当前位置:首页 > 用户服务 > 过刊查询 > 过刊查询中国财政年鉴 > 中国财政年鉴2006年卷 > 中国财政年鉴2006年卷文章 > 正文

当前位置:首页 > 用户服务 > 过刊查询 > 过刊查询中国财政年鉴 > 中国财政年鉴2006年卷 > 中国财政年鉴2006年卷文章 > 正文[大]

[中]

[小]

摘要:

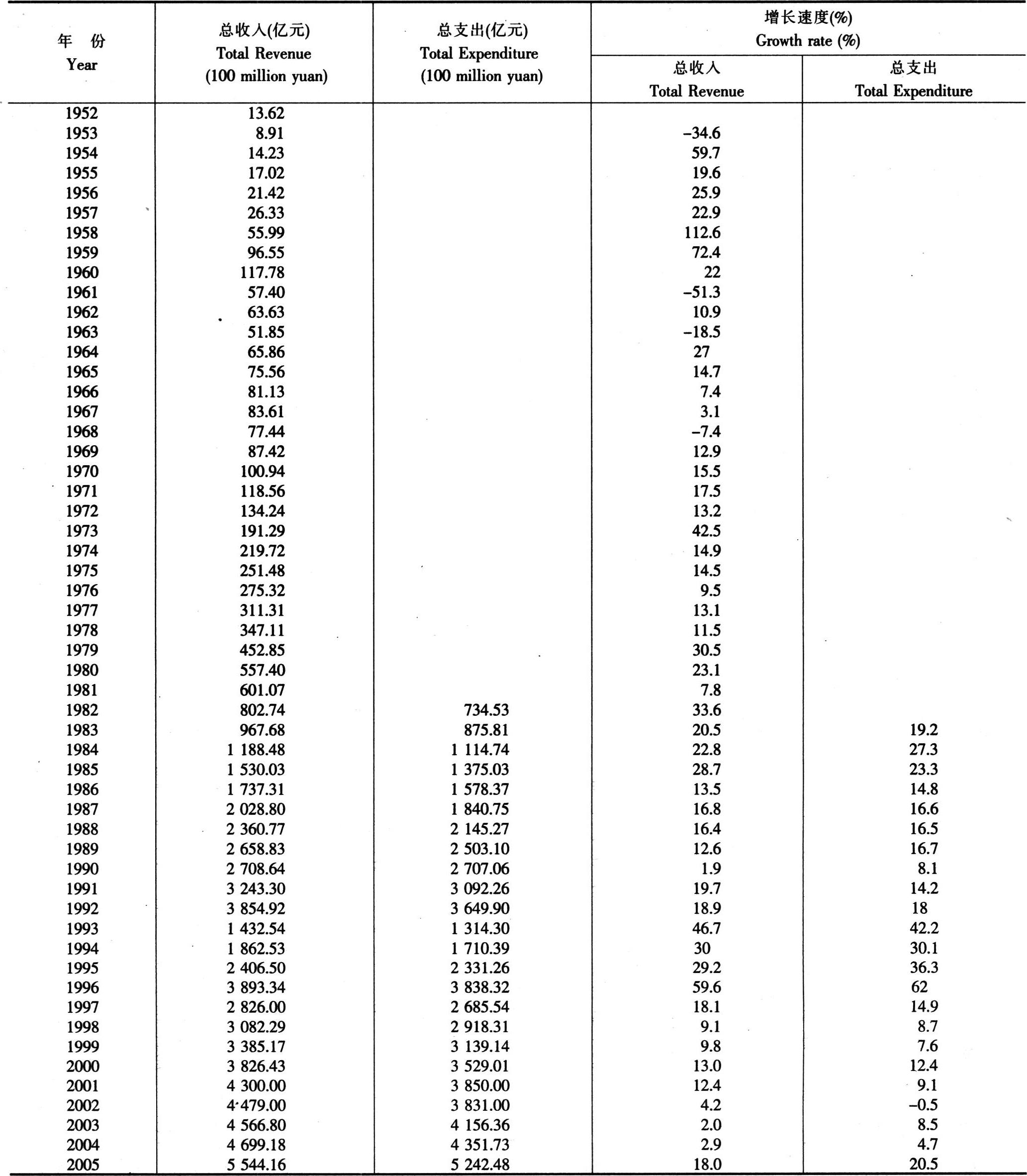

HISTORICAL ANNUAL REVENUES AND EXPENDITURES

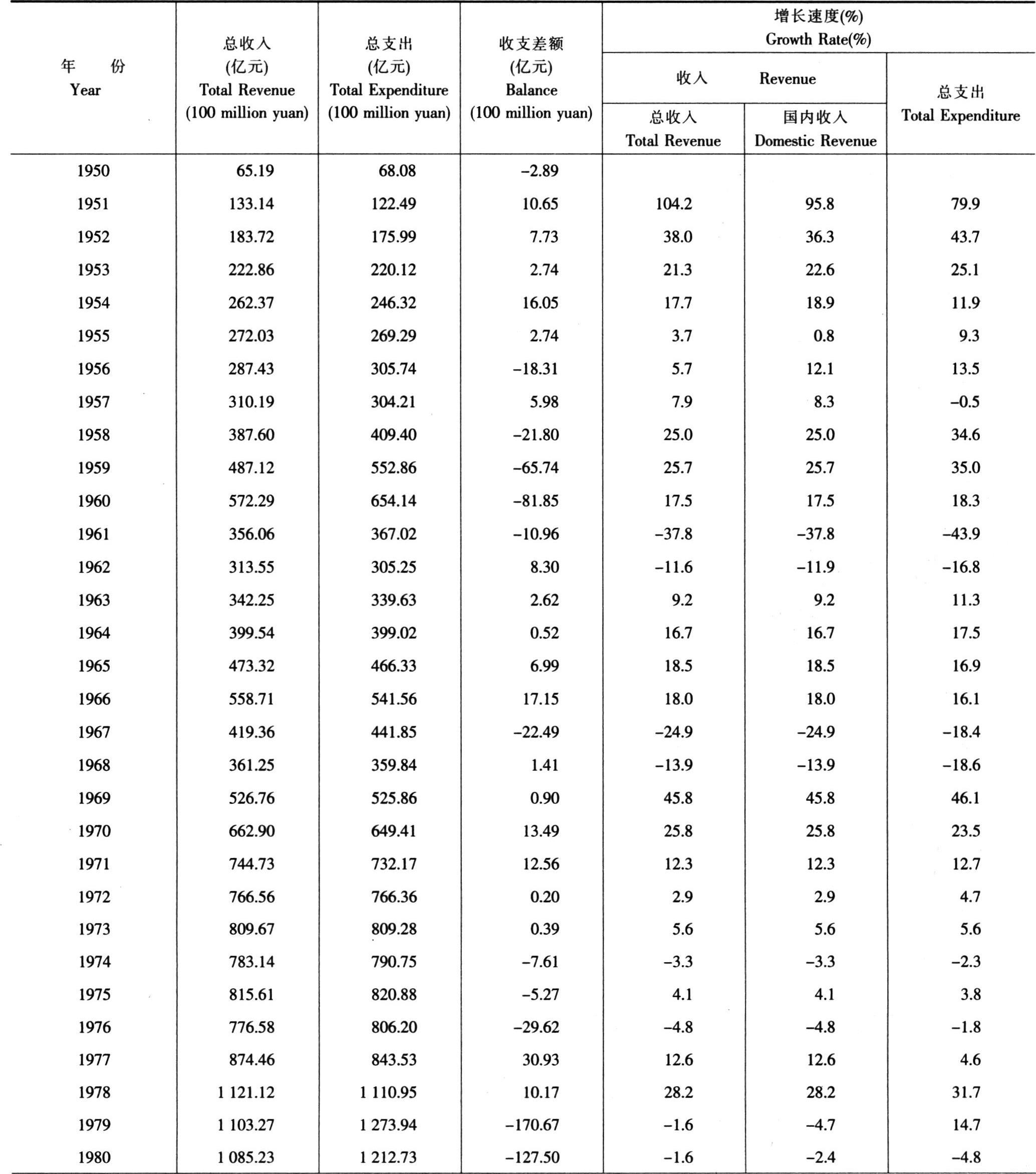

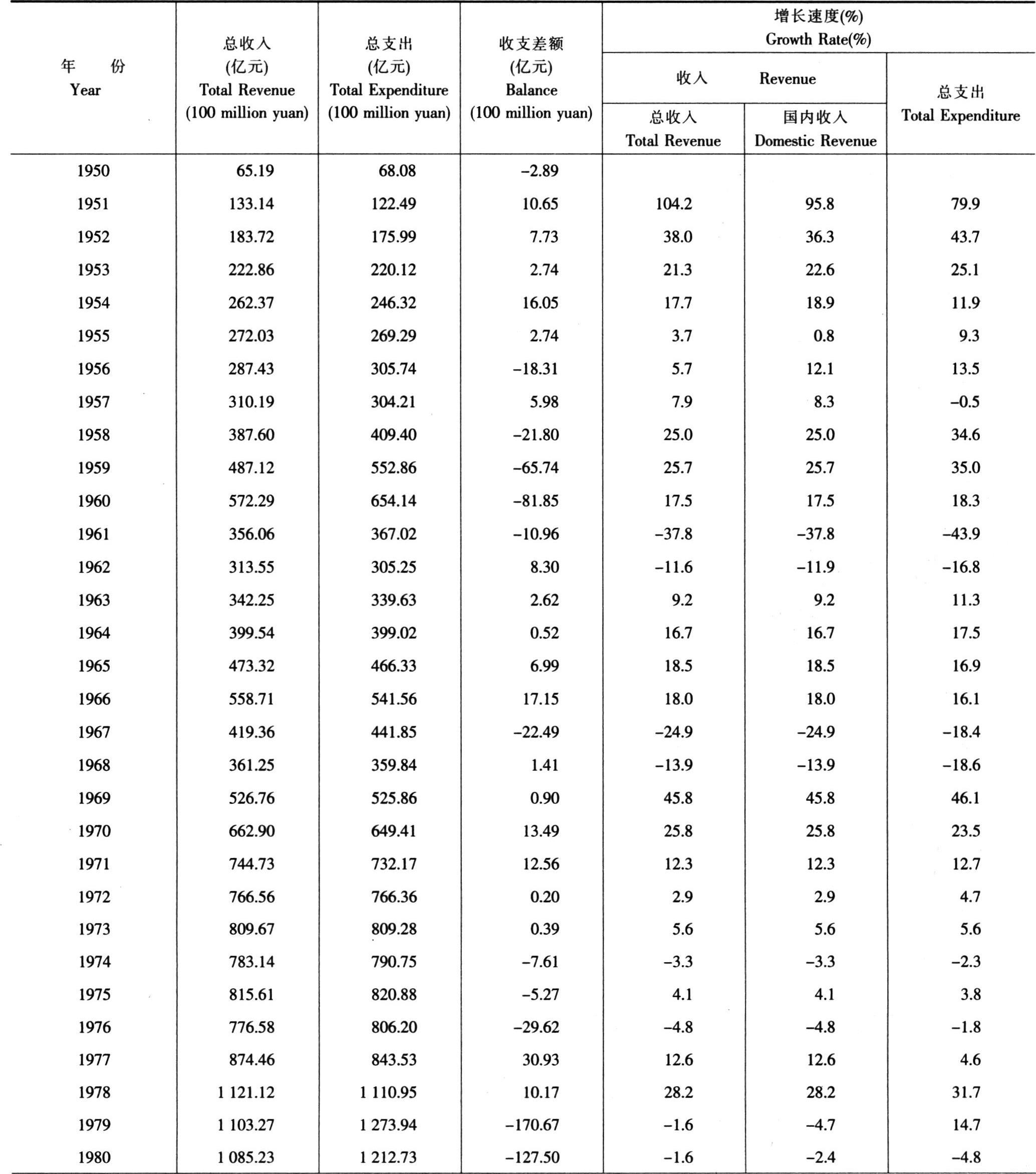

国家财政收支总额及增长速度(包括国内外债务部分)

