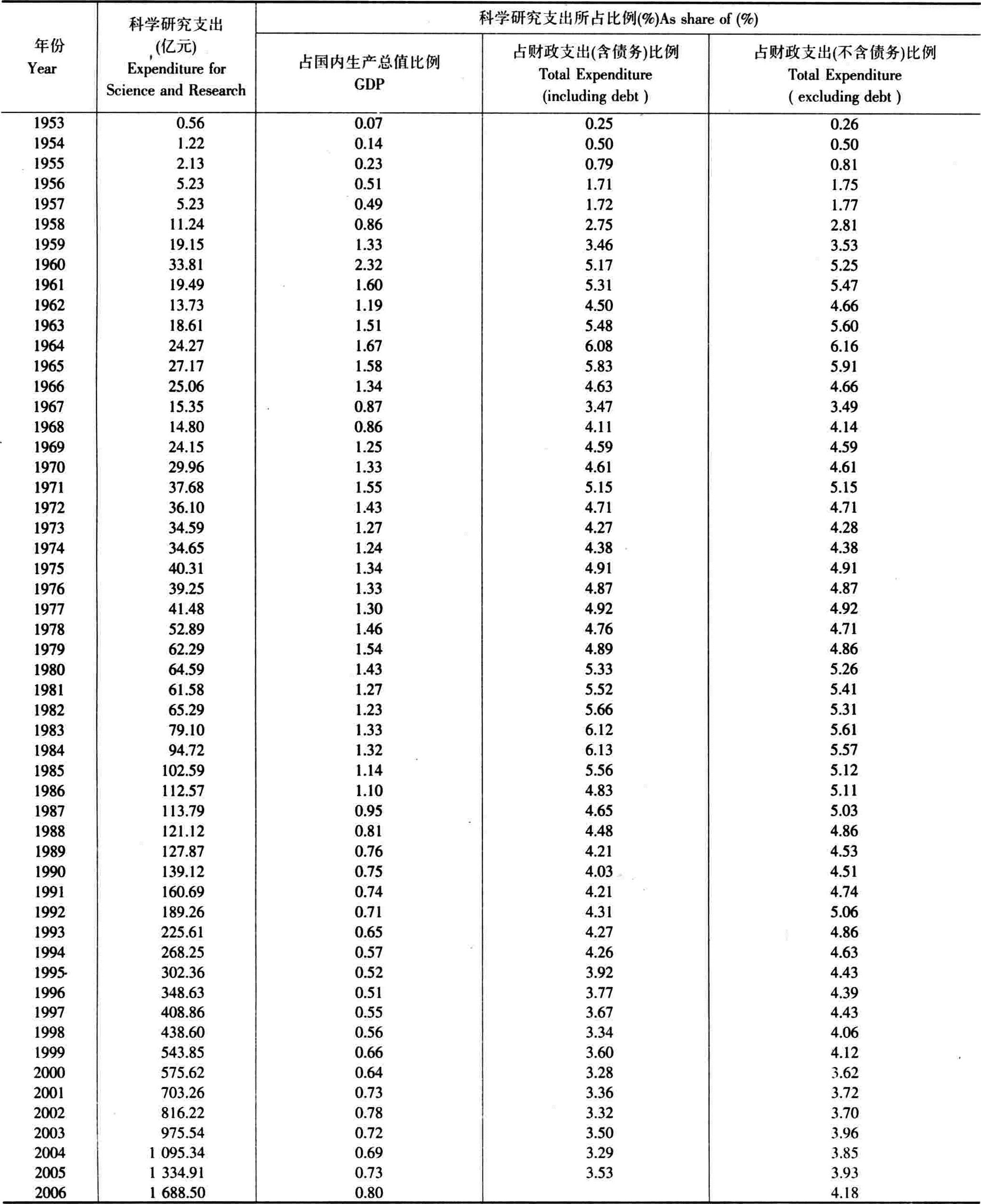

国家财政用于科学研究的支出与有关指标的比例

BUDGETARY EXPENDITURE ON SCIENCE AND RESEARCH AS SHARE OF RELEVANT INDICATORS

注:从2006年起实行债务余额管理,国家财政预决算不再反映债务还本支出。

Note:Since 2006,the Chinese government has executed outstanding debt balance management and principal payment for the government debt is not reported in the government budget and final accounts.

注:从2006年起实行债务余额管理,国家财政预决算不再反映债务还本支出。

Note:Since 2006,the Chinese government has executed outstanding debt balance management and principal payment for the government debt is not reported in the government budget and final accounts.

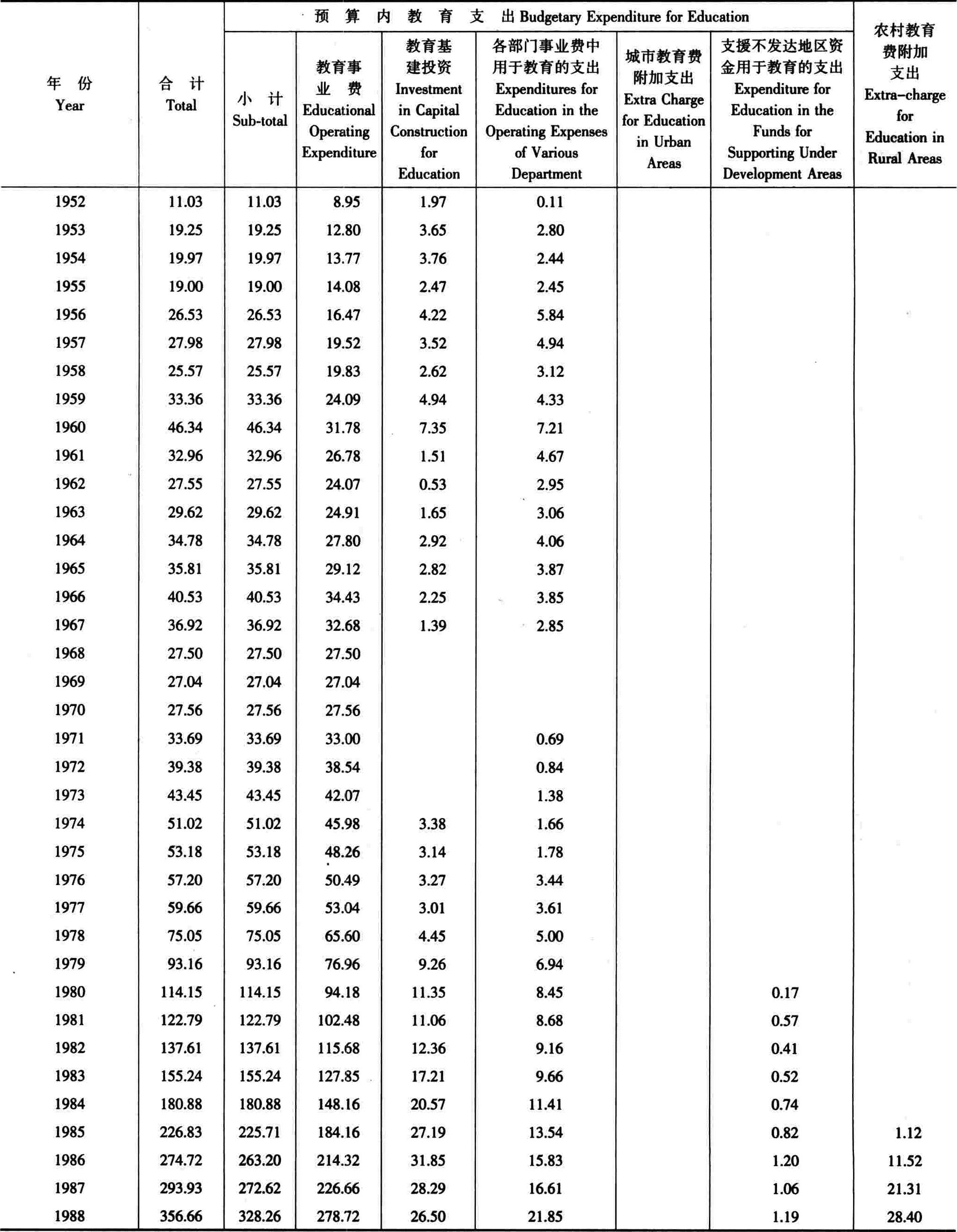

国家财政用于教育的支出

GOVERNMENT EXPENDITURE ON EDUCATION

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

注:1.从1998年起,“各部门事业费中用于教育的支出”减少较多,是因为各部门事业费中的此项支出大部分改列在“教育事业费”中。

2.因实行农村税费改革,从2004年起,农村教育费附加全面取消。

Notes:a)Since 1998,there was a big decrease in“Expenditure for education in the operating expense of various department”;it is because this kind of expense was listed in item of“education operating expenditure”.

b)Since 2004,the extra-charge for education in rural areas was completely abolished due to the“the tax and charge reform”in rural areas.

续表 Continued

注:1.从1998年起,“各部门事业费中用于教育的支出”减少较多,是因为各部门事业费中的此项支出大部分改列在“教育事业费”中。

2.因实行农村税费改革,从2004年起,农村教育费附加全面取消。

Notes:a)Since 1998,there was a big decrease in“Expenditure for education in the operating expense of various department”;it is because this kind of expense was listed in item of“education operating expenditure”.

b)Since 2004,the extra-charge for education in rural areas was completely abolished due to the“the tax and charge reform”in rural areas.

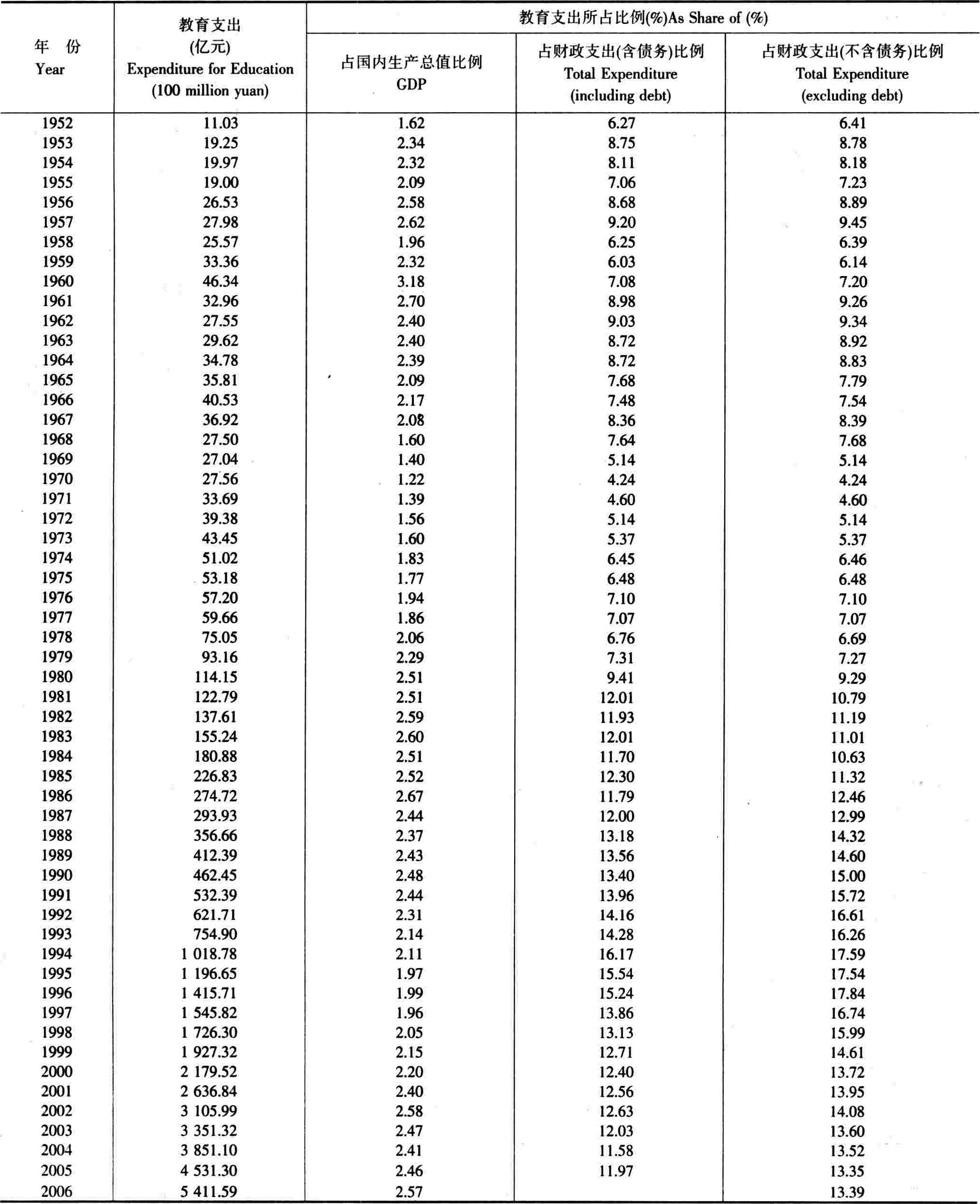

国家财政用于教育的支出与有关指标的比例

GOVERNMENT EXPENDITURE ON EDUCATION AS SHARE OF RELEVANT INDICATORS

注:从2006年起实行债务余额管理,国家财政预决算不再反映债务还本支出。

Note:Since 2006,the Chinese government has executed outstanding debt balance management and principal payment for the government debt is not reported in the government budget and final accounts.

注:从2006年起实行债务余额管理,国家财政预决算不再反映债务还本支出。

Note:Since 2006,the Chinese government has executed outstanding debt balance management and principal payment for the government debt is not reported in the government budget and final accounts.

国家财政用于抚恤和社会福利的支出

BUDGETARY EXPENDITURE ON PENSION AND SOCIAL WELFARE

单位:亿元 Unit:100 million yuan

注:1.1977年及以前各年退休费包括在抚恤支出中。从1996年起离退休费不包括已划入行政事业单位离退休经费支出类中的由民政部门管理的地方离退休费。

2.从1976年起救灾支出中包括抗震救灾费。

Note:a)Prior to 1978,the expenditure for pension for retires was included in the item“Pension for disable”.Since 1996,local pension for retires which are adminnistrated by civil department has been excluded from the item“Pension for retires”.

b)Since 1976,the relief funds for nature disasters included the earthquake relief funds.

单位:亿元 Unit:100 million yuan

注:1.1977年及以前各年退休费包括在抚恤支出中。从1996年起离退休费不包括已划入行政事业单位离退休经费支出类中的由民政部门管理的地方离退休费。

2.从1976年起救灾支出中包括抗震救灾费。

Note:a)Prior to 1978,the expenditure for pension for retires was included in the item“Pension for disable”.Since 1996,local pension for retires which are adminnistrated by civil department has been excluded from the item“Pension for retires”.

b)Since 1976,the relief funds for nature disasters included the earthquake relief funds.