续表 Continued

续表 ContinuedTOTAL BUDGETARY REVENUE AND EXPENDITURE AND THEIR GROWTH RATES(INCLUDING FOREIGN AND DOMESTIC DEBTS)

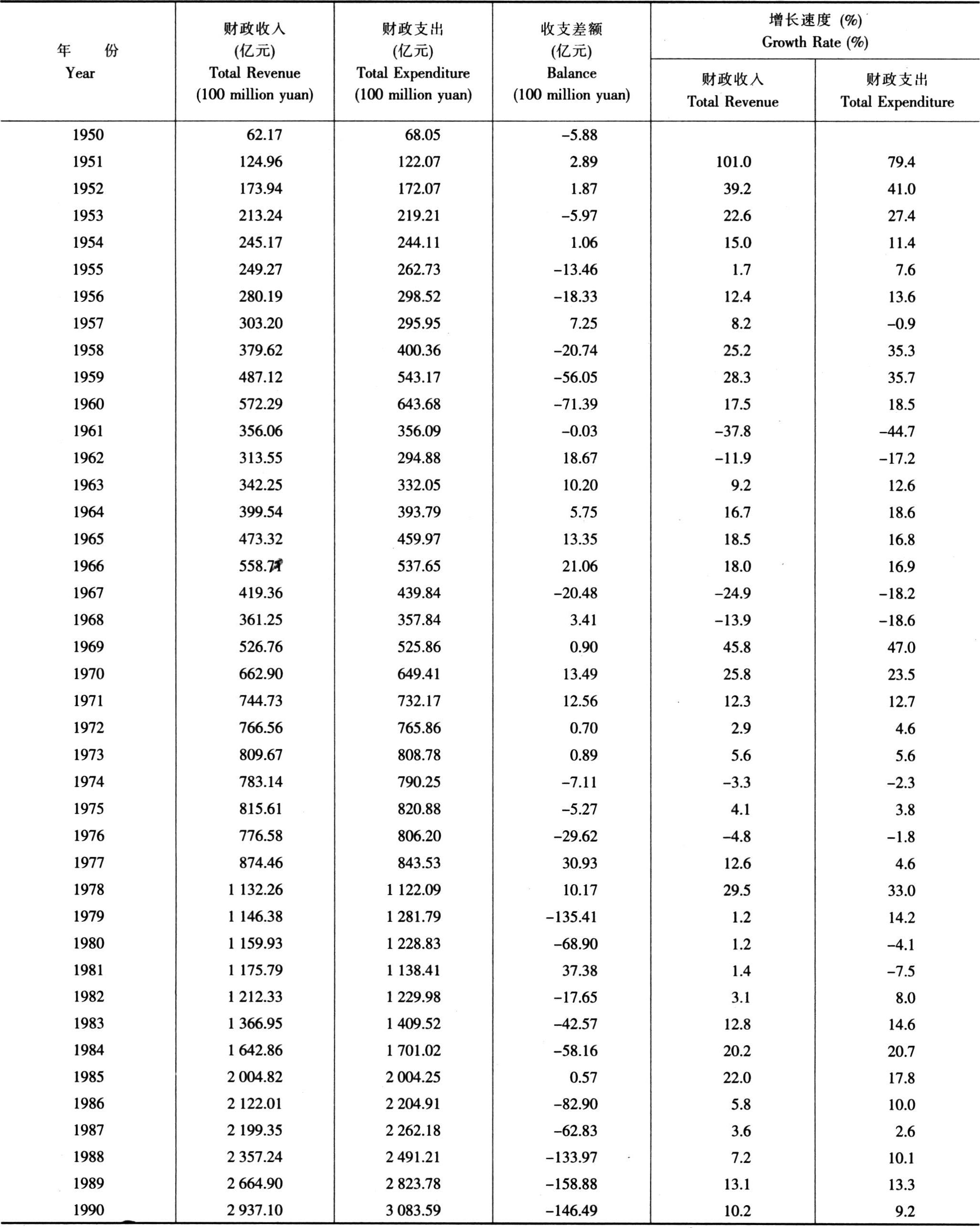

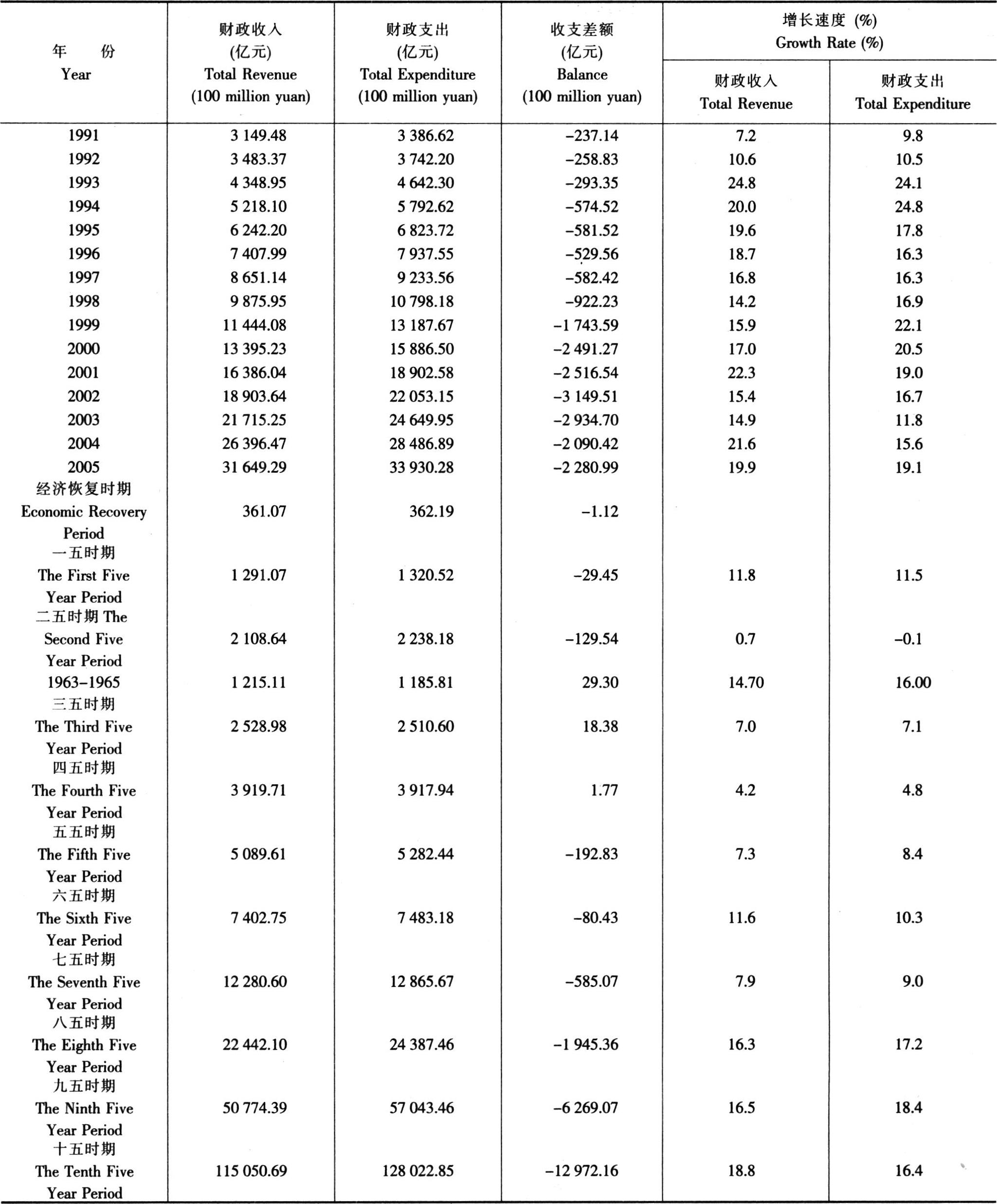

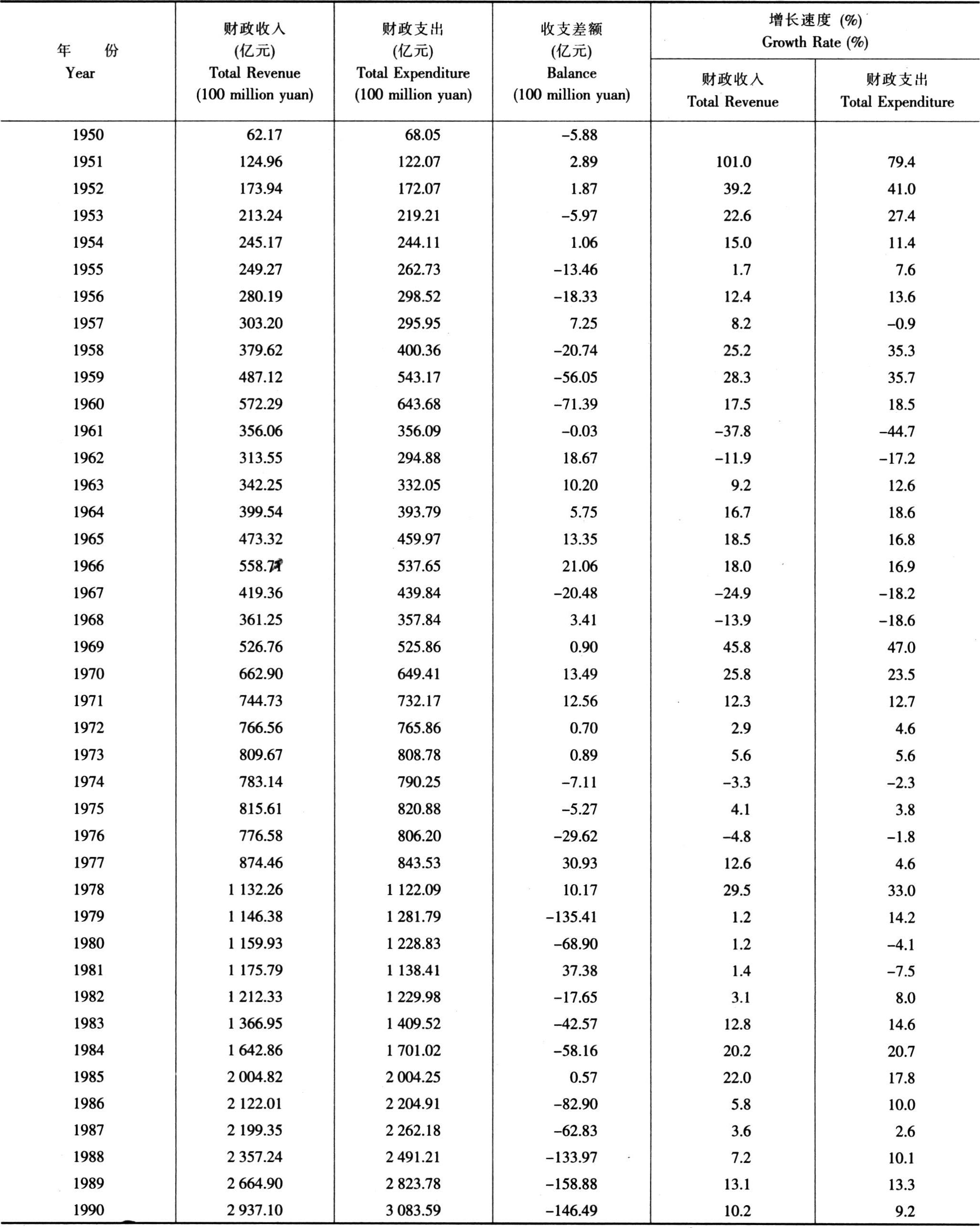

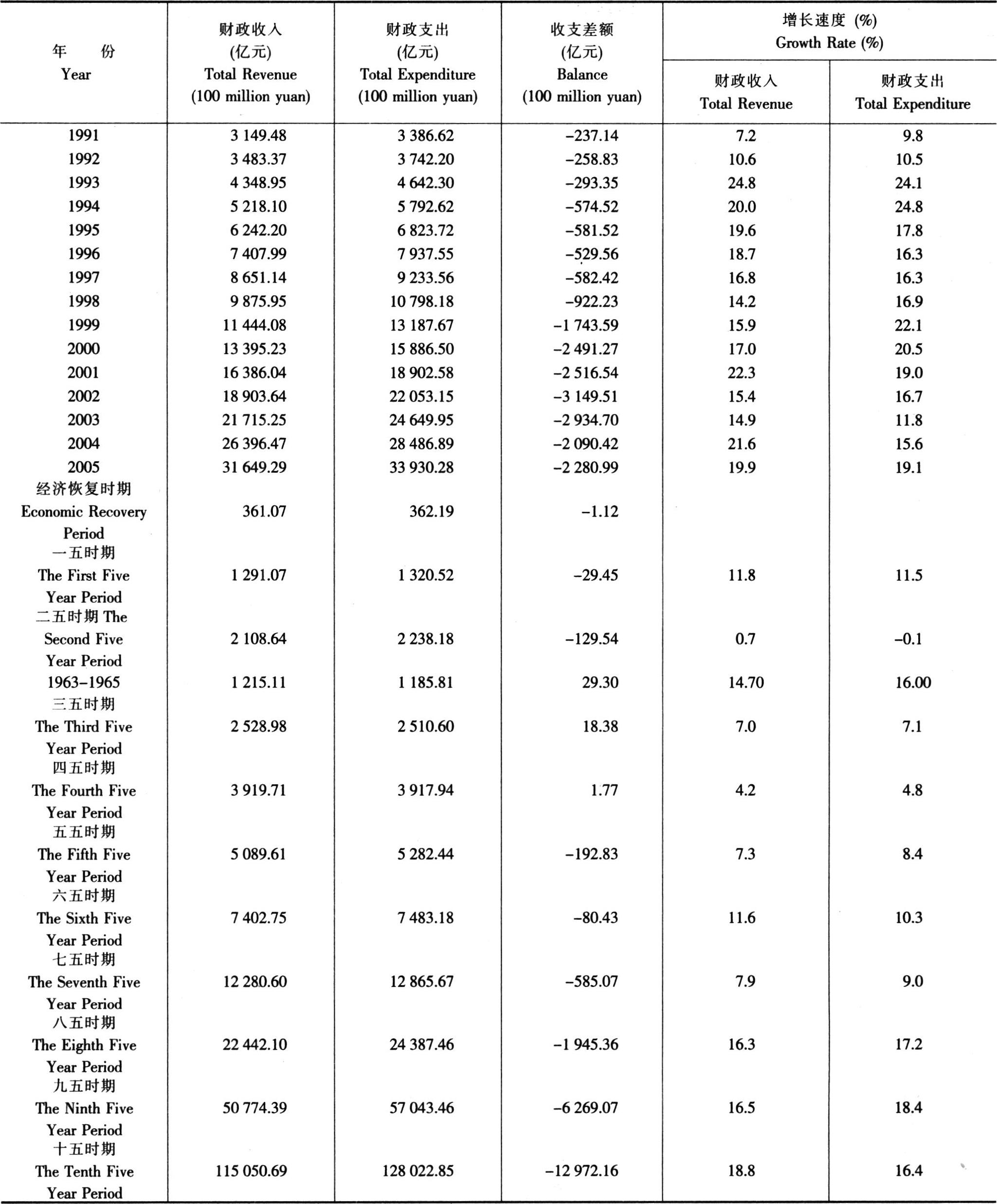

国家财政收支总额及增长速度(不包括国内外债务部分)

续表 Continued

续表 ContinuedTOTAL BUDGETARY REVENUE AND EXPENDITURE AND THEIR GROWTH RATES(NOT INCLUDING FOREIGN AND DOMESTIC DEBTS)

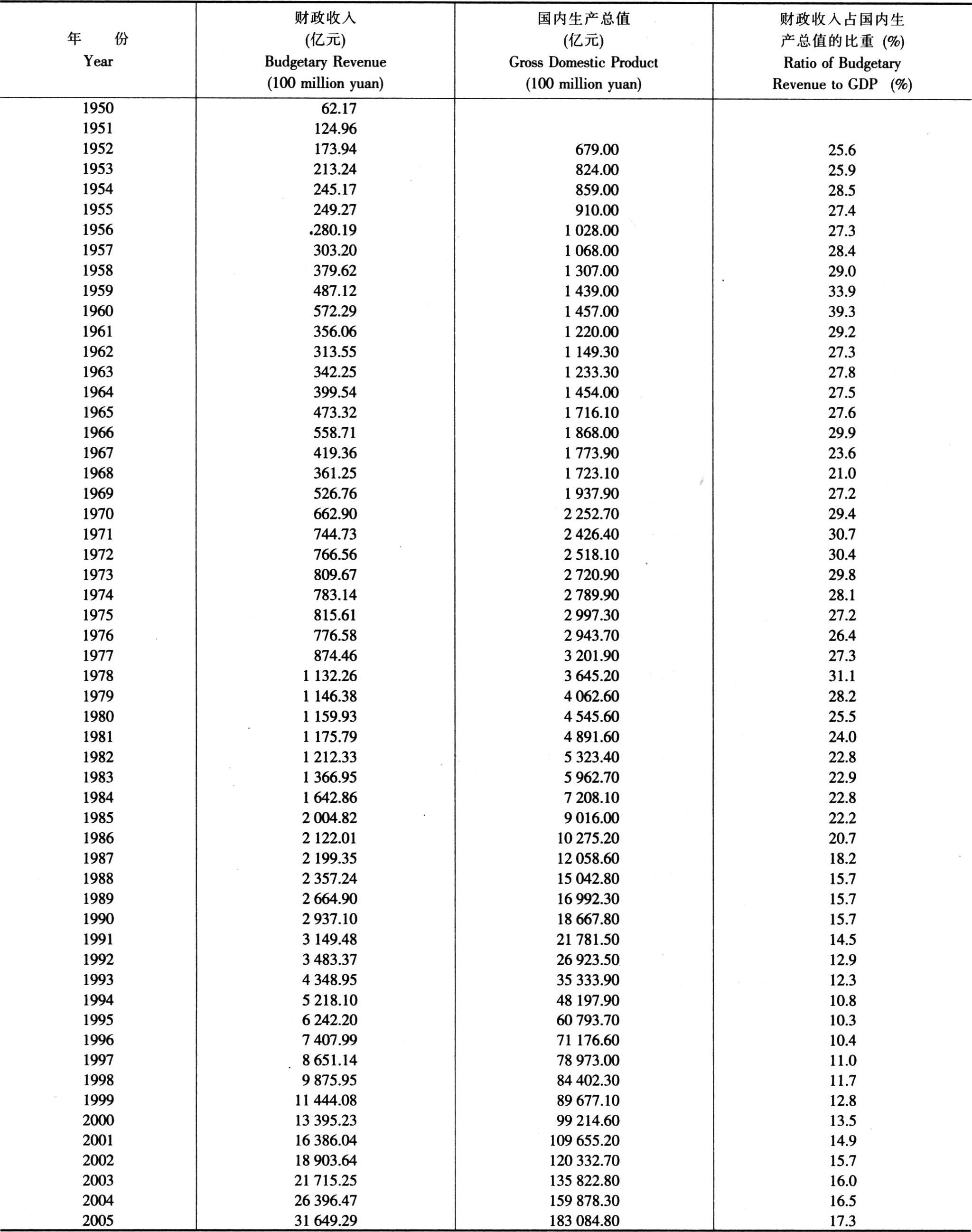

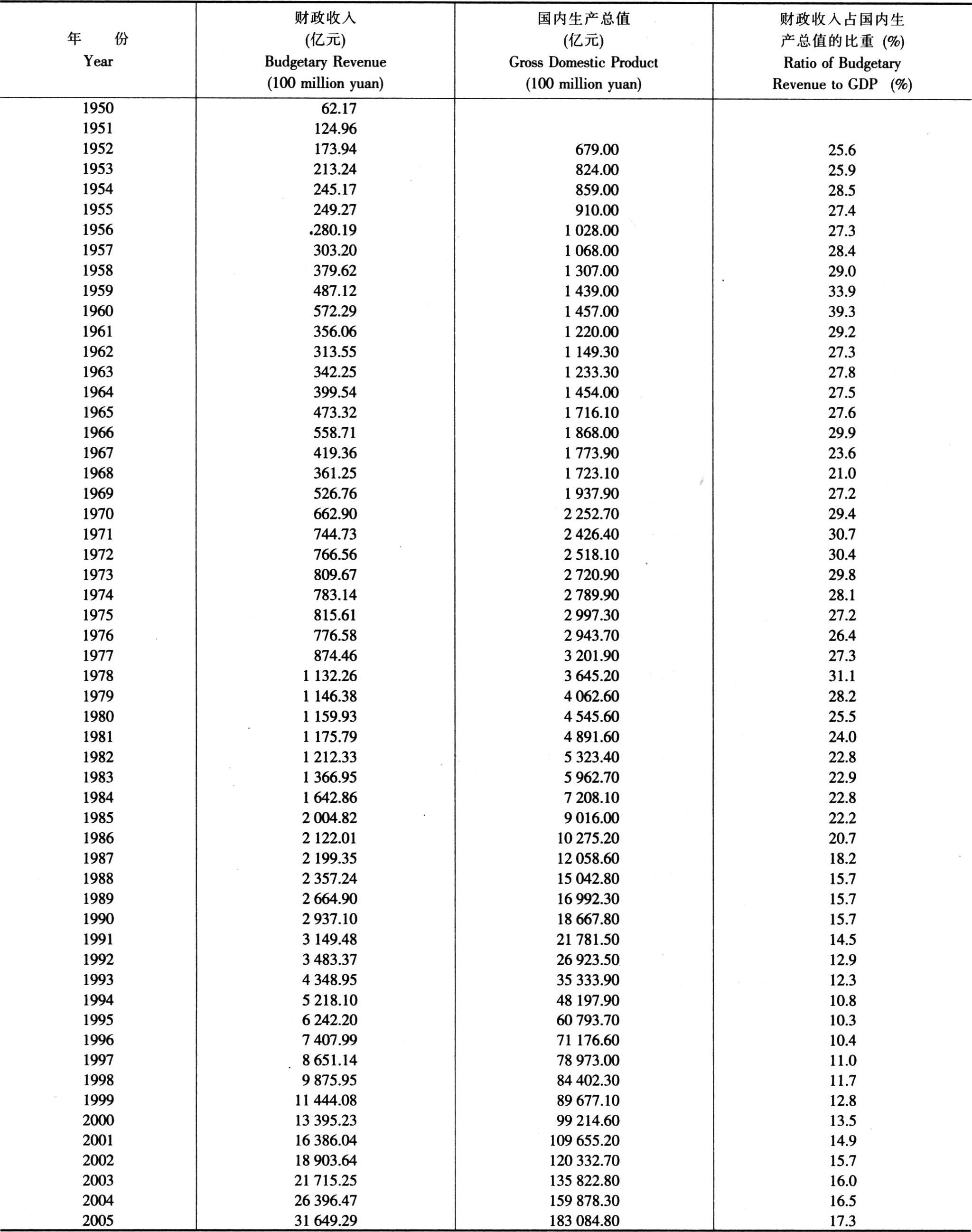

国家财政收入占国内生产总值的比重

RAT...