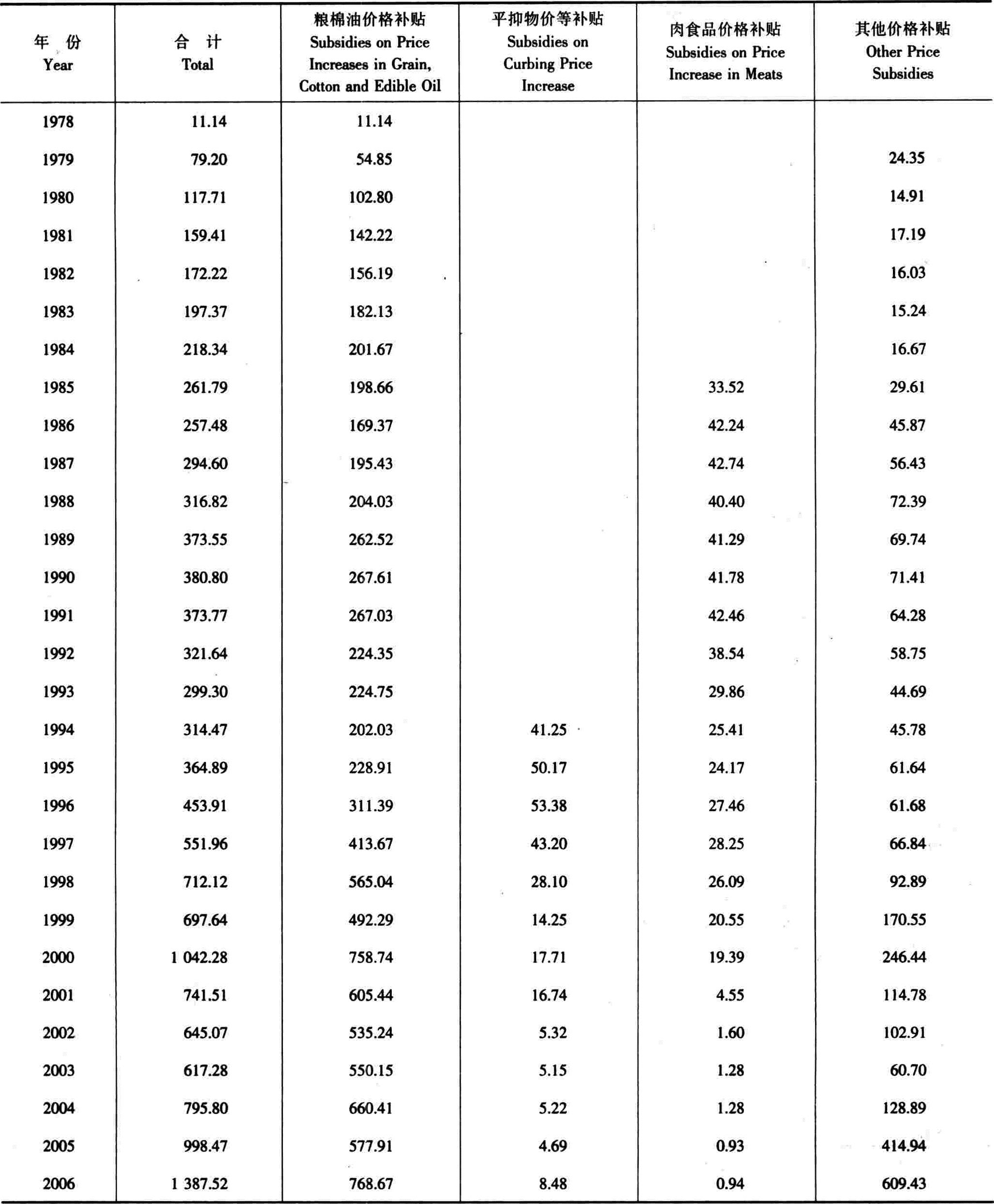

政策性补贴支出

BUDGETARY EXPENDITURE ON PRICE SUBSIDIES

单位:亿元 Unit:100 million yuan

注:政策性补贴支出,1985年以前冲减财政收入,1986年以后作为支出项目列在财政支出中。

Note:The budgetary expenditures for price subsidies listed as a negative revenue item prior to 1986 have been listed as a budgetary expenditure item since 1986.

单位:亿元 Unit:100 million yuan

注:政策性补贴支出,1985年以前冲减财政收入,1986年以后作为支出项目列在财政支出中。

Note:The budgetary expenditures for price subsidies listed as a negative revenue item prior to 1986 have been listed as a budgetary expenditure item since 1986.

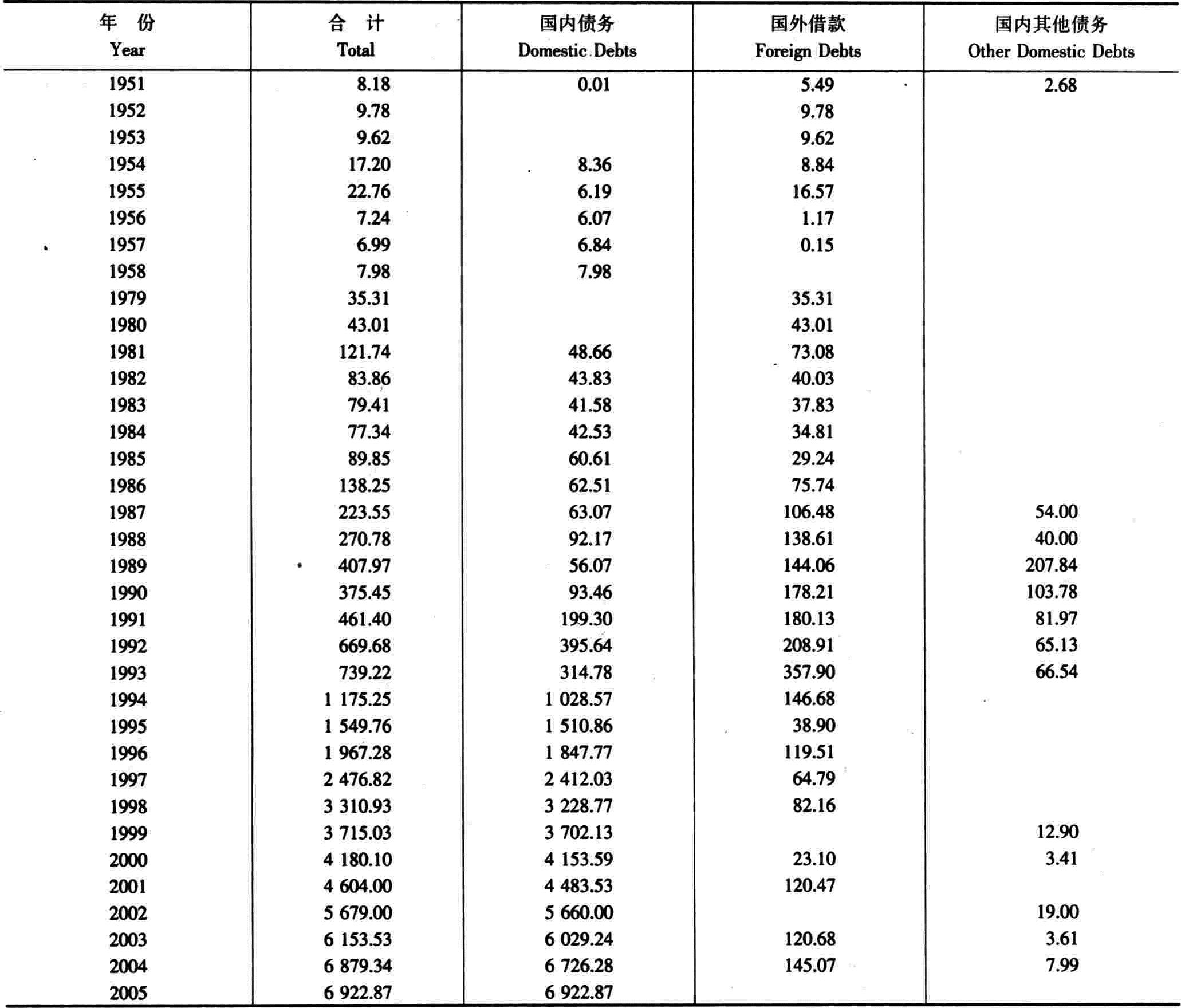

国家财政债务发行情况

GOVERNMENT DEBTS ISSUANCE

单位:亿元 Unit:100 million yuan

注:1)从1999年开始国内其他债务项目为债务收入大于支出部分增列的偿债基金。

2)从2006年起实行债务余额管理,国家财政预决算不再反映债务发行收入。

Note:a)Since 1999,other domestic debts were the repayment fund which come from the excessive part of the revenue from borrowings minus the ex-penditure for debts.

b)Since 2006,the Chinese government has executed outstanding debt balance management and government debts issuance is not reported in the government budget andfinal accounts.

单位:亿元 Unit:100 million yuan

注:1)从1999年开始国内其他债务项目为债务收入大于支出部分增列的偿债基金。

2)从2006年起实行债务余额管理,国家财政预决算不再反映债务发行收入。

Note:a)Since 1999,other domestic debts were the repayment fund which come from the excessive part of the revenue from borrowings minus the ex-penditure for debts.

b)Since 2006,the Chinese government has executed outstanding debt balance management and government debts issuance is not reported in the government budget andfinal accounts.

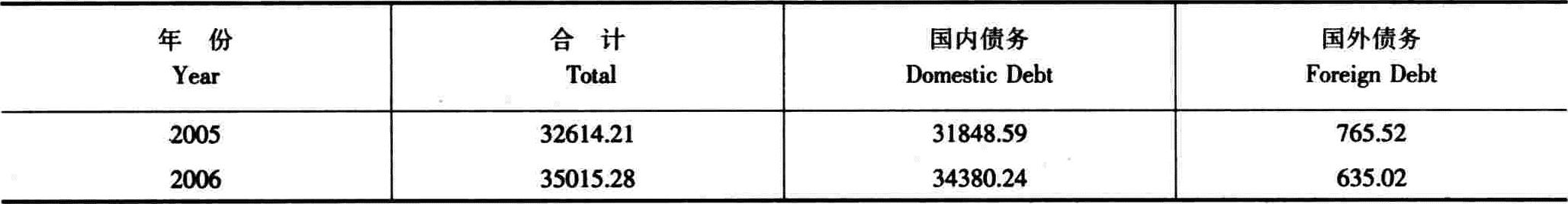

中央财政债务余额情况

CENTRAL GOVERNMENT DEBT

单位:亿元 Unit:100 million yuan

注:从2006年起实行债务余额管理。

Note:Since 2006,the Chinese government has executed outstanding debt balance management.

单位:亿元 Unit:100 million yuan

注:从2006年起实行债务余额管理。

Note:Since 2006,the Chinese government has executed outstanding debt balance management.

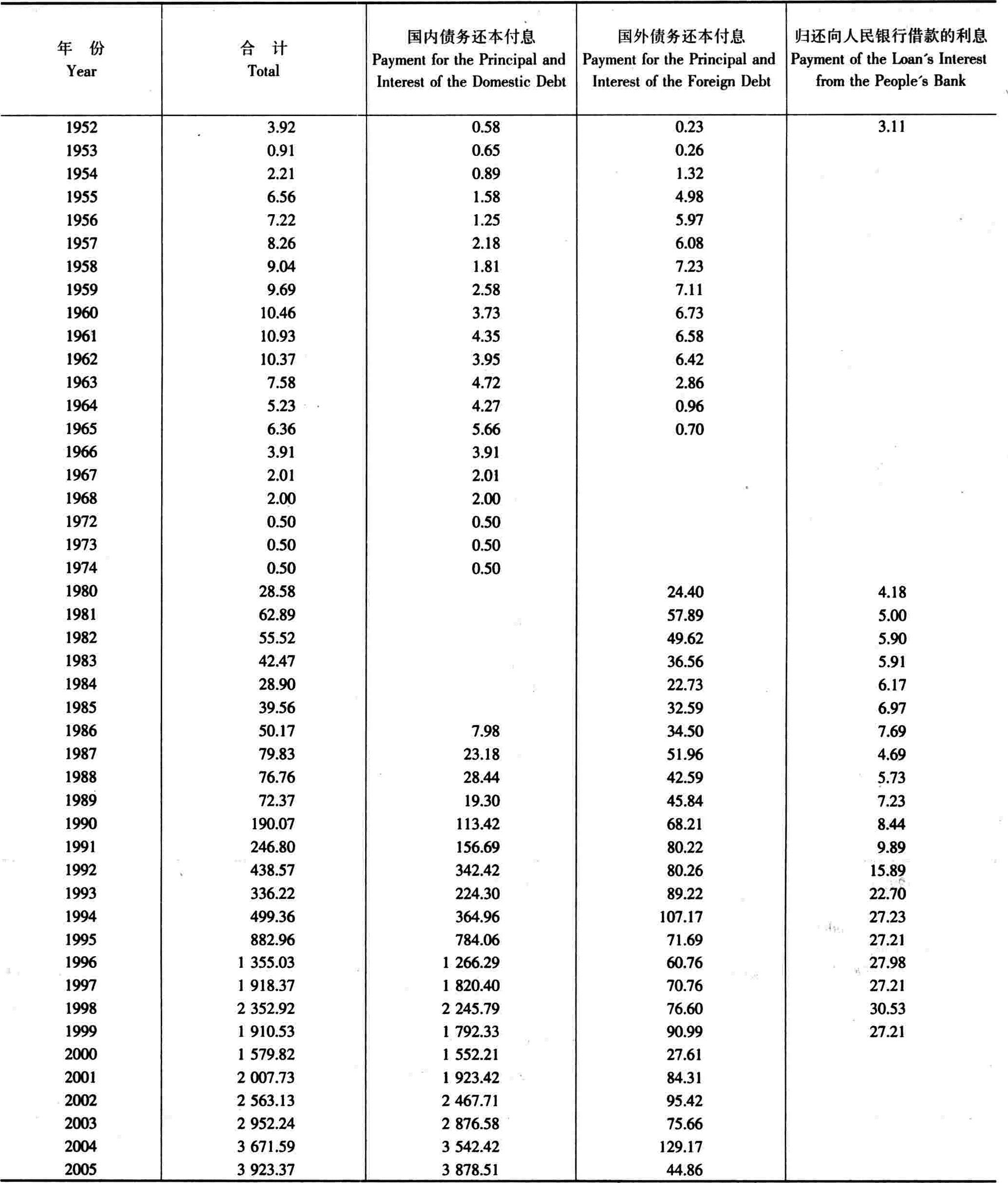

国家财政债务还本付息支出

BUDGETARY EXPENDITURE ON PAYMENT FOR THE PRINCIPAL AND INTEREST OF DEBT

单位:亿元 Unit:100 million yuan

注:1)从2000年开始,表中数据均为债务还本支出。

2)从2006年起实行债务余额管理,国家财政预决算不再反映债务还本支出。

Note:a)Since 2000,the data of this form was only the payment for the principal of debt.

b)Since 2006,the Chinese government has executed outstanding debt balance management and the principal and interest payment of debt is not reported in the government budget and final accounts.

单位:亿元 Unit:100 million yuan

注:1)从2000年开始,表中数据均为债务还本支出。

2)从2006年起实行债务余额管理,国家财政预决算不再反映债务还本支出。

Note:a)Since 2000,the data of this form was only the payment for the principal of debt.

b)Since 2006,the Chinese government has executed outstanding debt balance management and the principal and interest payment of debt is not reported in the government budget and final accounts.

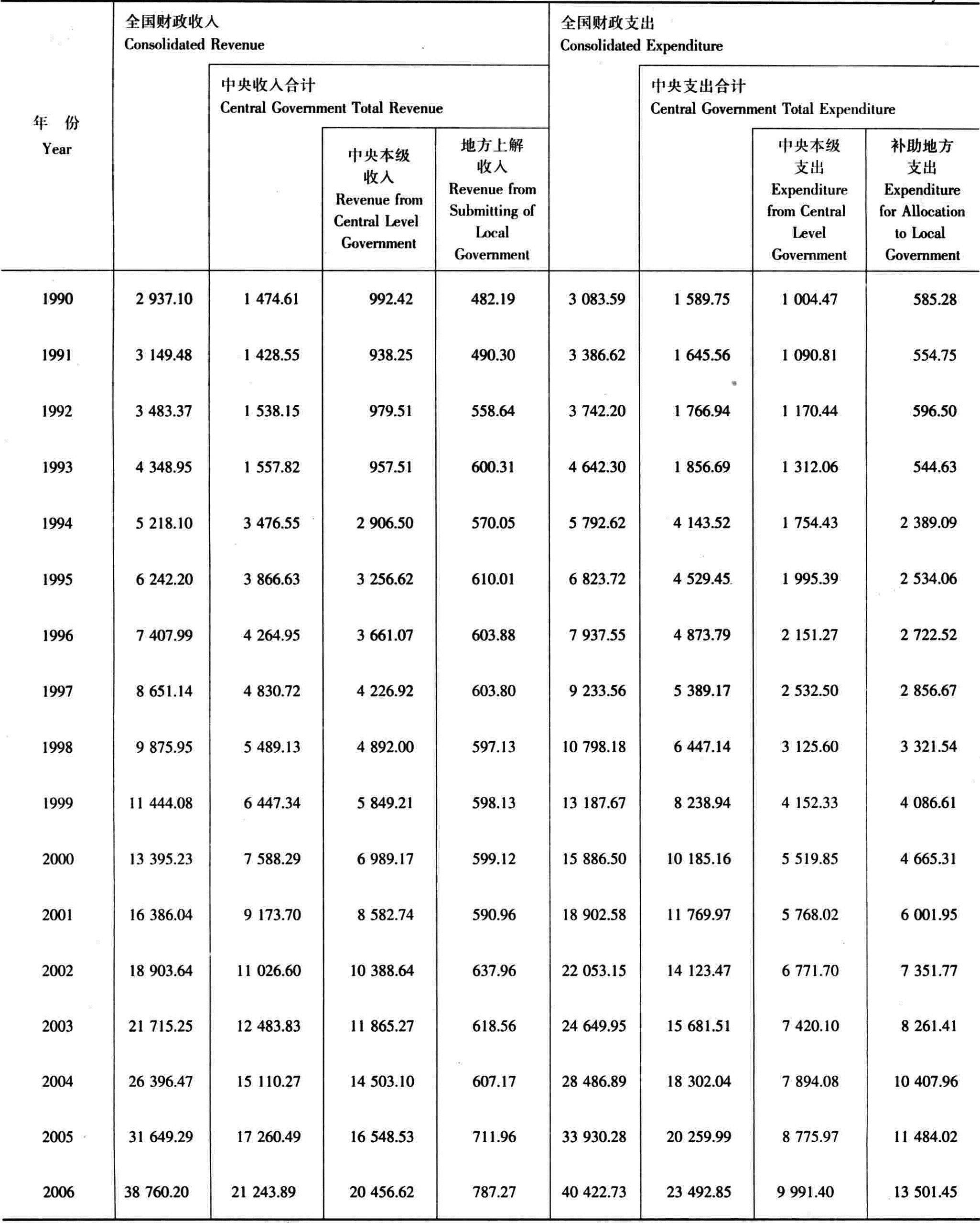

补助地方(地方上解)后的中央财政收支

CENTRAL BUDGETARY REVENUE AND EXPENDITURE AFTER REALLOCATION BETWEEN CENTRAL AND LOCAL GOVERNMENT

单位:亿元 Unit:100 million yuan

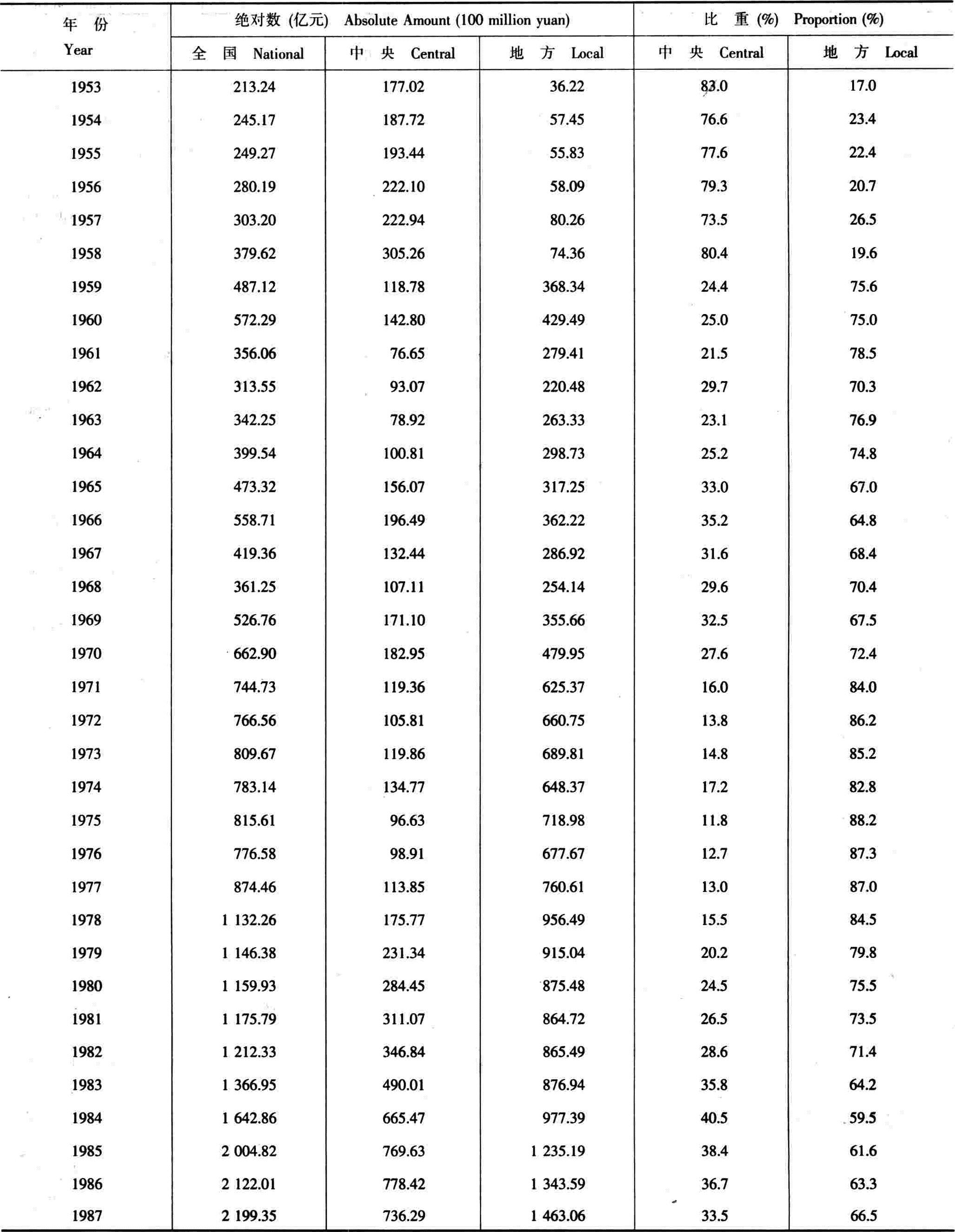

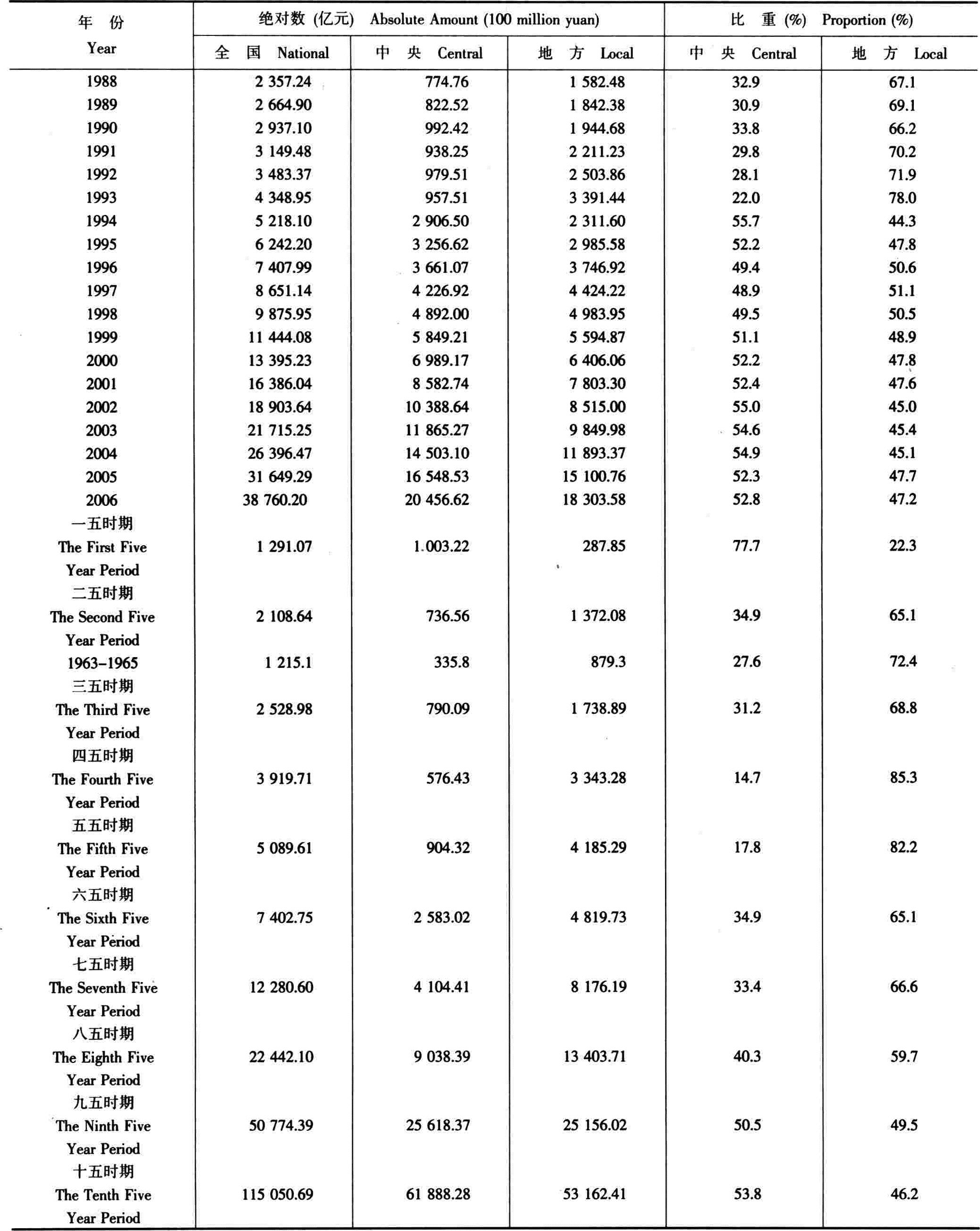

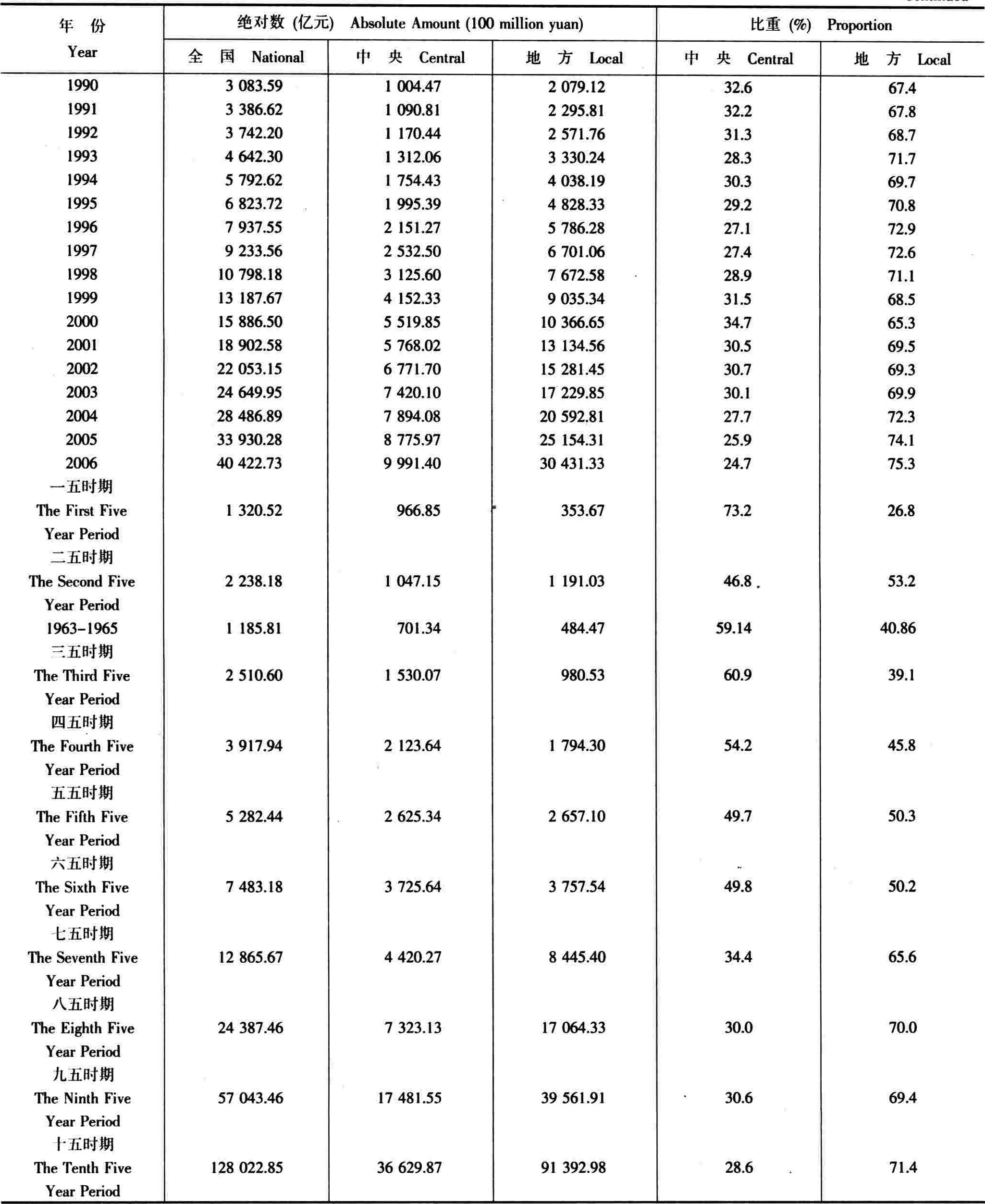

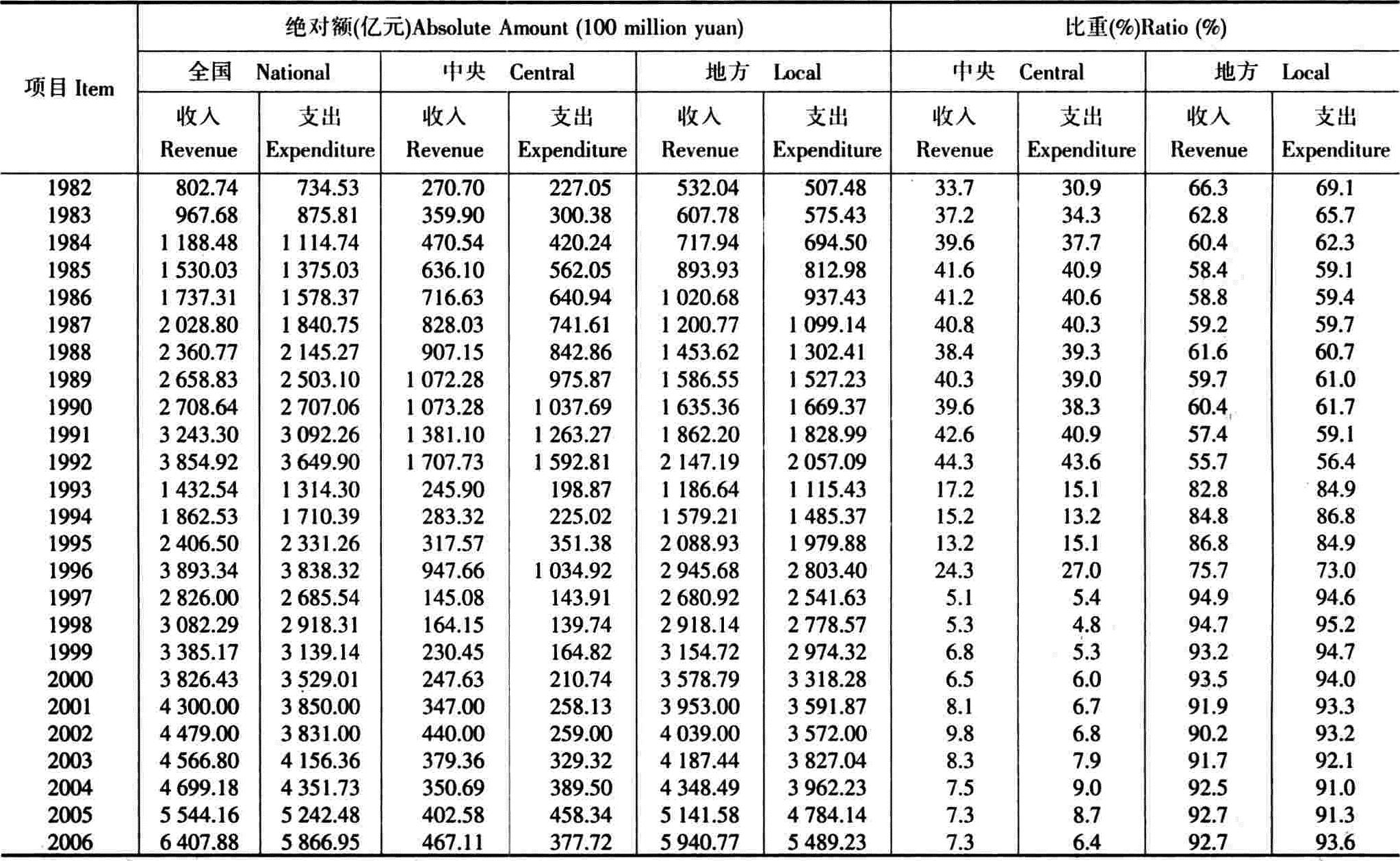

单位:亿元 Unit:100 million yuan中央和地方财政收入及比重

CENTRAL AND LOCAL BUDGETARY REVENUE AND THEIR PROPORTIONS

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

注:1.中央、地方财政收入均为本级收入。

2.本表数字不包括国内外债务收入。

Note:a)The central and local revenue in this table represent the income from the central and local level government themselves.

b)The figure here excludes debt revenue.