HISTORICAL ANNUAL REVENUES AND EXPENDITURES

国家财政收支总额及增长速度(包括国内外债务部分)

续表 Continued

续表 ContinuedTOTAL BUDGETARY REVENUE AND EXPENDITURE AND THEIR GROWTH RATES(INCLUDING FOREIGN AND DOMESTIC DEBTS)

国家财政收支总额及增长速度(不包括国内外债务部分)

续表 Continued

续表 ContinuedTOTAL BUDGETARY REVENUE AND EXPENDITURE AND THEIR GROWTH RATES(NOT INCLUDING FOREIGN AND DOMESTIC DEBTS)

国家财政收入占国内生产总值的比重

RATIO OF BUDGETARY REVENUE TO GROSS DOMESTIC PRODUCT

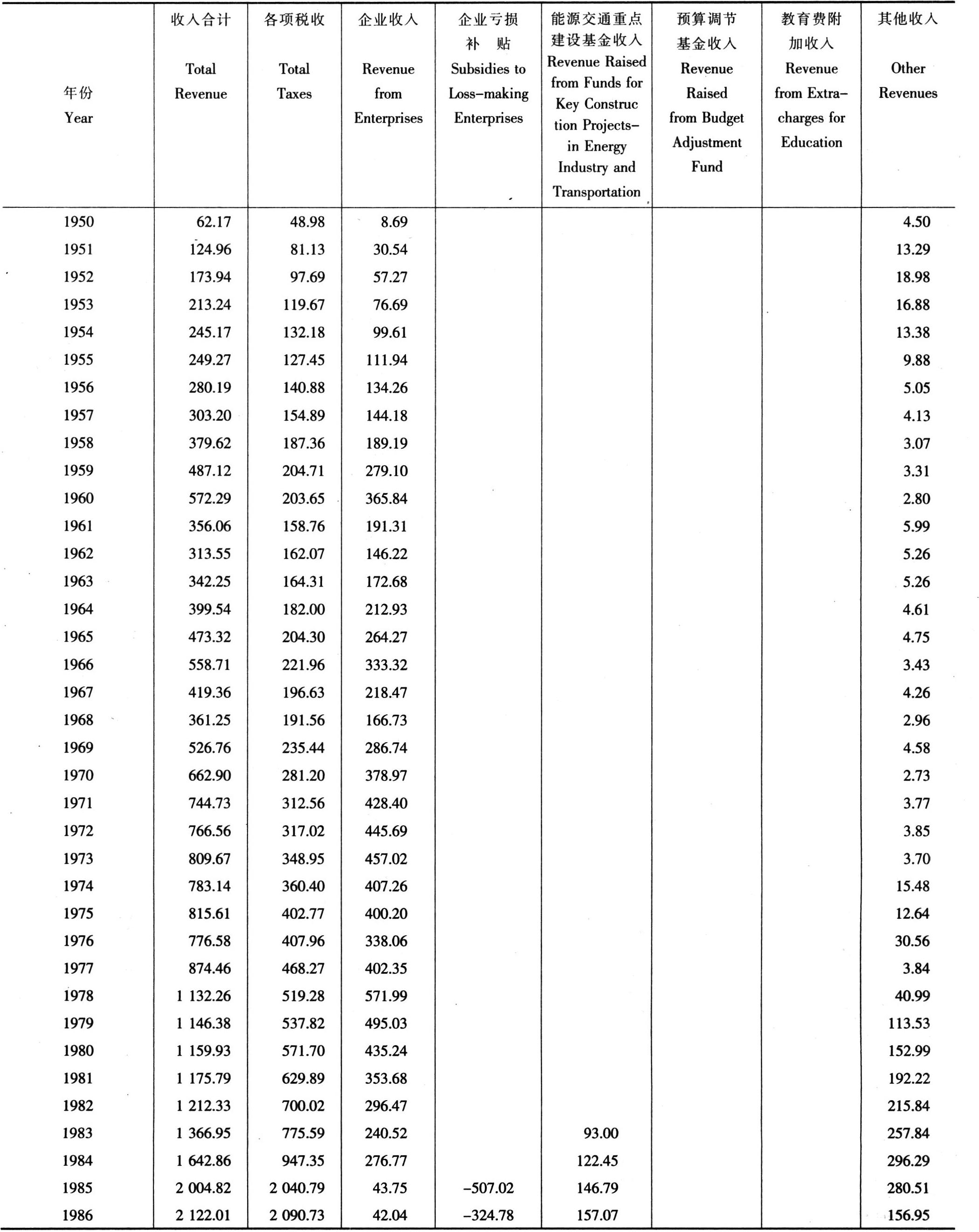

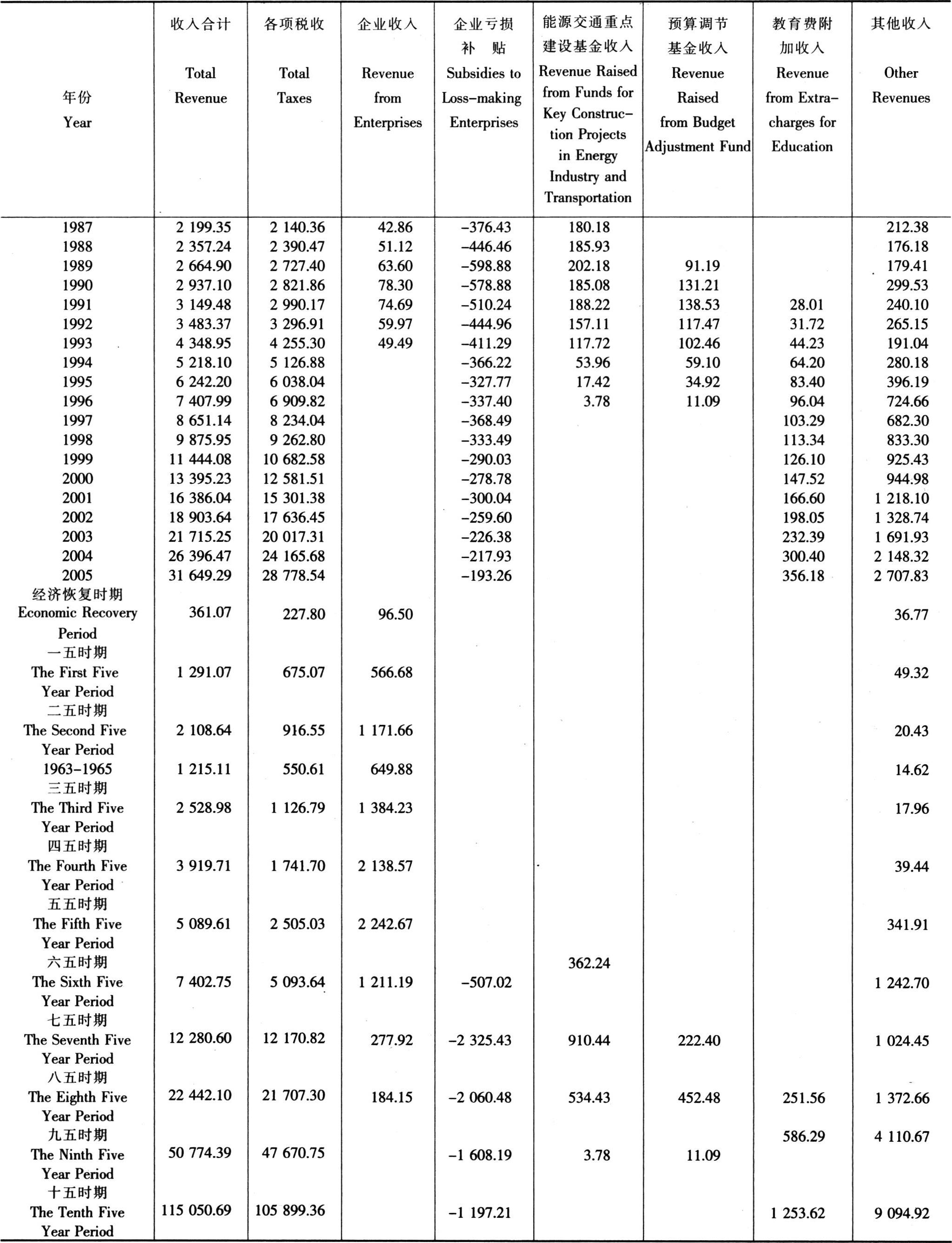

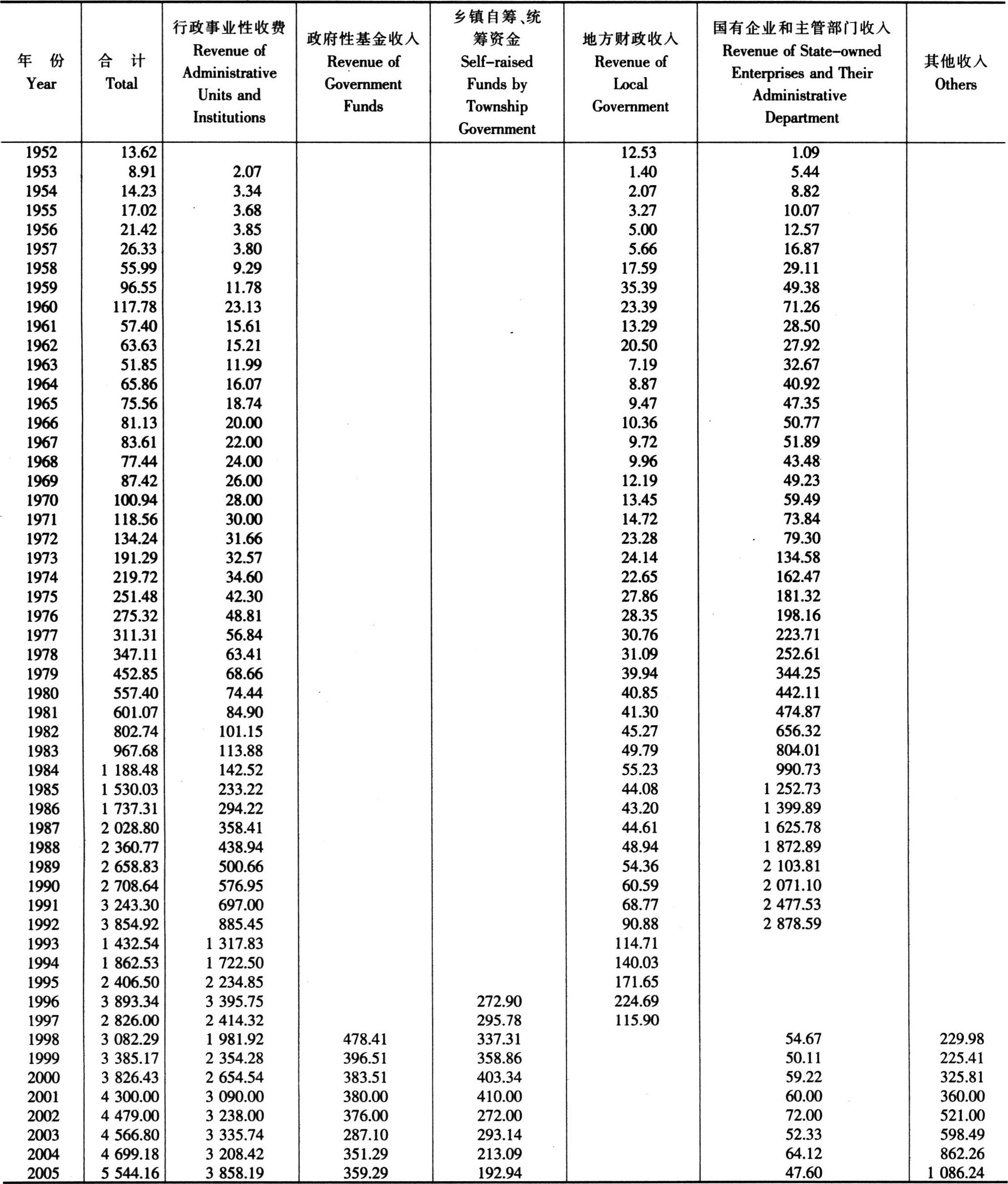

国家财政分项目收入