续表 Continued

注:1.中央、地方财政收入均为本级收入。

2.本表数字不包括国内外债务收入。

Note:a)The central and local revenue in this table represent the income from the central and local level government themselves.

b)The figure here excludes debt revenue.

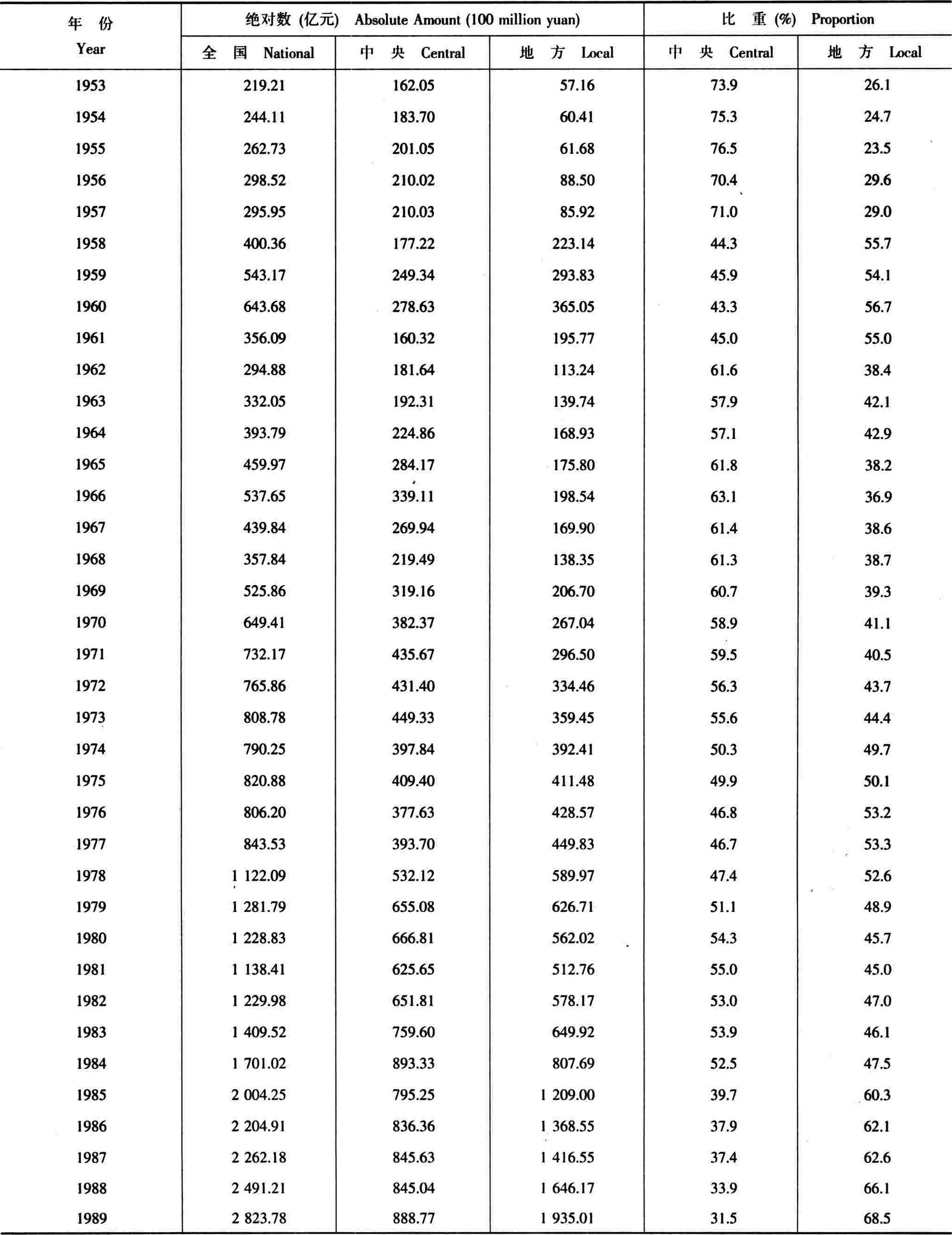

中央和地方财政支出及比重

CENTRAL AND LOCAL BUDGETARY EXPENDITURE AND THEIR PROPORTIONS

续表 Continued

注:1.中央、地方财政支出均为本级支出。

2.本表数字2000年以前不包括国内外债务还本付息支出和利用国外借款收入安排的基本建设支出。从2000年起,全国财政支出和中央财政支出中包括国内外债务付息支出。

Note:a)The central and local revenue in the table represent the income from central and local level government themselves.

b)The expenditure in the table excludes the payment for principal and interest of domestic and foreign debt and the capital construction expen-diture financed by foreign debt before2000.The expenditure of national and central government included the payment for interest of domes-tic and foreign debt since2000.

续表 Continued

注:1.中央、地方财政支出均为本级支出。

2.本表数字2000年以前不包括国内外债务还本付息支出和利用国外借款收入安排的基本建设支出。从2000年起,全国财政支出和中央财政支出中包括国内外债务付息支出。

Note:a)The central and local revenue in the table represent the income from central and local level government themselves.

b)The expenditure in the table excludes the payment for principal and interest of domestic and foreign debt and the capital construction expen-diture financed by foreign debt before2000.The expenditure of national and central government included the payment for interest of domes-tic and foreign debt since2000.

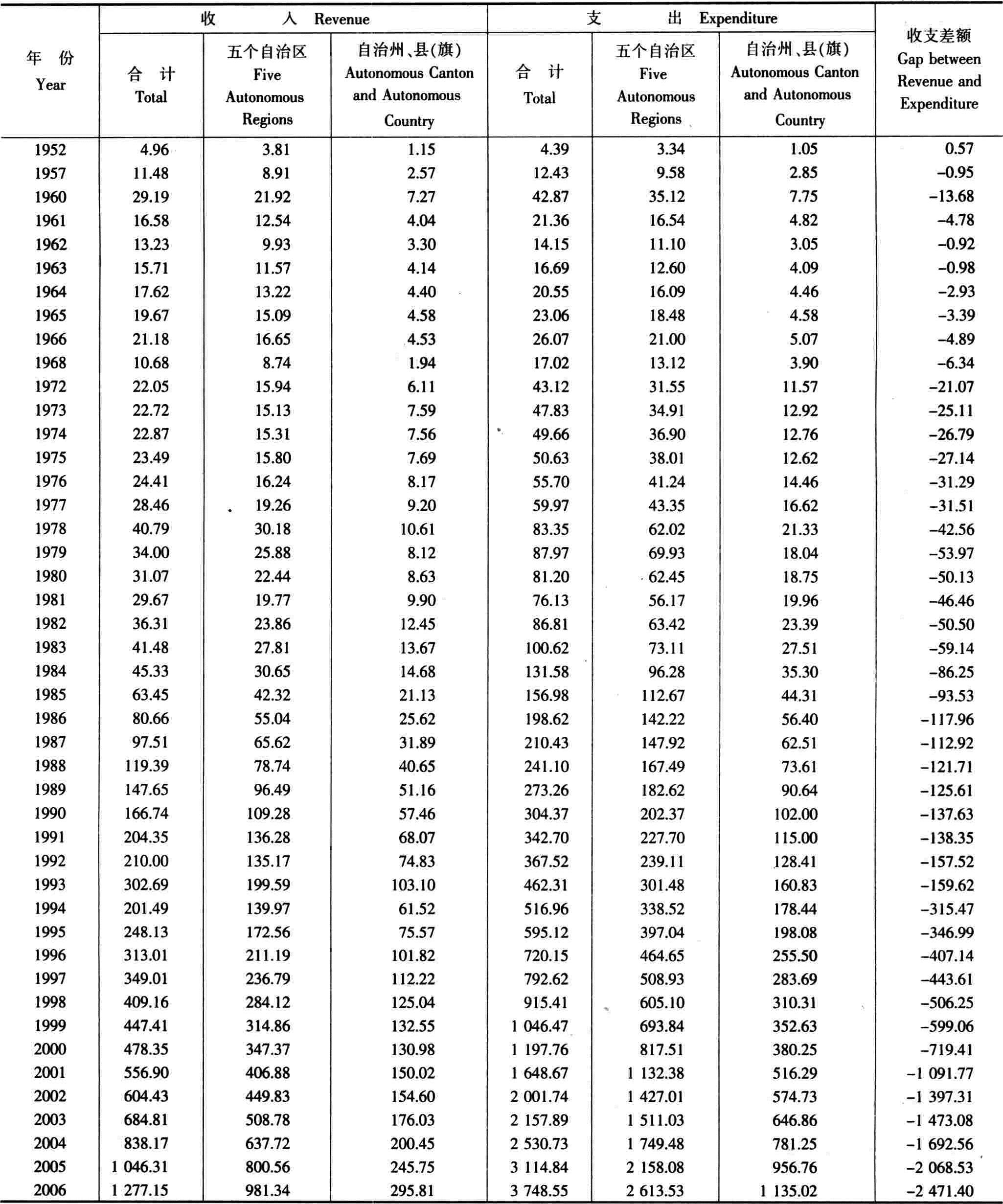

少数民族自治地区财政收支

BUDGETARY REVENUE AND EXPENDITURE OF ETHNIC REGIONS

单位:亿元 Unit:100 million yuan

注:表列五个自治区,系指内蒙古自治区、西藏自治区、宁夏回族自治区、新疆维吾尔自治区和广西壮族自治区。自治州、县(旗)系指除上述五个自治区以外各省所属的少数民族自治州、自治县(旗)。

Note:Five autonomous regions:inner Mongolia,Ningxia,Xinjiang and Guangxi.Autonomous canton and auton and autonomous county refer to au-tonomous cantons and counties other than five autonomous regions mentioned above.

单位:亿元 Unit:100 million yuan

注:表列五个自治区,系指内蒙古自治区、西藏自治区、宁夏回族自治区、新疆维吾尔自治区和广西壮族自治区。自治州、县(旗)系指除上述五个自治区以外各省所属的少数民族自治州、自治县(旗)。

Note:Five autonomous regions:inner Mongolia,Ningxia,Xinjiang and Guangxi.Autonomous canton and auton and autonomous county refer to au-tonomous cantons and counties other than five autonomous regions mentioned above.