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

续表 ContinuedBUDGETARY REVENUE BY ITEM

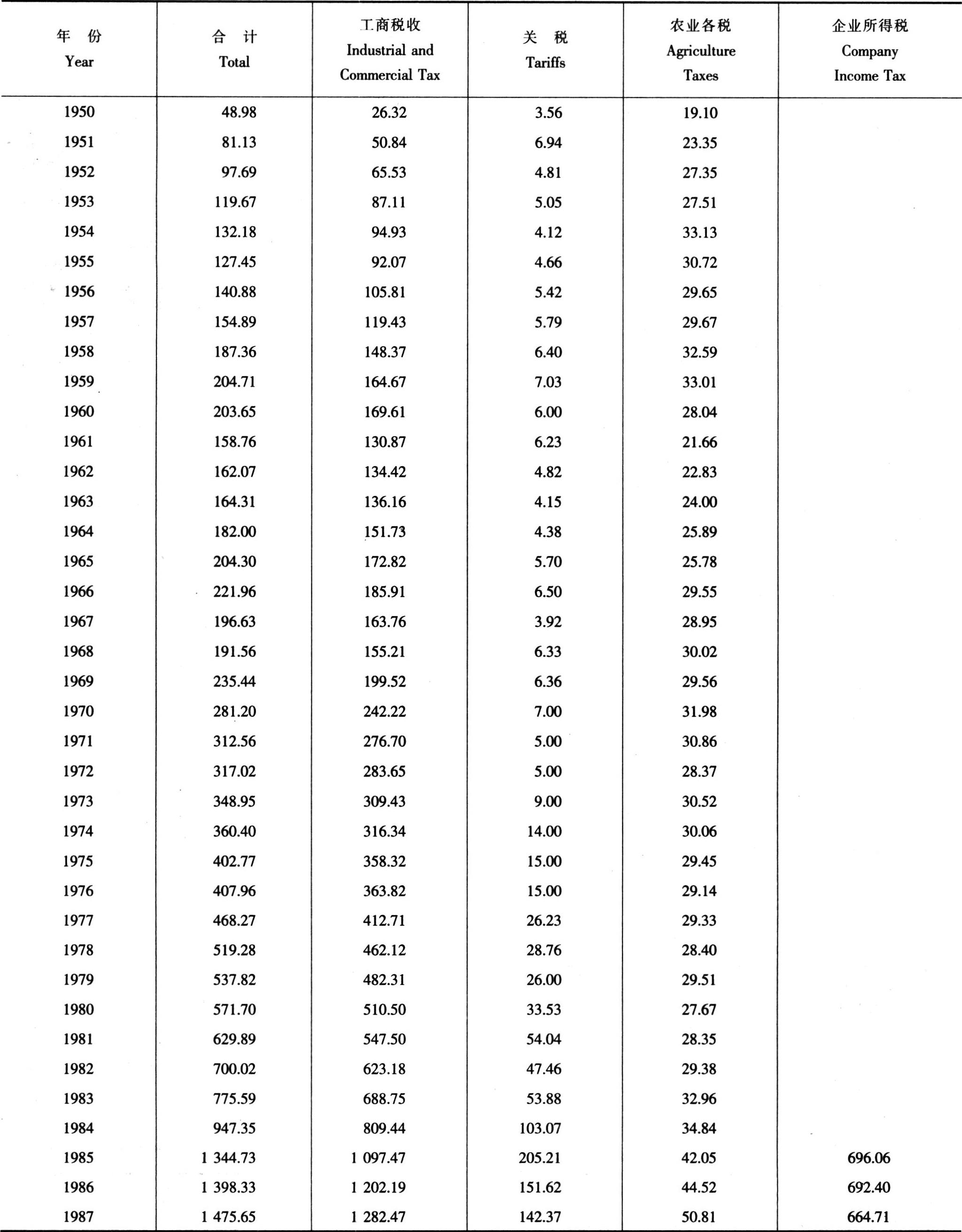

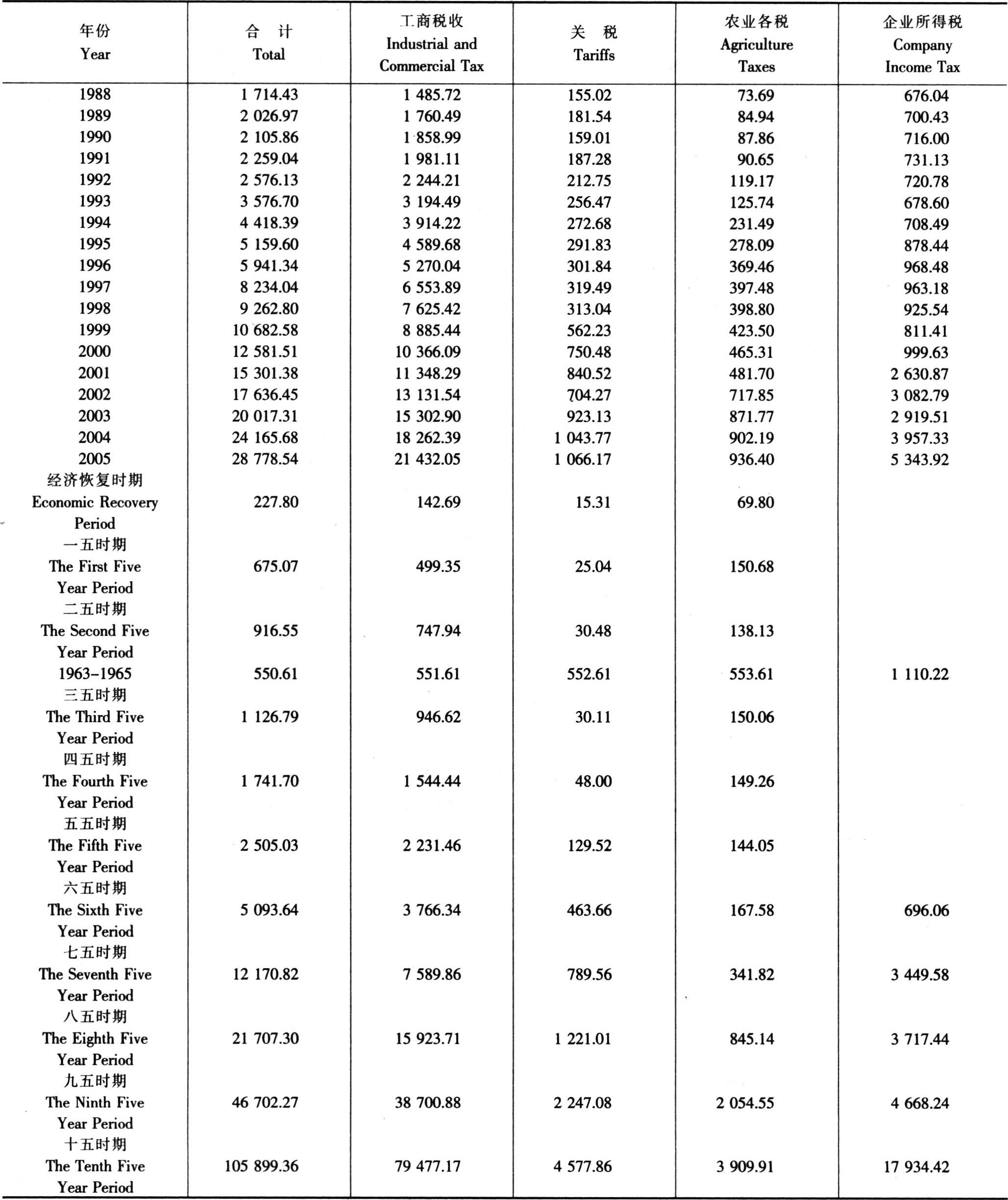

各项税收收入

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

续表 ContinuedGOVERNMENT TAXES REVENUE

产品税、增值税、营业税和消费税收入

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanREVENUES FROM PRODUCT TAX,VALUE ADDED TAX,BUSINESS TAX AND CONSUMPTION TAX

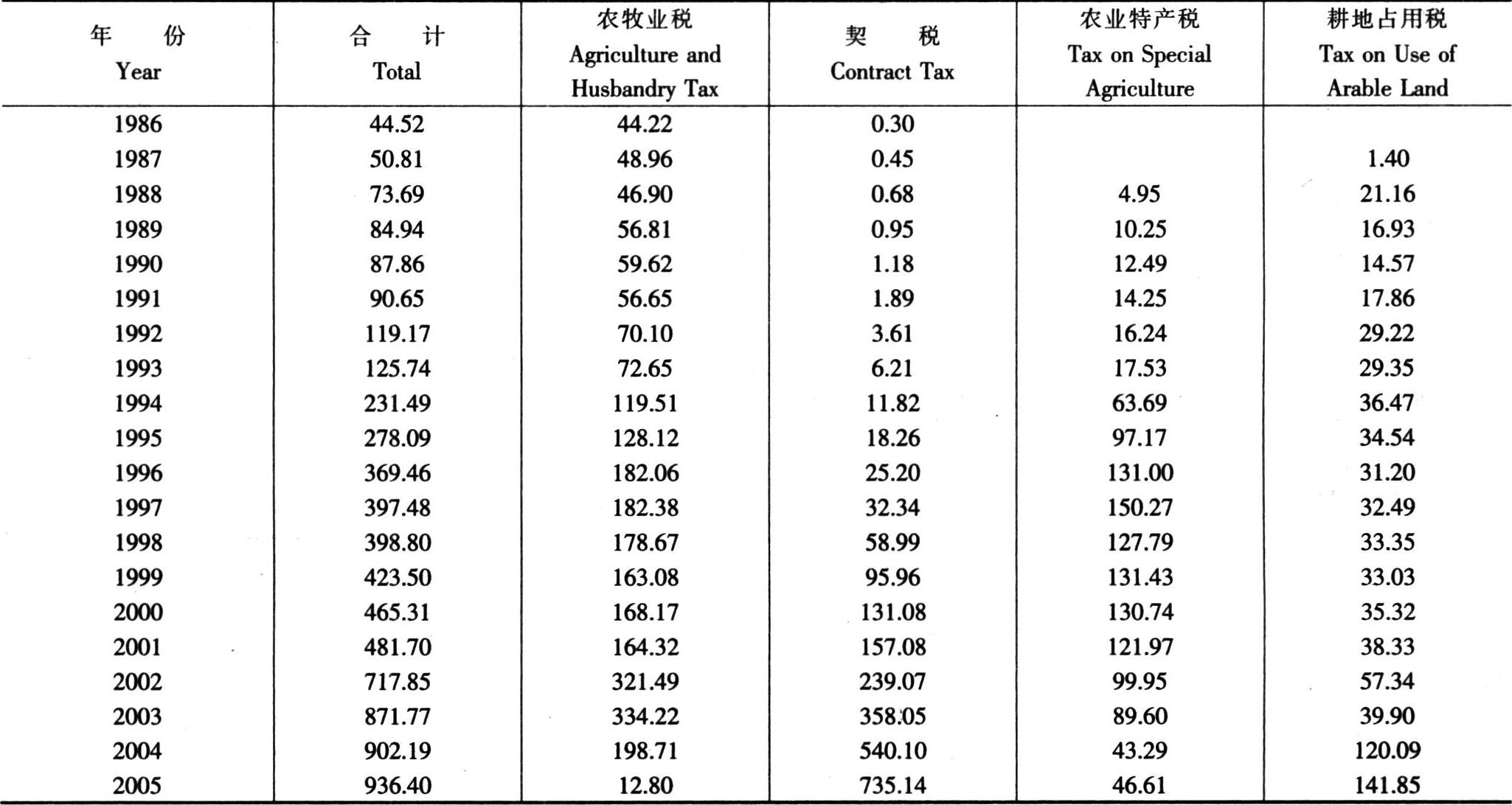

农业主要税收收入

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanREVENUE FROM TAXES IN AGRICULTURAL SECTOR