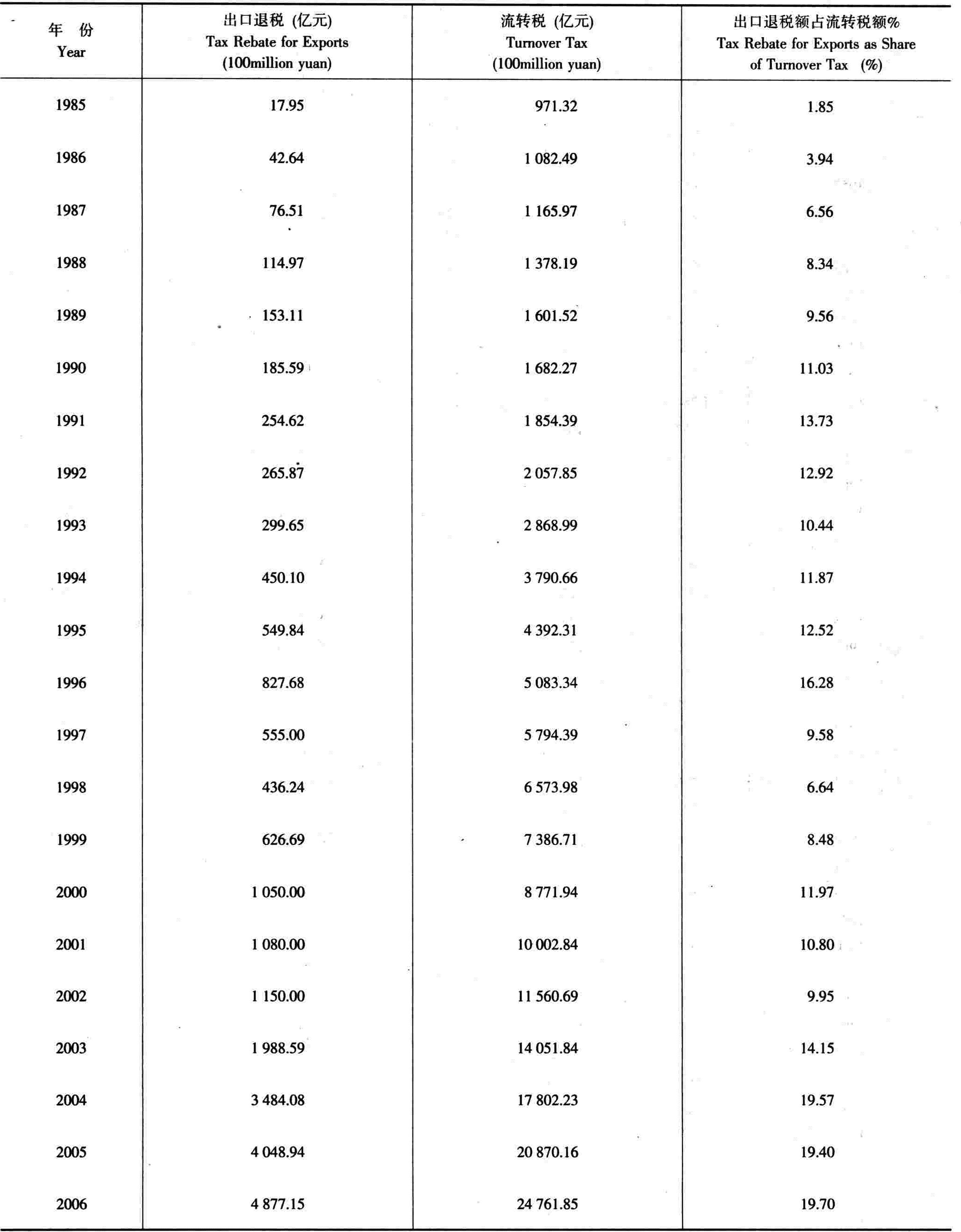

外贸出口退税占全部流转税的比重

RATIO OF TAX REBATE FOR EXPORTS OVER TOTAL TURNOVER TAX

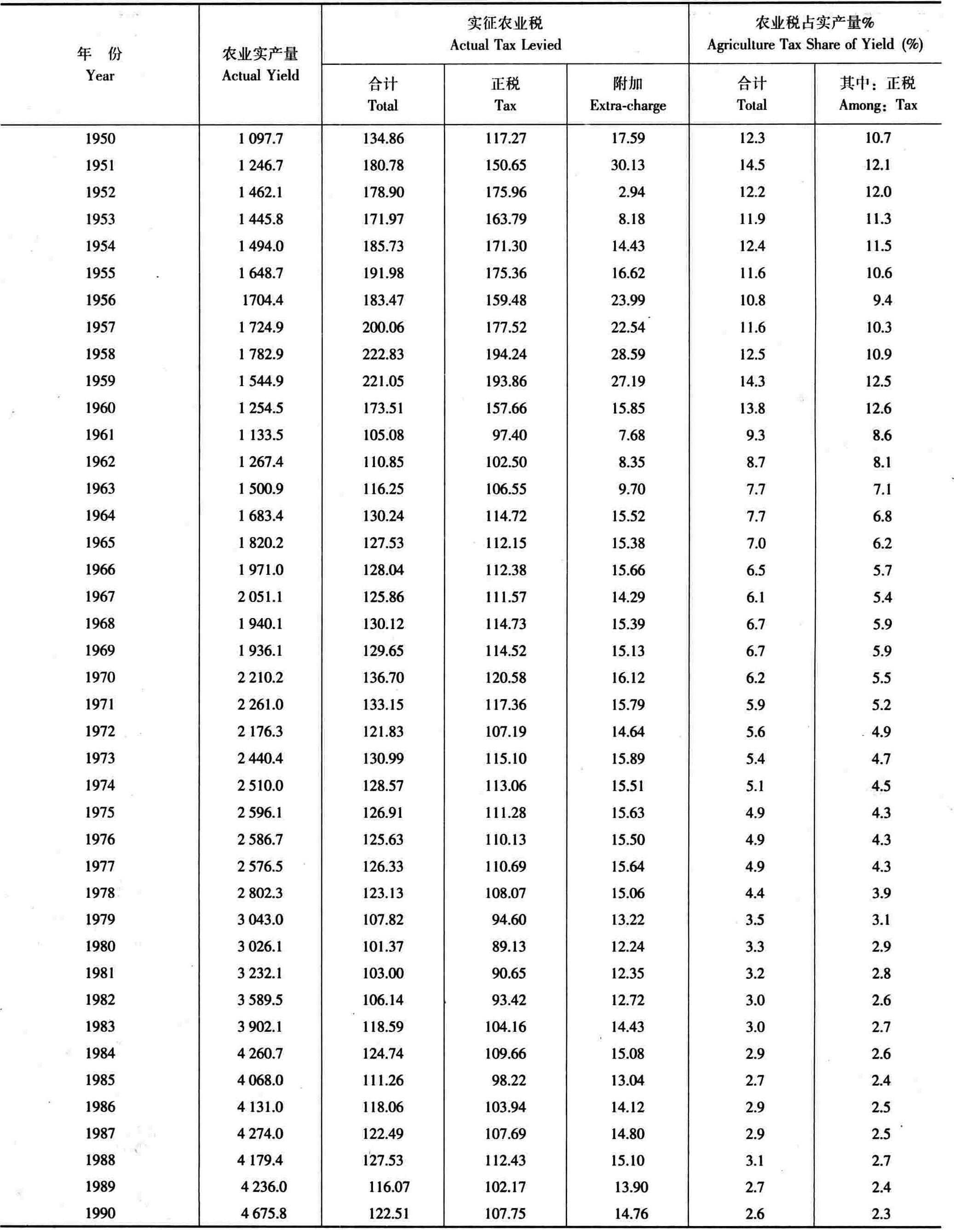

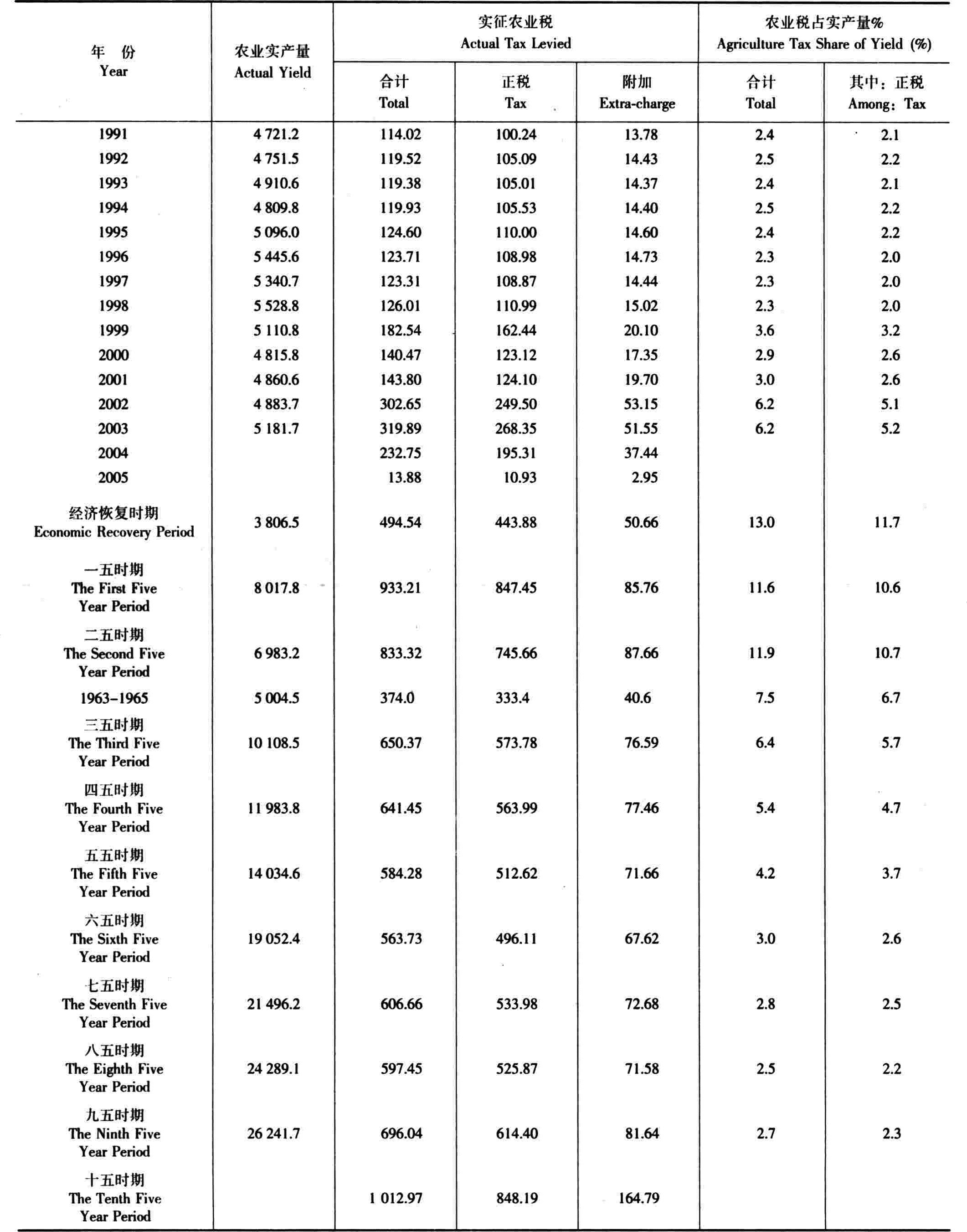

全国农业税负担情况

AGRICULTURAL TAXES

税额单位:细粮亿公斤 Tax unit:100 million kg flour and rice

税额单位:细粮亿公斤 Tax unit:100 million kg flour and rice 续表 Continued

注:自2006年1月1日起,《中华人民共和国农业税条例》废止。

Note:The Agricultural Taxes Statute of P.R.China was abolished since Jan1st,2006.

续表 Continued

注:自2006年1月1日起,《中华人民共和国农业税条例》废止。

Note:The Agricultural Taxes Statute of P.R.China was abolished since Jan1st,2006.