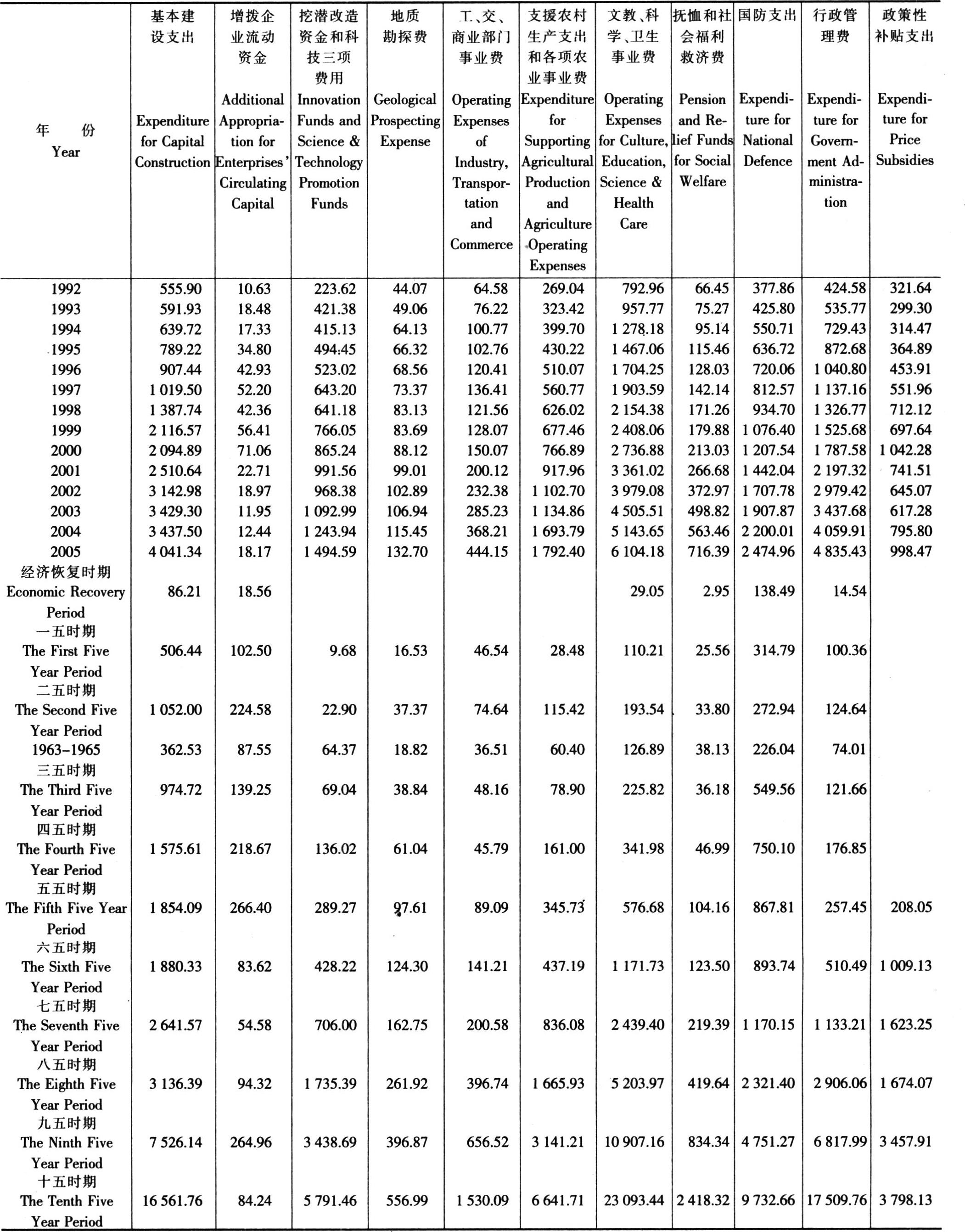

国家财政主要支出项目

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

续表 ContinuedBUDGETARY EXPENDITURE BY MAIN ITEM

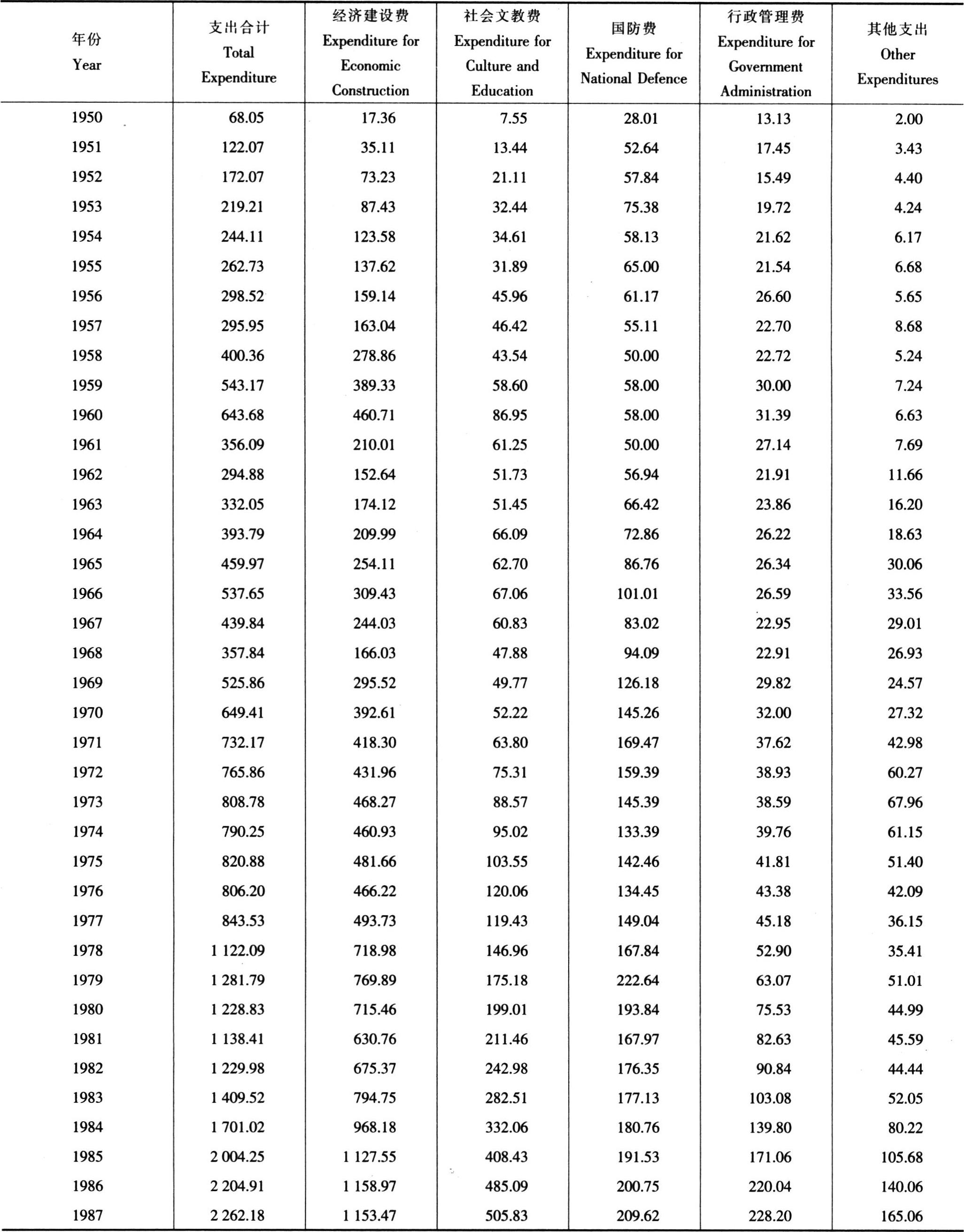

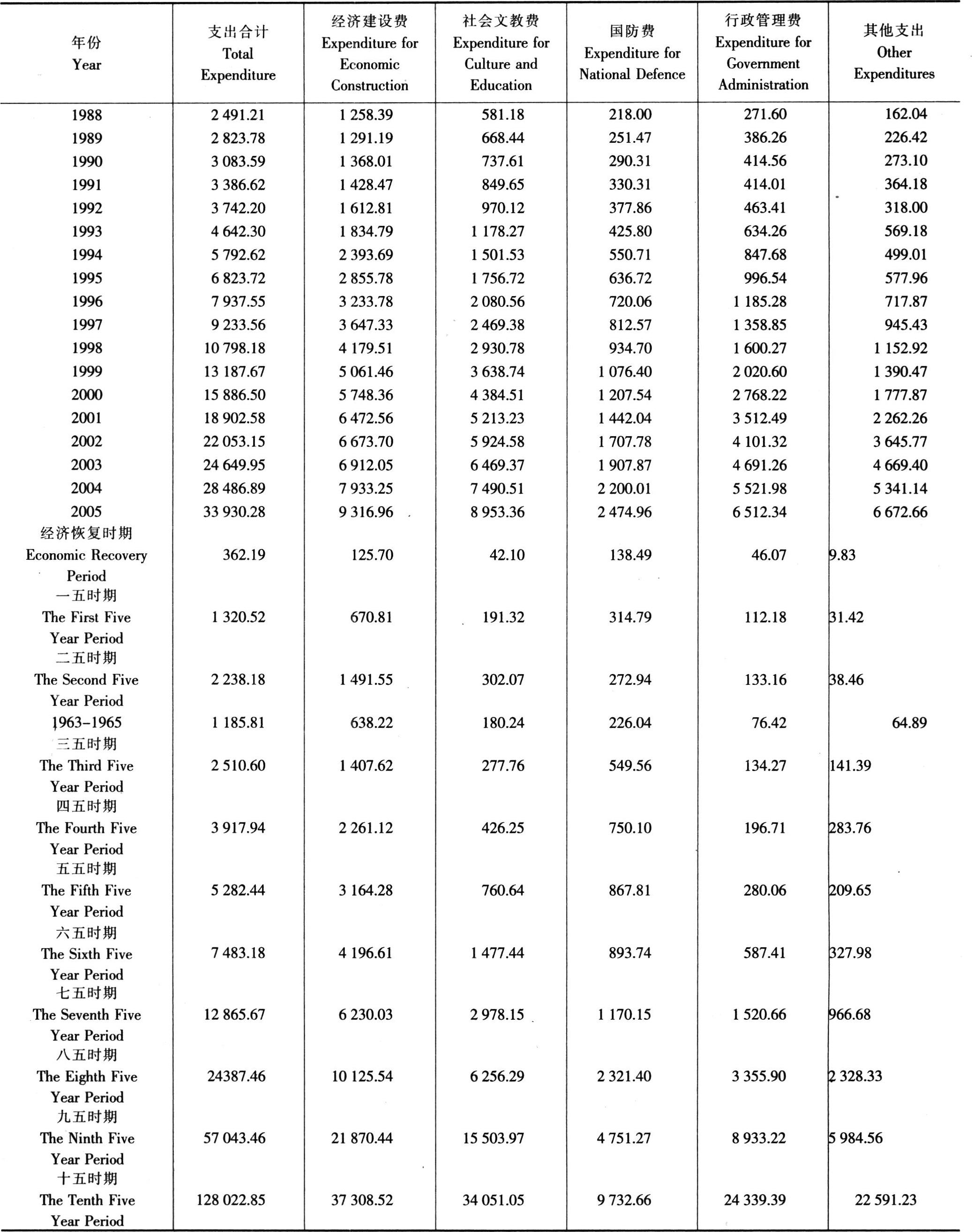

国家财政按功能性质分类的支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

续表 ContinuedBUDGETARY EXPENDITURE BY FUNCTION

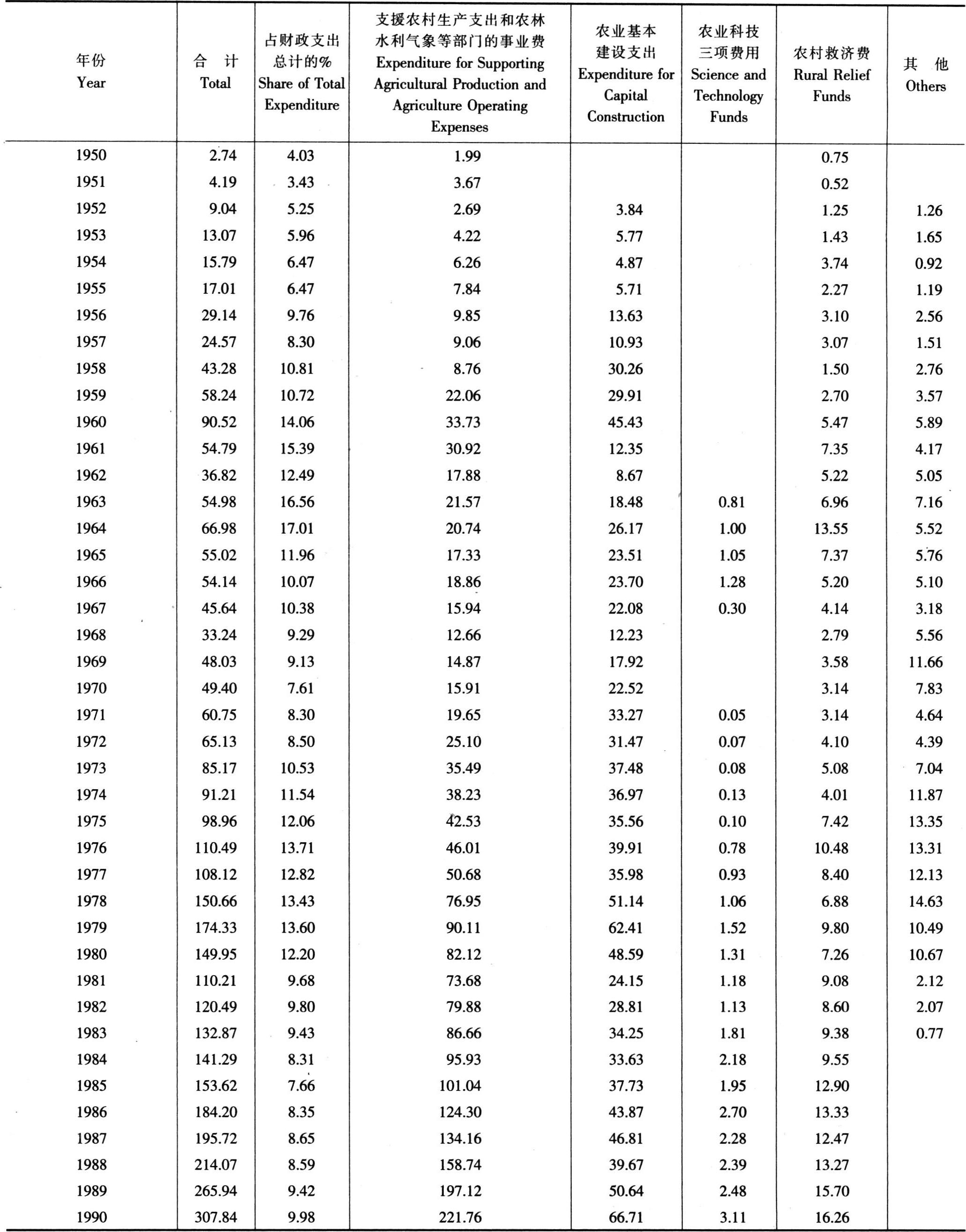