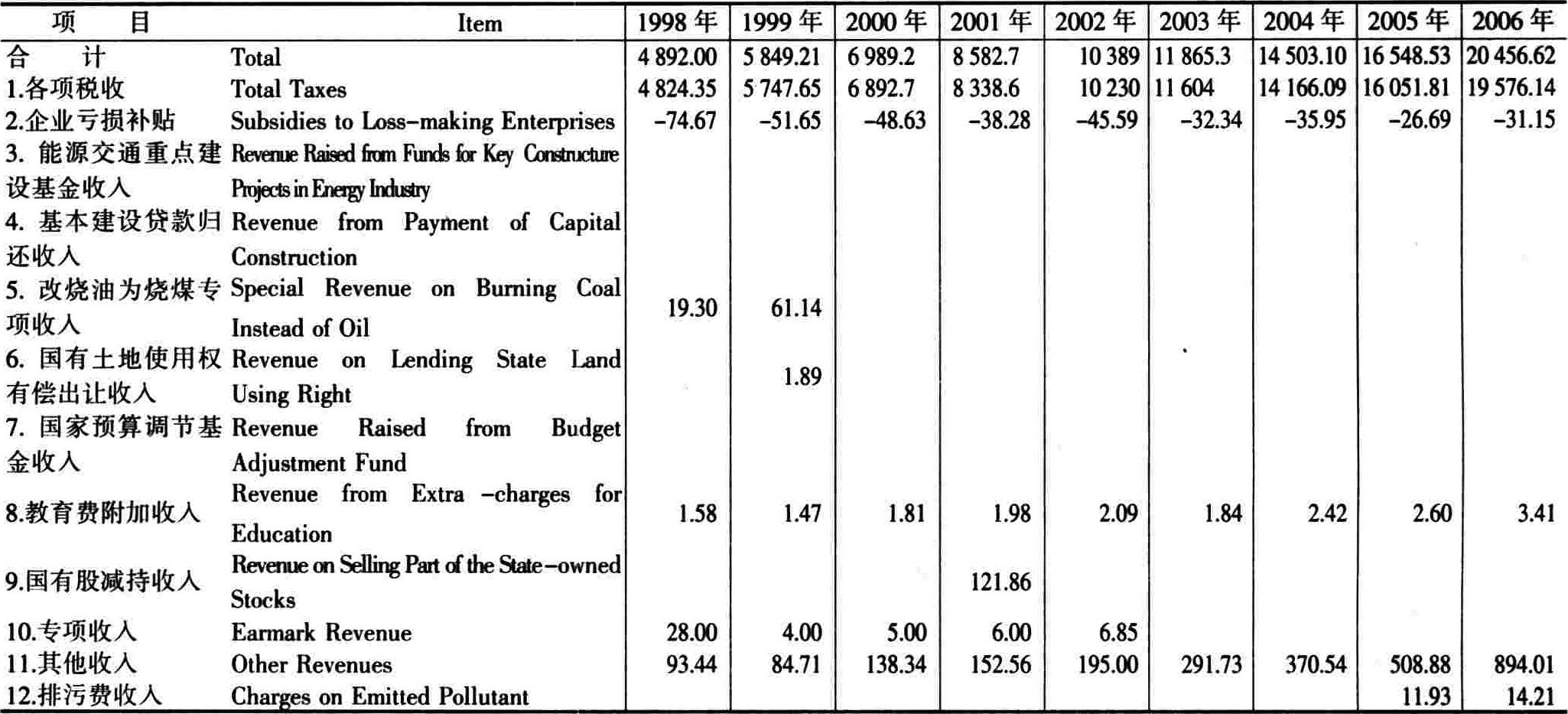

中央财政收入主要项目

BUDGETARY REVENUE OF CENTRAL GOVERNMENT BY ITEM

单位:亿元 Unit:100 million yuan

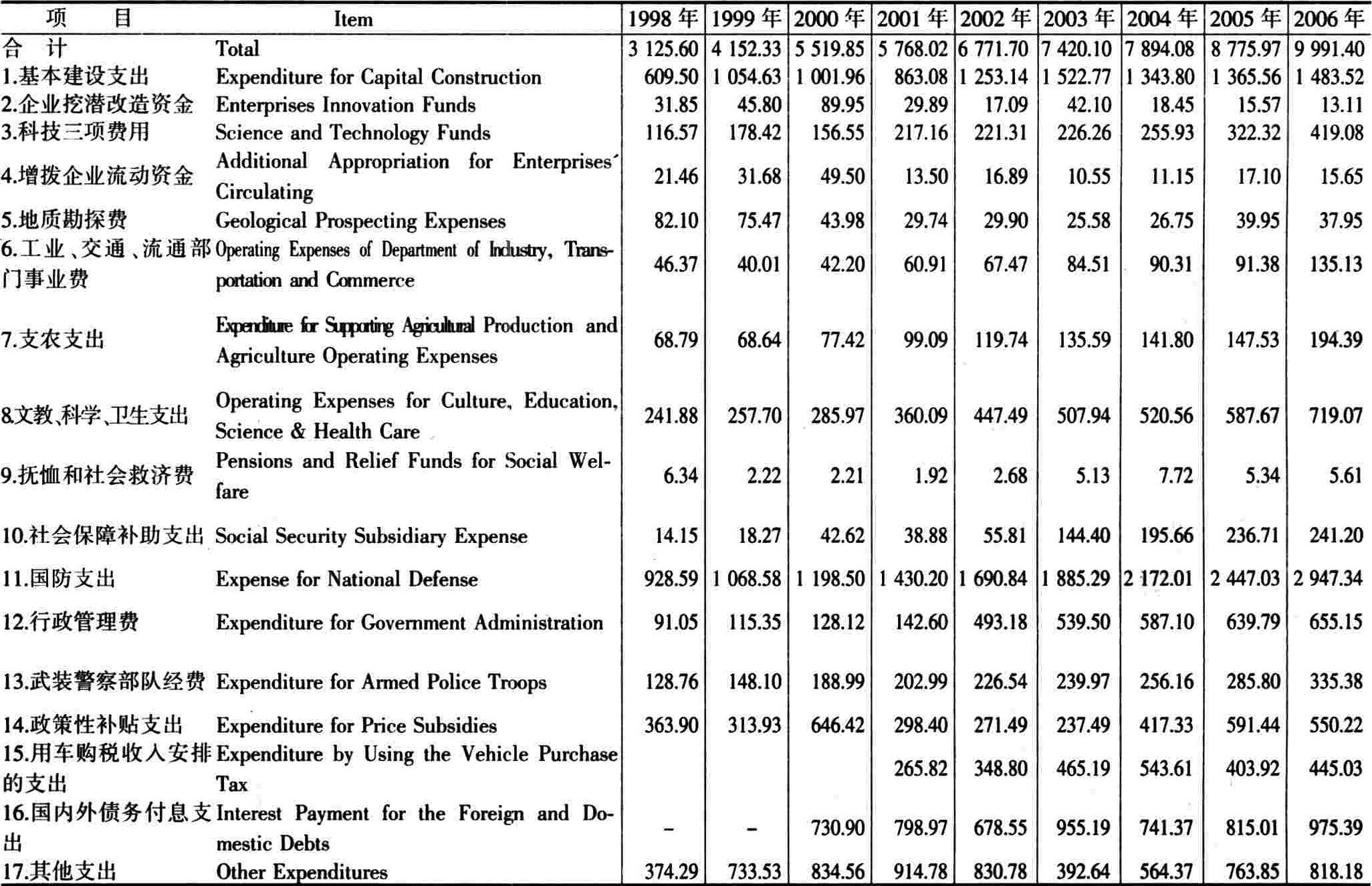

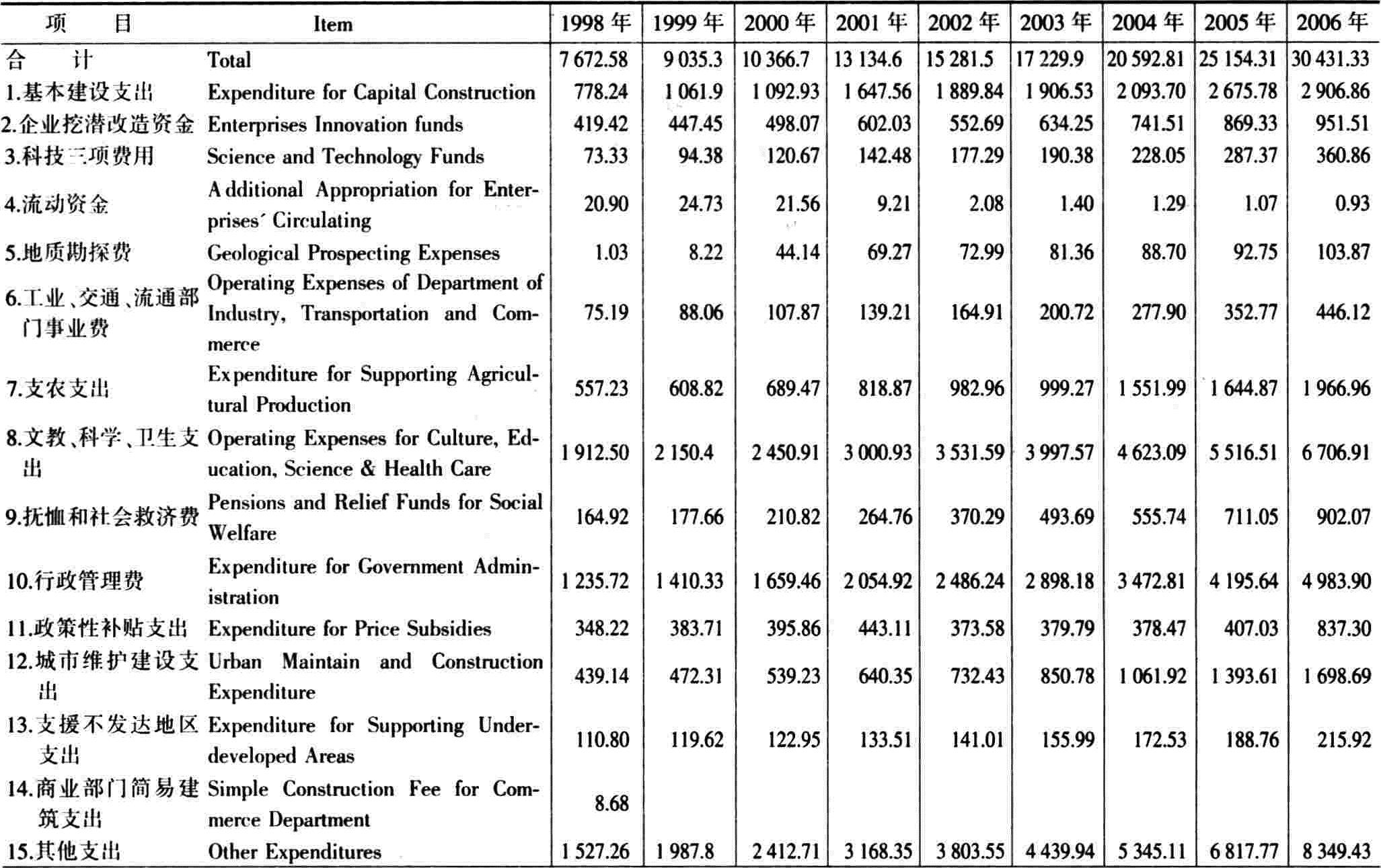

单位:亿元 Unit:100 million yuan中央财政支出主要项目

BUDGETARY EXPENDITURE OF CENTRAL GOVERNMENT BY ITEM

单位:亿元 Unit:100 million yuan

注:1.行政管理费中包括公检法司支出和外交外事支出。

2.从2000年开始,国内外债务付息支出计入财政支出。

Note:a)Expenditure for government administration includes the expenditures for public security,procuratorial work and the court of justice and for foreign affairs.

b)The expenditure of national and central government included the payment for interest of domestic and foreign debt since2000.

单位:亿元 Unit:100 million yuan

注:1.行政管理费中包括公检法司支出和外交外事支出。

2.从2000年开始,国内外债务付息支出计入财政支出。

Note:a)Expenditure for government administration includes the expenditures for public security,procuratorial work and the court of justice and for foreign affairs.

b)The expenditure of national and central government included the payment for interest of domestic and foreign debt since2000.

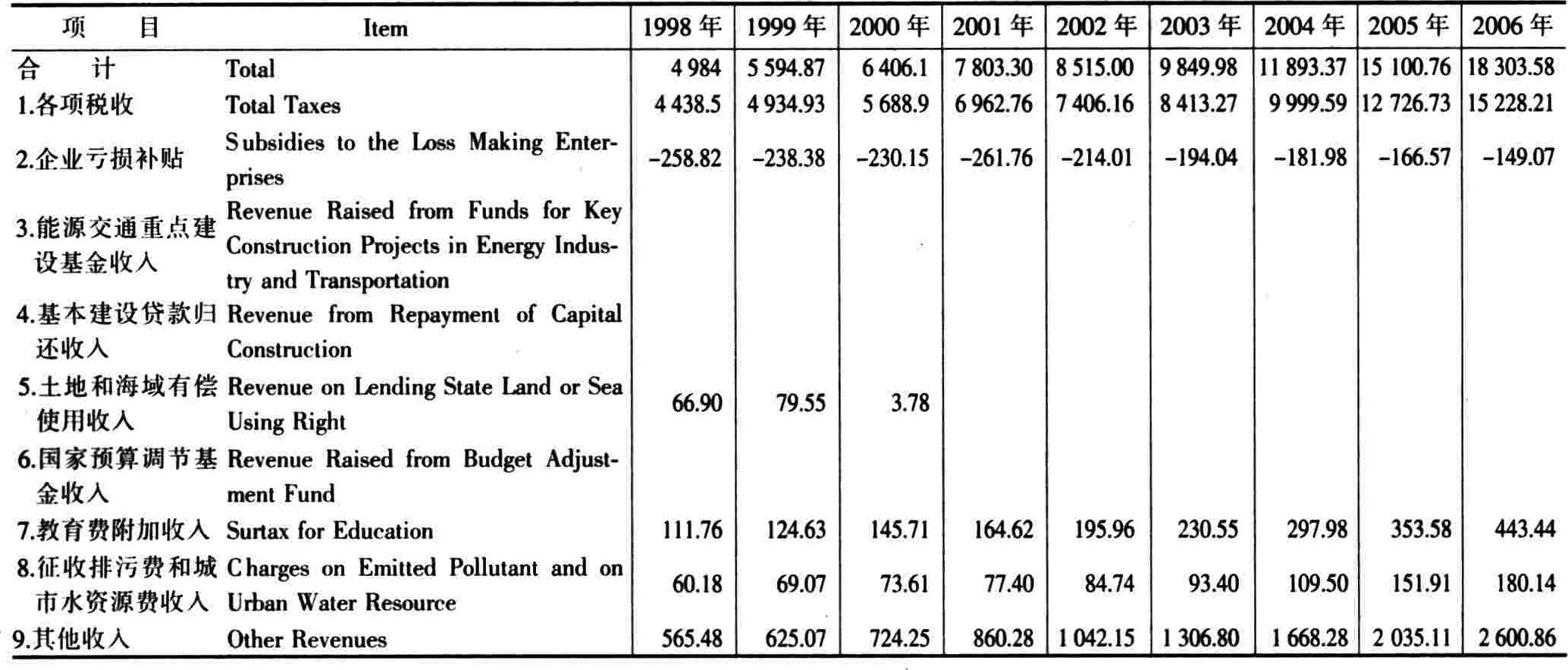

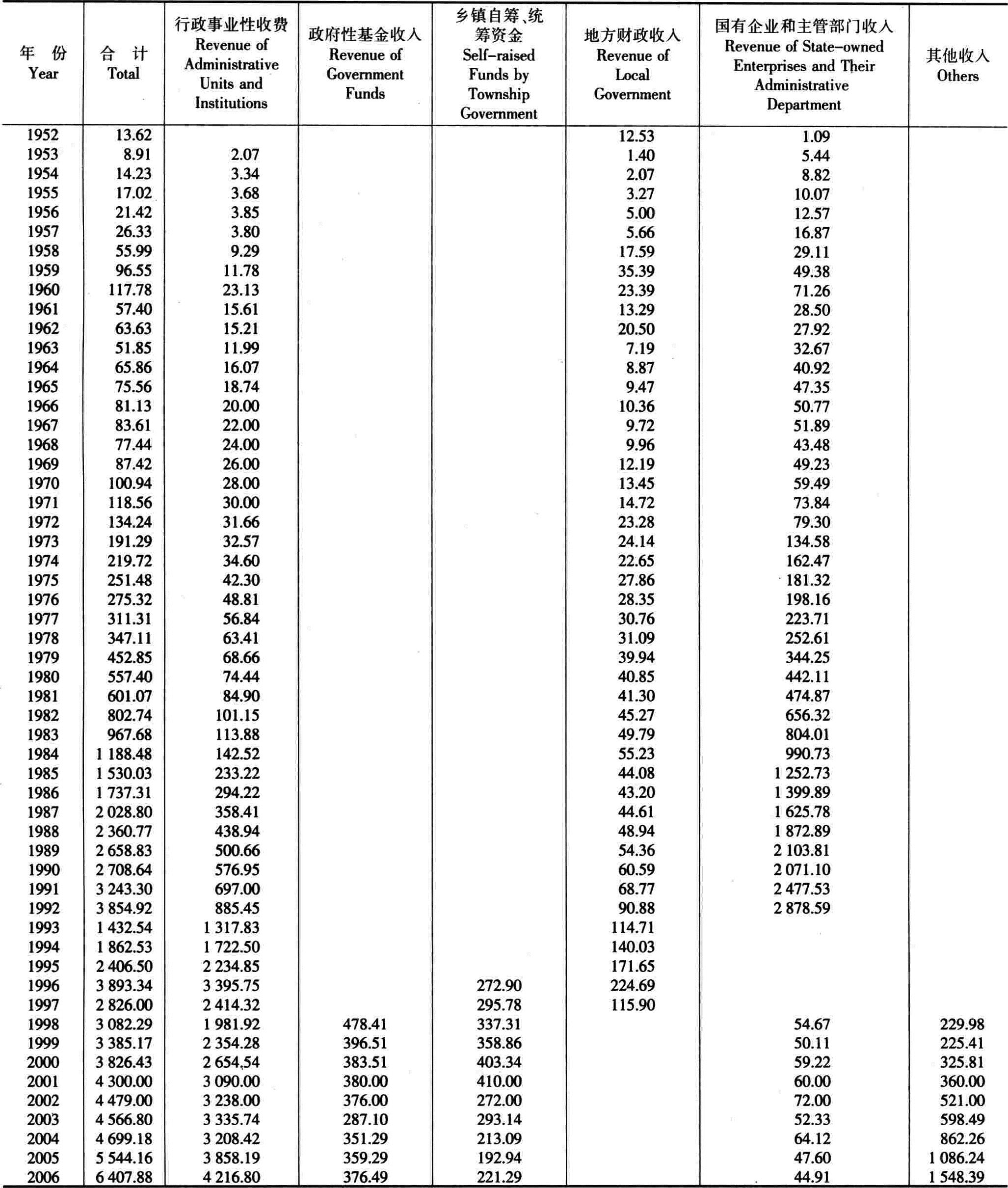

地方财政收入主要项目

BUDGETARY REVENUE OF LOCAL GOVERNMENT BY ITEM

单位:亿元 Unit:100 million yuan

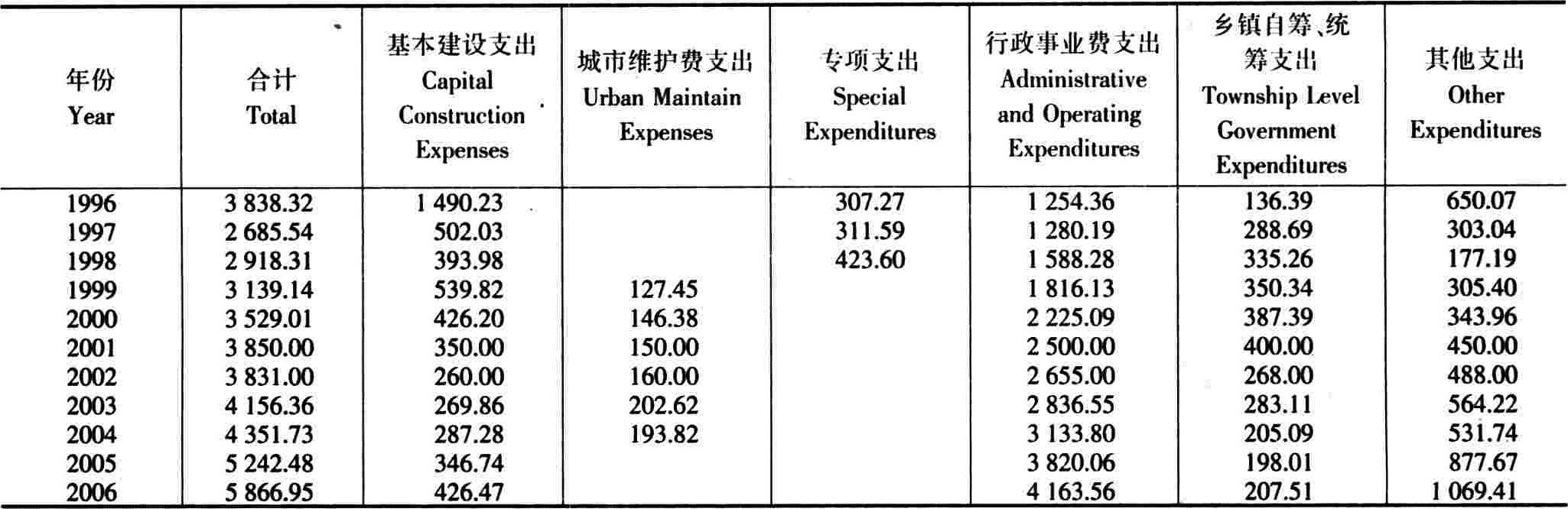

单位:亿元 Unit:100 million yuan地方财政支出主要项目

BUDGETARY EXPENDITURE OF LOCAL GOVERNMENT BY ITEM

单位:亿元 Unit:100 million yuan

注:行政管理费中包括公检法司支出和外交外事支出。

Note:Expenditure for government administration includes the expenditures for public security,procuratorial work and the court of justice and for for-eign affairs.

单位:亿元 Unit:100 million yuan

注:行政管理费中包括公检法司支出和外交外事支出。

Note:Expenditure for government administration includes the expenditures for public security,procuratorial work and the court of justice and for for-eign affairs.

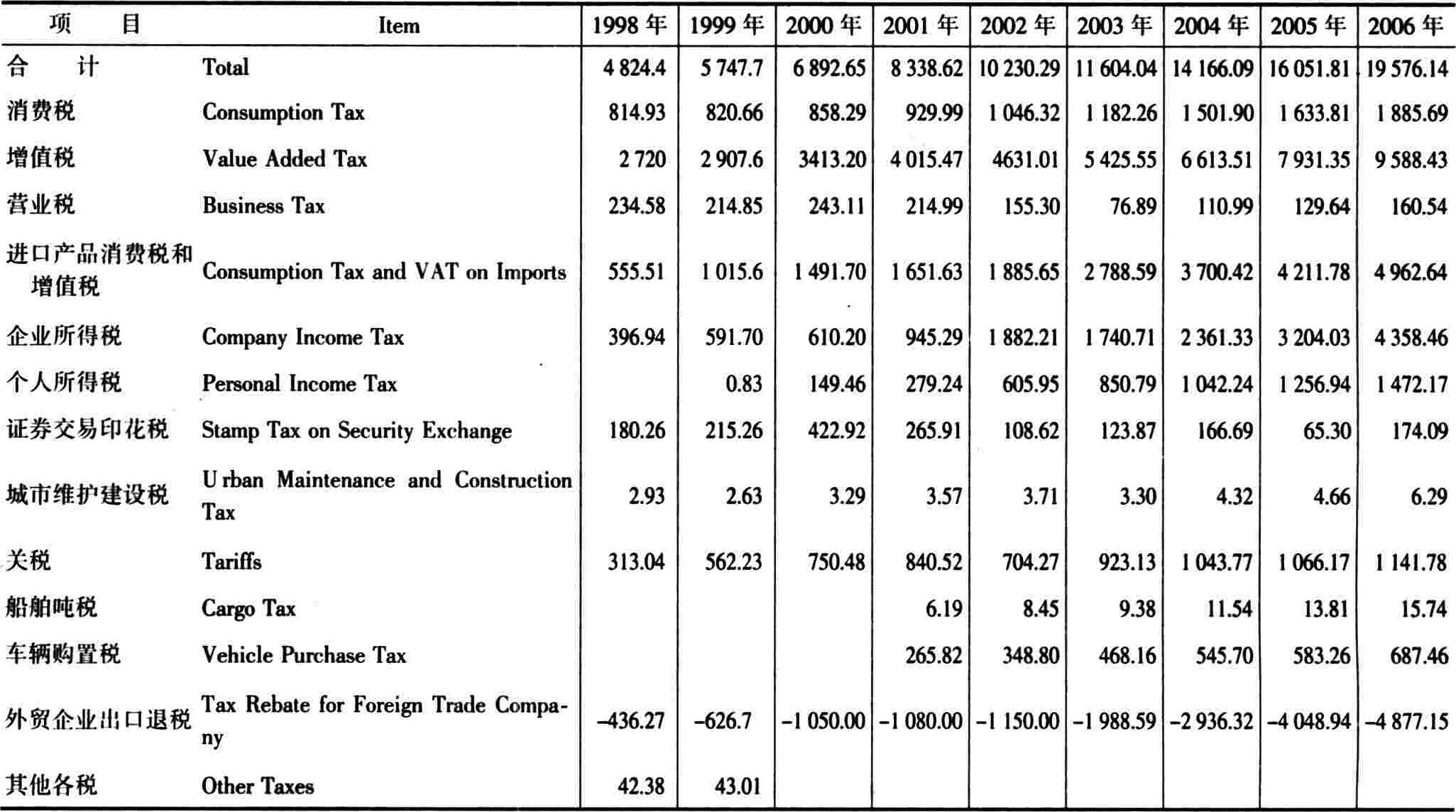

中央财政各项税收

CENTRAL GOVERNMENT TAXES

单位:亿元 Unit:100 million yuan

注:2001年以前的企业所得税为国有企业所得税。

Note:Prior to 2001,the company income tax only included the state-owned company income tax.

单位:亿元 Unit:100 million yuan

注:2001年以前的企业所得税为国有企业所得税。

Note:Prior to 2001,the company income tax only included the state-owned company income tax.

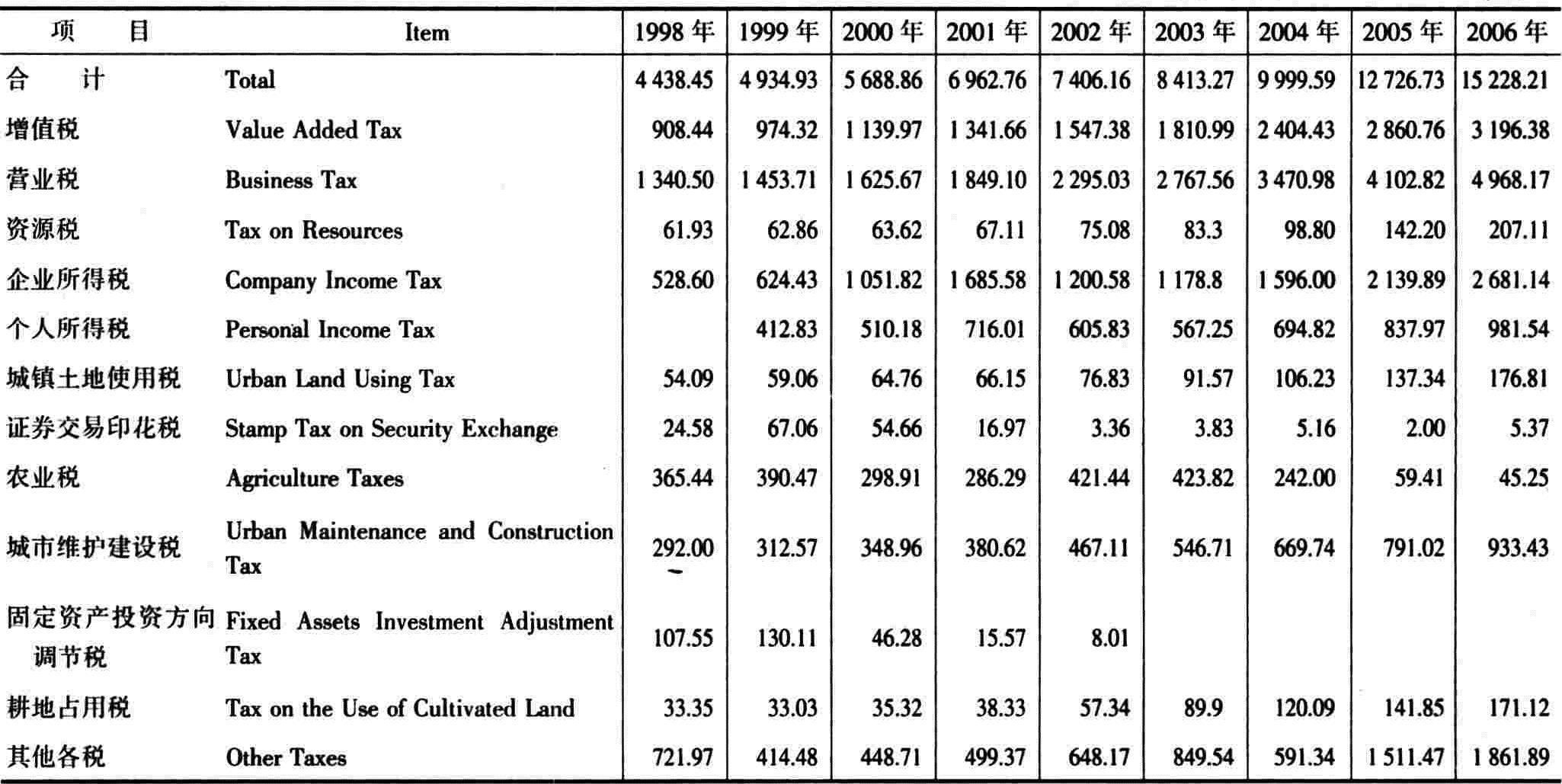

地方财政各项税收

LOCAL GOVERNMENT TAXES

单位:亿元 Unit:100 million yuan

注:2001年以前的企业所得税为国有企业所得税。

Note:Prior to 2001,the company income tax only included the state-owned company income tax.

单位:亿元 Unit:100 million yuan

注:2001年以前的企业所得税为国有企业所得税。

Note:Prior to 2001,the company income tax only included the state-owned company income tax.

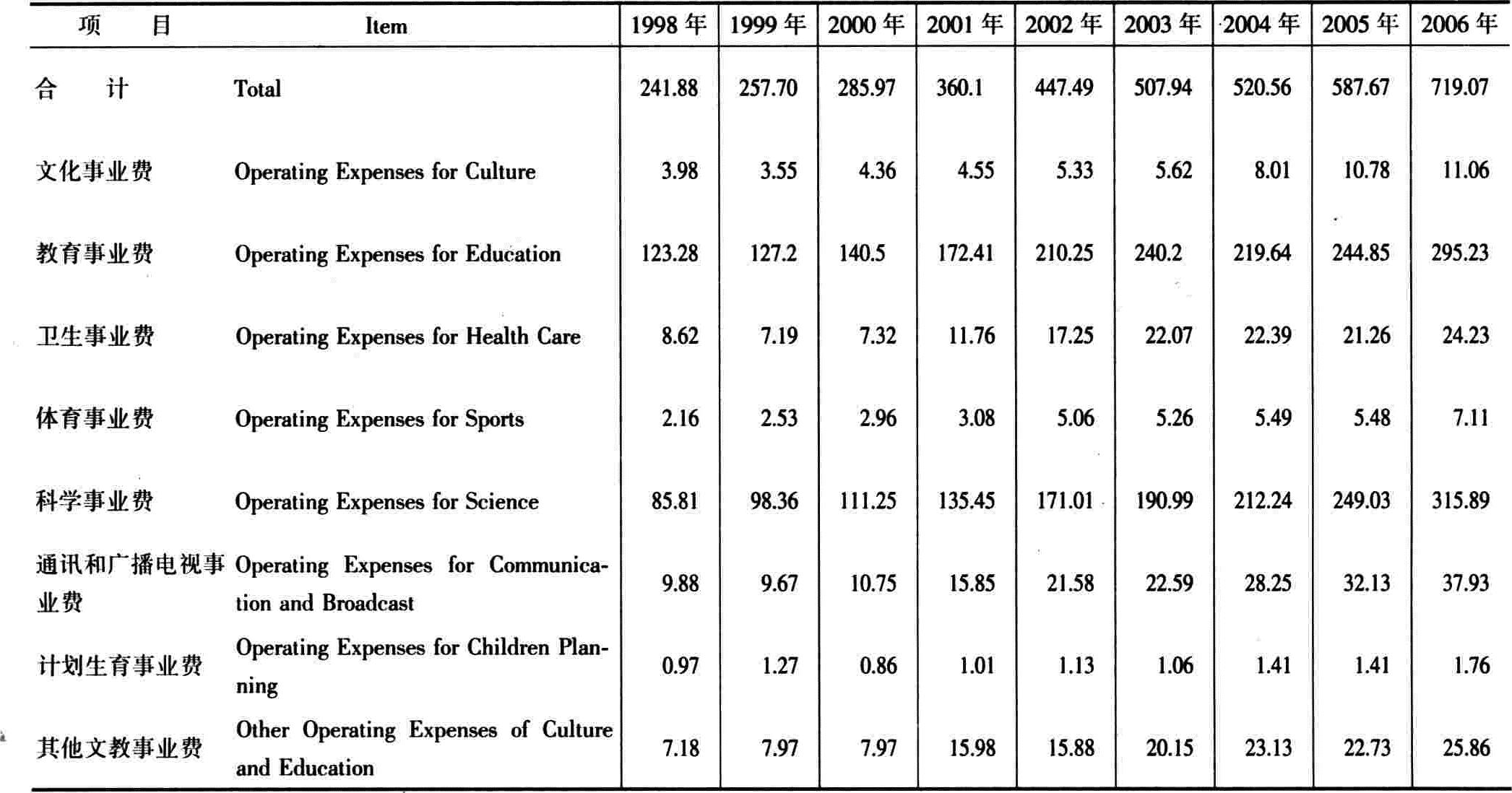

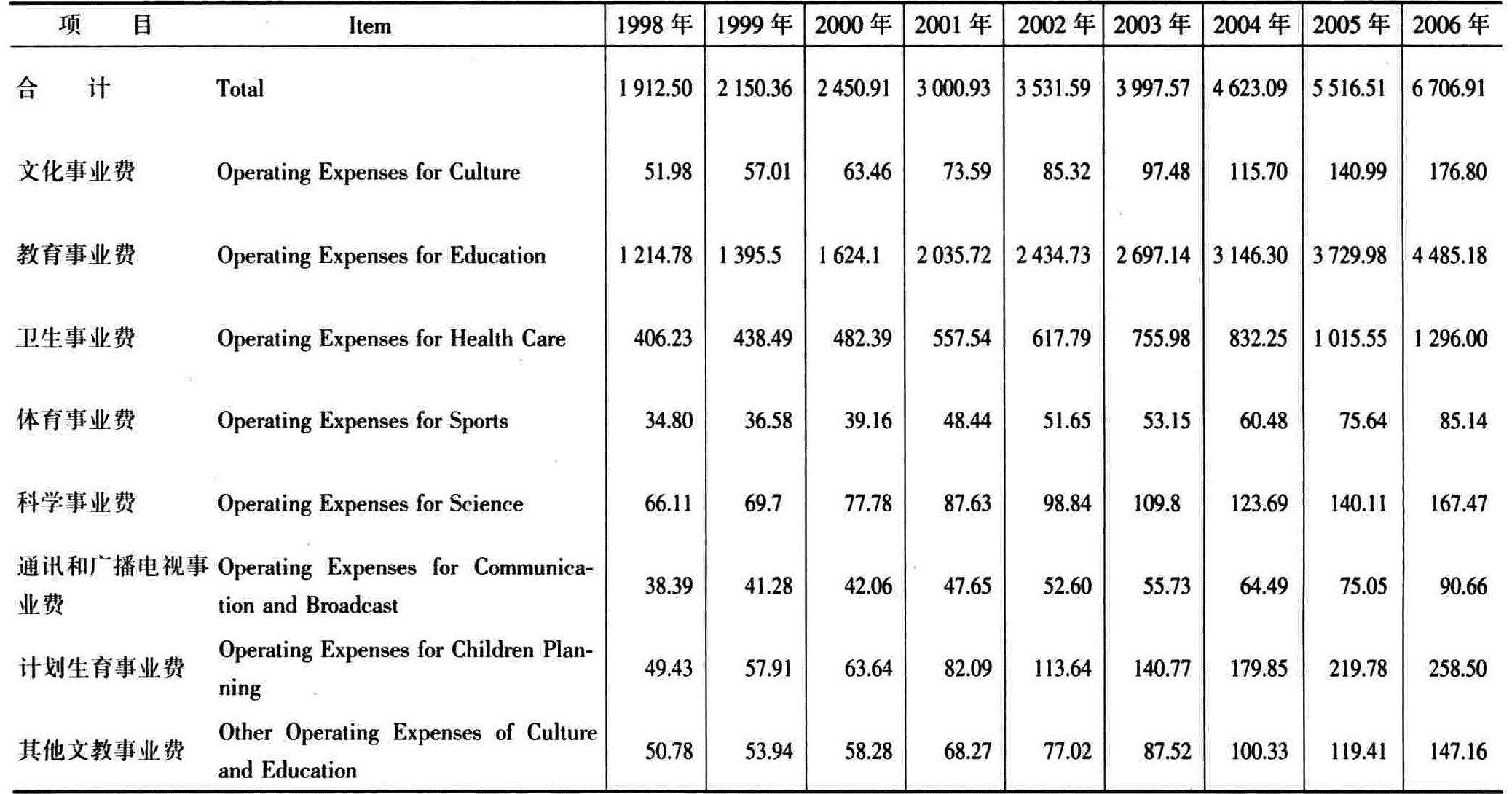

中央财政文教、科学、卫生事业费支出

CENTRAL BUDGETARY EXPENDITURE ON OPERATION OF CULTURE,EDUCATION,SCIENCE&HEALTH CARE

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan地方财政文教、科学、卫生事业费支出

LOCAL BUDGETARY EXPENDITURE ON OPERATION OF CULTURE,EDUCATION,SCIENCE&HEALTH CARE

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan预算外资金收支总额及增长速度

TOTAL REVENUE AND EXPENDITURE OF EXTRA-BUDGETARY FUND AND THEIR GROWTH RATES

注:1993-1995年和1996年的预算外资金收支包括的范围分别进行了调整,与以前各年不可比。从1997年起,预算外资金收支不包括纳入预算内管理的政府性基金(收费),与以前各年也不可比。从2004年起,预算外资金收支数据,按财政预算外专户收支口径进行反映。各年收入和支出增长速度均按可比口径计算。

Note:The scope of extra budgetary revenue and expenditure was adjusted between 1993-1995and1996,not comparable with previous years;Since 1997,the extra budgetary revenue and expenditure hasn’t included those funds(fees)brought into government budgets,not consisted with previous year;Since 2004,the extra budgetary revenue and expenditure is the fiscal extra budgetary revenue and expenditure in special ac-count.The growth rate was calculated by constant figures each year.