国家财政用于农业的支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

续表 ContinuedBUDGETARY EXPENDITURE ON AGRICULTURE

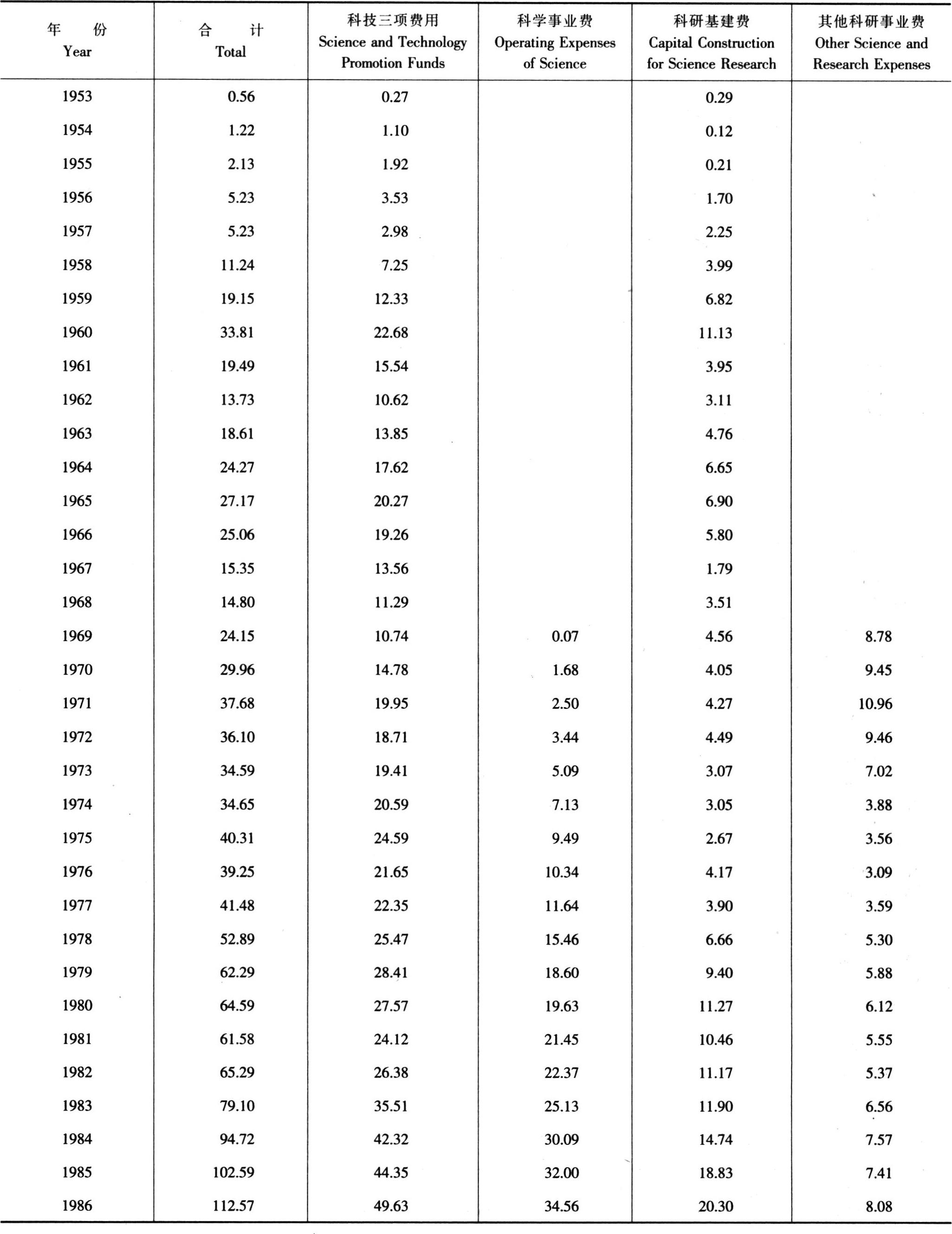

国家财政用于科学研究的支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

续表 ContinuedBUDGETARY EXPENDITURE ON SCIENCE AND RESEARCH

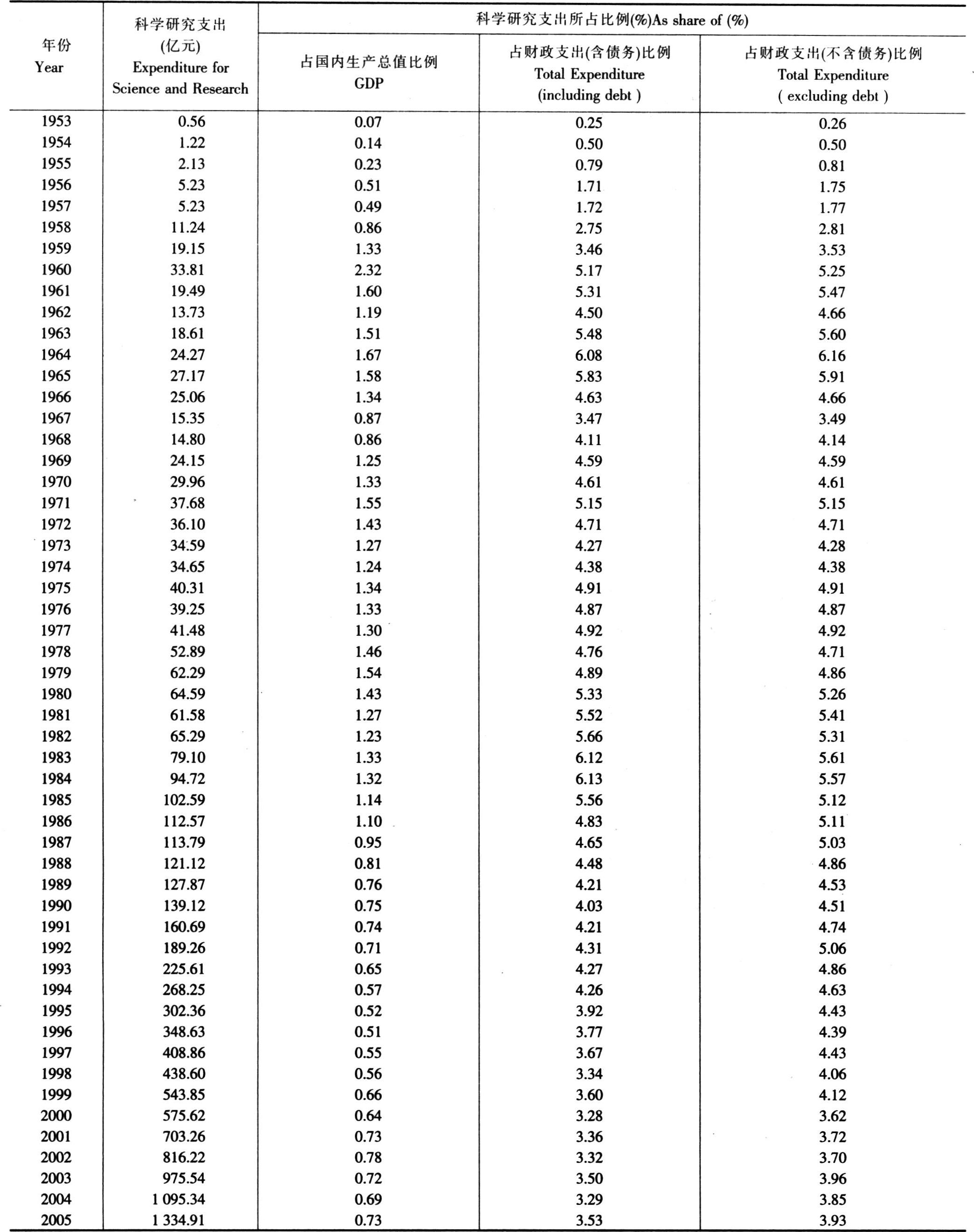

国家财政用于科学研究的支出与有关指标的比例