注:1993-1995年和1996年的预算外资金收支包括的范围分别进行了调整,与以前各年不可比。从1997年起,预算外资金收支不包括纳入预算内管理的政府性基金(收费),与以前各年也不可比。从2004年起,预算外资金收支数据,按财政预算外专户收支口径进行反映。各年收入和支出增长速度均按可比口径计算。

Note:The scope of extra budgetary revenue and expenditure was adjusted between 1993-1995and1996,not comparable with previous years;Since 1997,the extra budgetary revenue and expenditure hasn’t included those funds(fees)brought into government budgets,not consisted with previous year;Since 2004,the extra budgetary revenue and expenditure is the fiscal extra budgetary revenue and expenditure in special ac-count.The growth rate was calculated by constant figures each year.

预算外资金分项目收入

EXTRA-BUDGETARY REVENUE BY ITEM

单位:亿元 Unit:100 million yuan

注:1993-1995年和1996年的预算外资金收入包括的范围进行了调整,与以前各年不可比。从1997年起,预算外资金收入不包括纳入预算内管理的政府性基金(收费),与以前各年也不可比。从2004年起,预算外资金收支数据,按财政预算外专户收支口径进行反映。

Note:The scope of extra budgetary revenue and expenditure was changed between1993-1995and1996,not comparable with previous years;Since 1997,the extra budgetary revenue and expenditure hasn’t included those funds(fees)brought into government budgets,not consisted with pre-vious year;Since 2004,the extra budgetary revenue and expenditure is the fiscal extra budgetary revenue and expenditure in special account.

单位:亿元 Unit:100 million yuan

注:1993-1995年和1996年的预算外资金收入包括的范围进行了调整,与以前各年不可比。从1997年起,预算外资金收入不包括纳入预算内管理的政府性基金(收费),与以前各年也不可比。从2004年起,预算外资金收支数据,按财政预算外专户收支口径进行反映。

Note:The scope of extra budgetary revenue and expenditure was changed between1993-1995and1996,not comparable with previous years;Since 1997,the extra budgetary revenue and expenditure hasn’t included those funds(fees)brought into government budgets,not consisted with pre-vious year;Since 2004,the extra budgetary revenue and expenditure is the fiscal extra budgetary revenue and expenditure in special account.

预算外资金分项目支出

EXTRA-BUDGETARY EXPENDITURE BY ITEM

单位:亿元 Unit:100 million yuan

注:1996年预算外资金支出包括的范围进行了调整,与以前各年不可比。从1997年起,预算外资金支出不包括纳入预算内管理的政府性基金(收费)。从2004年起,预算外资金收支数据,按财政预算外专户收支口径进行反映。

Note:In 1996,the scope of extra-budgetary expenditure was changed,not consisted with previous years;Since 1997,the extra budgetary expenditure hasn’t included those funds(fees)brought into government budgets,not comparable with previous years;Since 2004,the extra budgetary rev-enue and expenditure is the fiscal extra budgetary revenue and expenditure in special account.

单位:亿元 Unit:100 million yuan

注:1996年预算外资金支出包括的范围进行了调整,与以前各年不可比。从1997年起,预算外资金支出不包括纳入预算内管理的政府性基金(收费)。从2004年起,预算外资金收支数据,按财政预算外专户收支口径进行反映。

Note:In 1996,the scope of extra-budgetary expenditure was changed,not consisted with previous years;Since 1997,the extra budgetary expenditure hasn’t included those funds(fees)brought into government budgets,not comparable with previous years;Since 2004,the extra budgetary rev-enue and expenditure is the fiscal extra budgetary revenue and expenditure in special account.

中央和地方预算外资金收支及比重

EXTRA-BUDGETARY REVENUE AND EXPENDITURE OF CENTRAL AND LOCAL GOVERNMENT AND THEIR RATIOS

注:1993-1995年和1996年的预算外资金收支包括的范围分别进行了调整,与以前各年不可比。从1997年起,预算外资金收支不包括纳入预算内管理的政府性基金(收费)。从2004年起,预算外资金收支数据,按财政预算外专户收支口径进行反映。

Note:The scope of extra budgetary revenue and expenditure was changed between1993-1995and1996,not comparables with previous years;Since 1997,the extra budgetary revenue and expenditure hasn’t included those funds(fees)brought into government budgets,not consisted with previ-ous year;Since 2004,the extra budgetary revenue and expenditure is the fiscal extra budgetary revenue and expenditure in special account.

注:1993-1995年和1996年的预算外资金收支包括的范围分别进行了调整,与以前各年不可比。从1997年起,预算外资金收支不包括纳入预算内管理的政府性基金(收费)。从2004年起,预算外资金收支数据,按财政预算外专户收支口径进行反映。

Note:The scope of extra budgetary revenue and expenditure was changed between1993-1995and1996,not comparables with previous years;Since 1997,the extra budgetary revenue and expenditure hasn’t included those funds(fees)brought into government budgets,not consisted with previ-ous year;Since 2004,the extra budgetary revenue and expenditure is the fiscal extra budgetary revenue and expenditure in special account.

各地区预算外资金收入

EXTRA-BUDGETARY REVENUE BY REGION

单位:亿元 Unit:100 million yuan

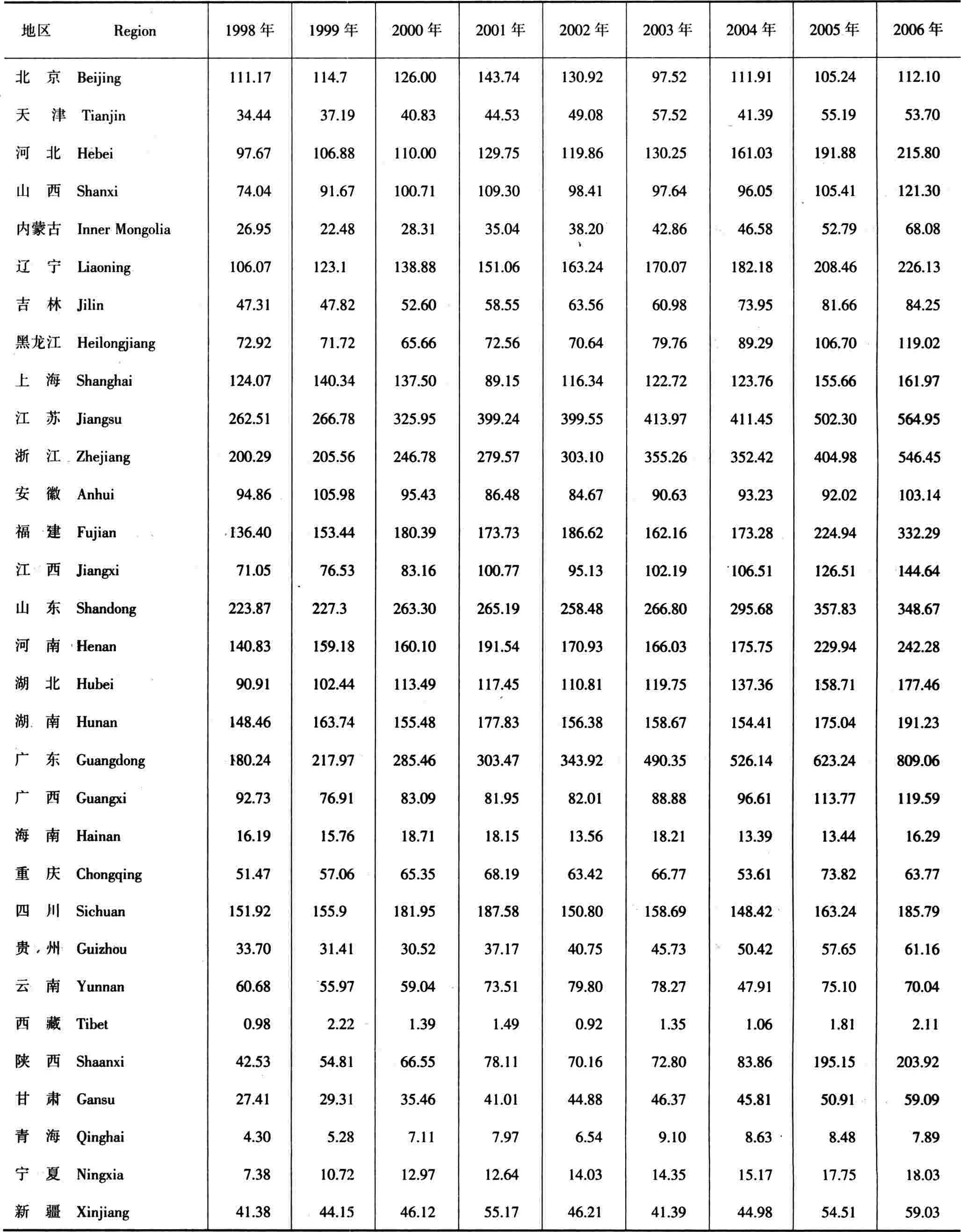

单位:亿元 Unit:100 million yuan各地区预算外资金支出

EXTRA-BUDGETARY EXPENDITURE BY REGION

单位:亿元 Unit:100 million yuan

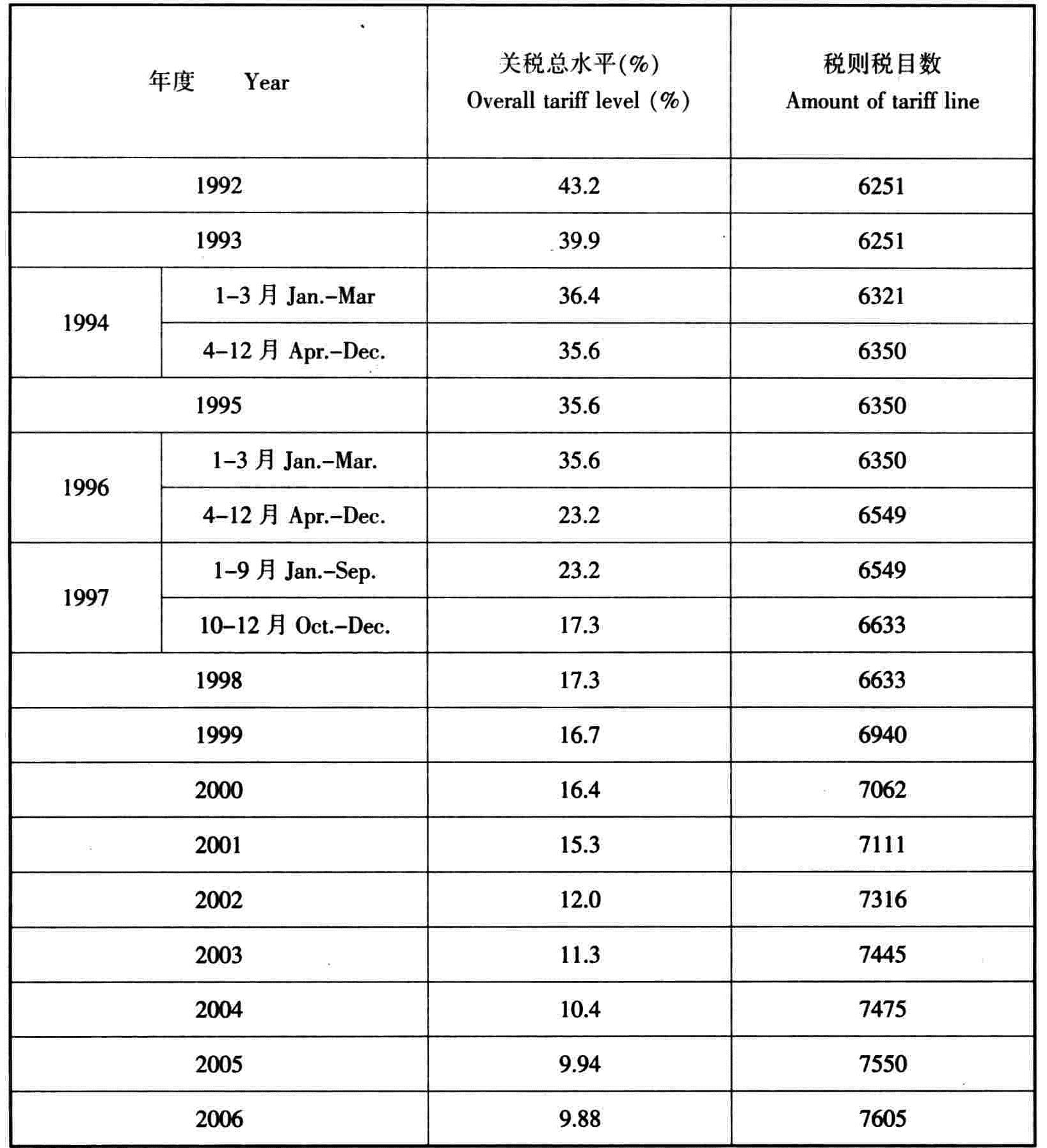

单位:亿元 Unit:100 million yuan1992年以来我国历年关税总水平及税目数

Overall Tariff Level and Amount of Tariff Line of China in Years Since 1v992

注:新中国建立至1992年,我国关税总水平一直维持在40%以上的较高水平;为扩大国内不能生产供应的先进技术产品和国内短缺的原材料等产品的进口,增强国内工业生产在竞争中前进的能力,1992年3月我国提出在三到五年内将关税总水平降低50%,并于1992年12月实施了第一步自主降税;1996年11月,江泽民主席在菲律宾苏比克湾APEC第四次领导人非正式会议上宣布“中国将在2000年把关税总水平降到15%左右”;入世之前,我国先后进行了四步自主降税;2001年12月我国正式加入WTO,此后我国开始按入世关税减让承诺逐年降税。

Remarks:Since New China’s founding to 1992,our overall tariff level had been kept at a higher level over40%;to import more products such as those with advanced technology and can’t be produced and supplied at home and raw materials in short supply in China,and enhance the progressing capability of domestic industrial induction in competition,in March 1992,China planned to cut down the overall tariff level by 50% within 3-5 years,and implemented the first-step tariff reduction in December 1992at its own decision;in November 1996,President Jiang Zemin announced at the4th Infor-mal Conference of Leaders of APEC held at Subic Ba),Philippines that,“China will cut down the overall tariff level to around 15% in 2000”;prior to its WTO entry,China had reduced the tariff rate at its own decision by successive four steps;in Ddcember 2001,China joined the WTO formally,since then,China has begun to reduce the tariff rate year by year under its WTO entry commitment on tariff concession.

注:新中国建立至1992年,我国关税总水平一直维持在40%以上的较高水平;为扩大国内不能生产供应的先进技术产品和国内短缺的原材料等产品的进口,增强国内工业生产在竞争中前进的能力,1992年3月我国提出在三到五年内将关税总水平降低50%,并于1992年12月实施了第一步自主降税;1996年11月,江泽民主席在菲律宾苏比克湾APEC第四次领导人非正式会议上宣布“中国将在2000年把关税总水平降到15%左右”;入世之前,我国先后进行了四步自主降税;2001年12月我国正式加入WTO,此后我国开始按入世关税减让承诺逐年降税。

Remarks:Since New China’s founding to 1992,our overall tariff level had been kept at a higher level over40%;to import more products such as those with advanced technology and can’t be produced and supplied at home and raw materials in short supply in China,and enhance the progressing capability of domestic industrial induction in competition,in March 1992,China planned to cut down the overall tariff level by 50% within 3-5 years,and implemented the first-step tariff reduction in December 1992at its own decision;in November 1996,President Jiang Zemin announced at the4th Infor-mal Conference of Leaders of APEC held at Subic Ba),Philippines that,“China will cut down the overall tariff level to around 15% in 2000”;prior to its WTO entry,China had reduced the tariff rate at its own decision by successive four steps;in Ddcember 2001,China joined the WTO formally,since then,China has begun to reduce the tariff rate year by year under its WTO entry commitment on tariff concession.

附件下载:

附件下载:相关推荐

京公网安备 11010802030967号

京公网安备 11010802030967号