BUDGETARY EXPENDITURE ON SCIENCE AND RESEARCH AS SHARE OF RELEVANT INDICATORS

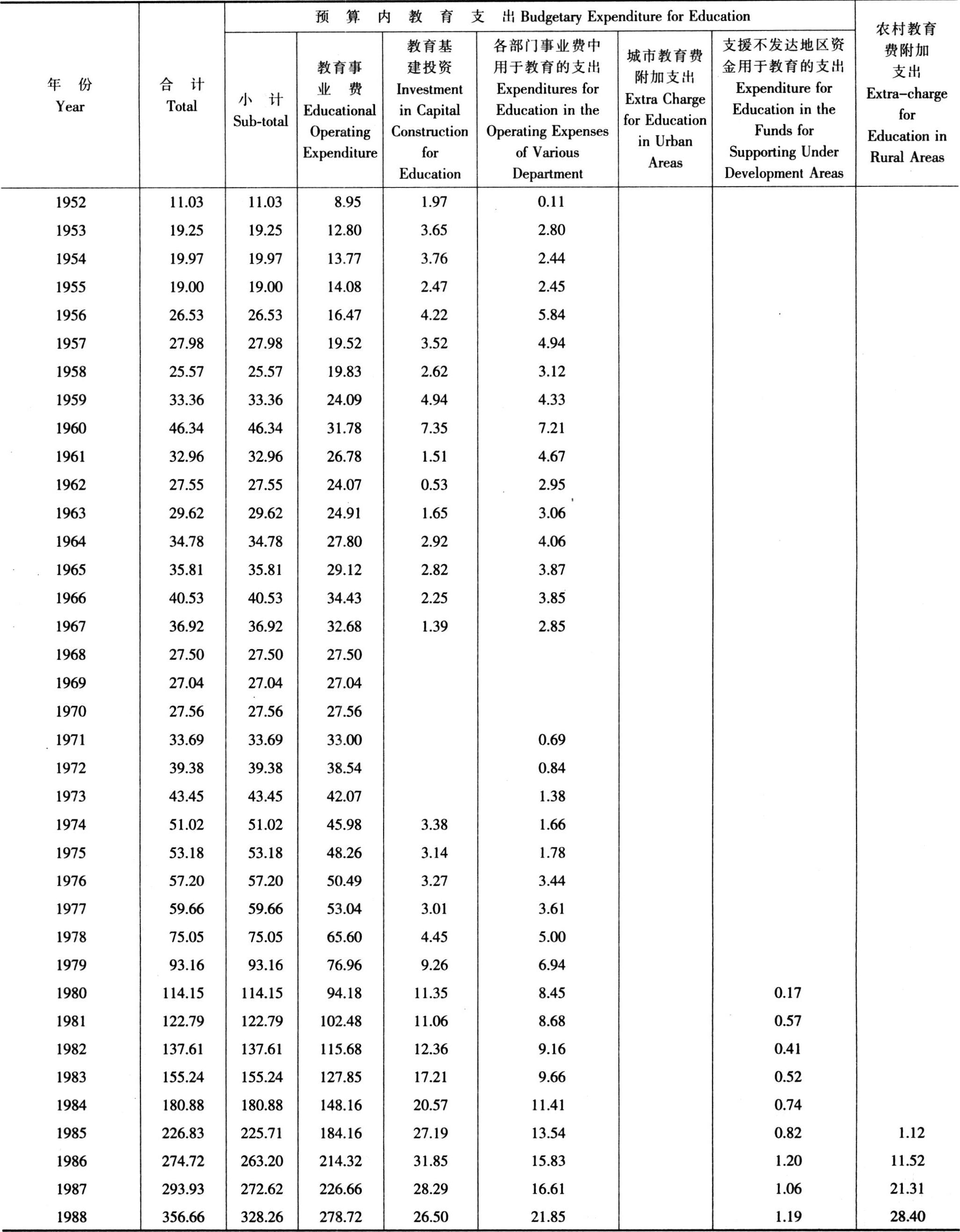

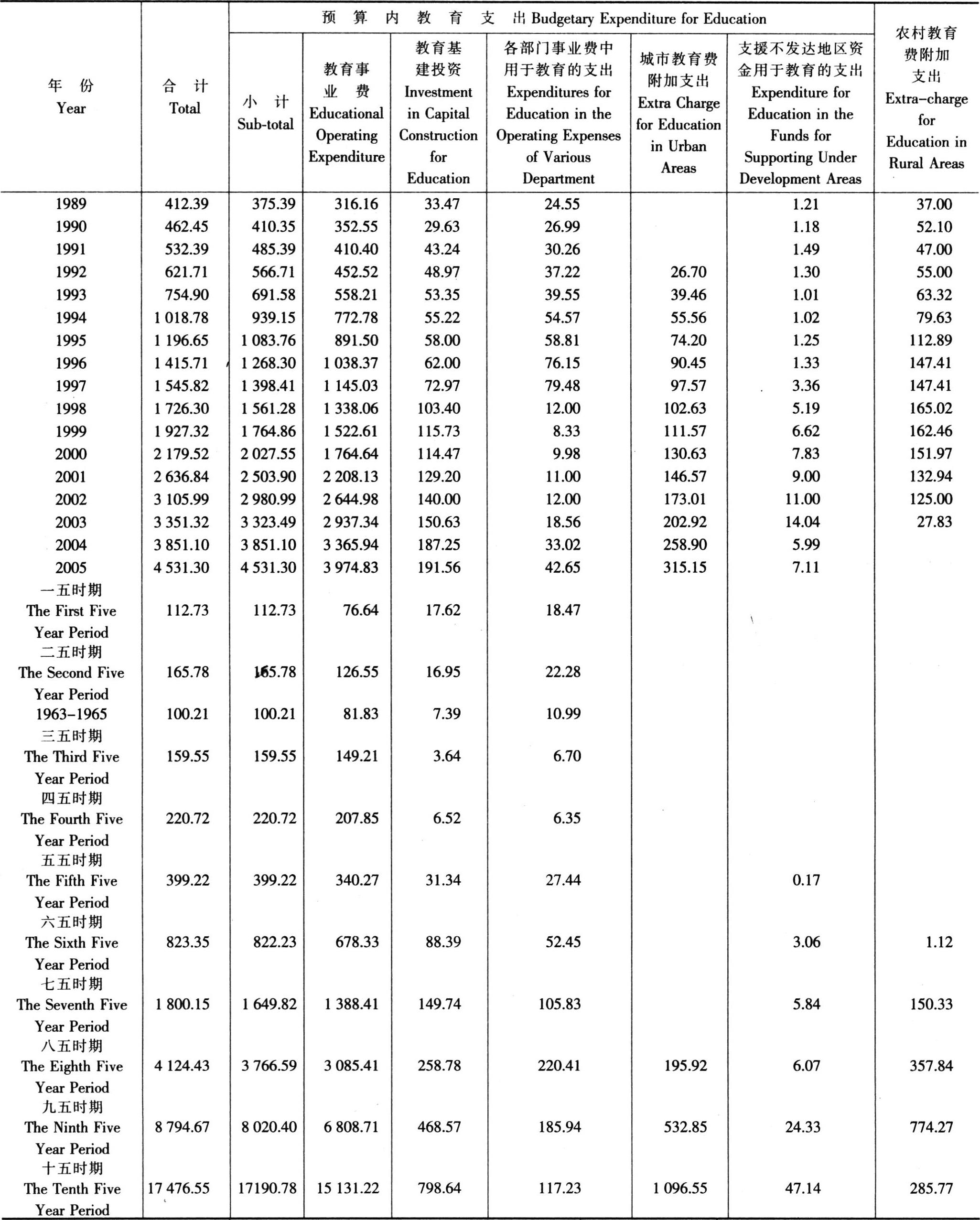

国家财政用于教育的支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

续表 ContinuedGOVERNMENT EXPENDITURE ON EDUCATION

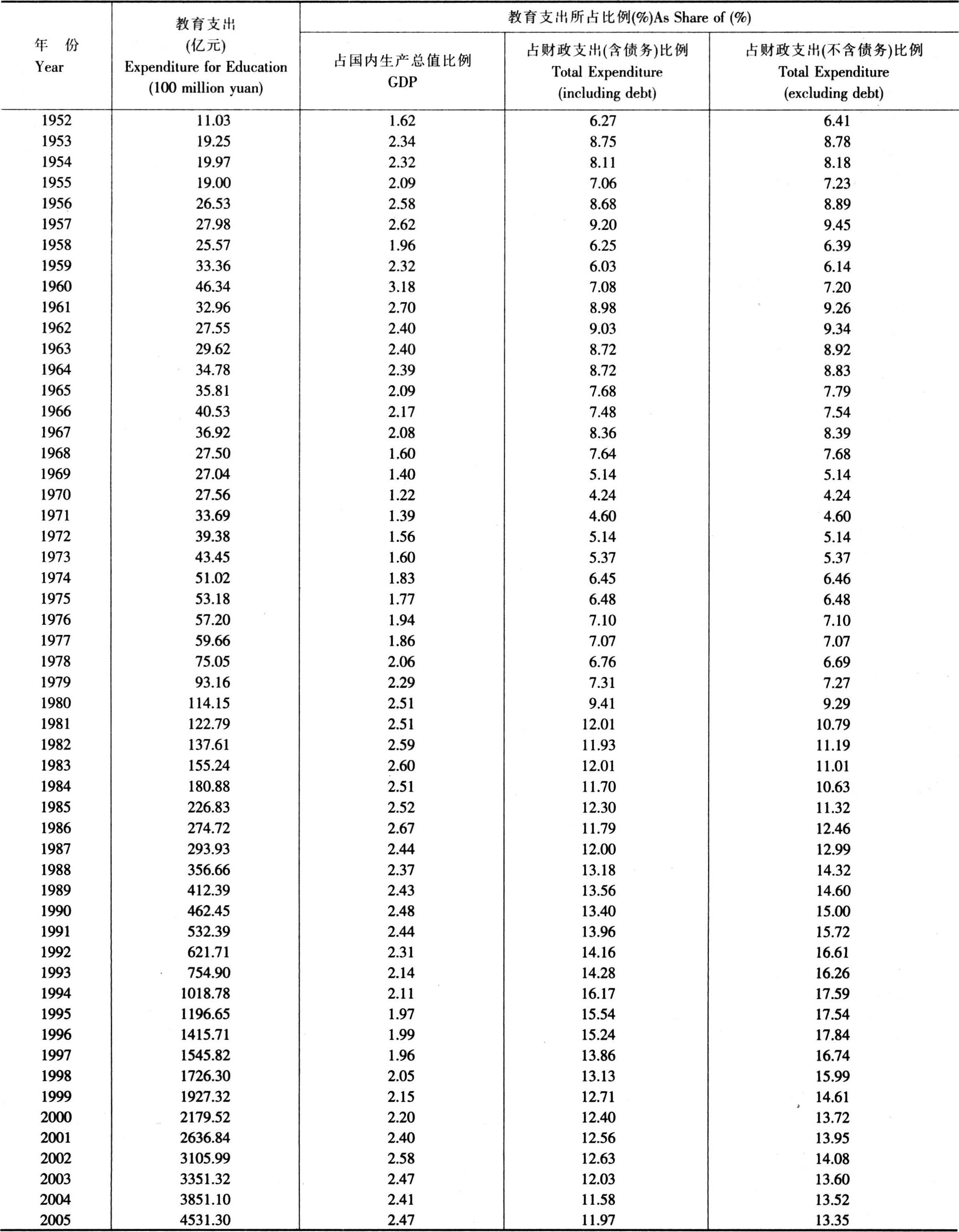

国家财政用于教育的支出与有关指标的比例

GOVERNMENT EXPENDITURE ON EDUCATION AS SHARE OF RELEVANT INDICATORS

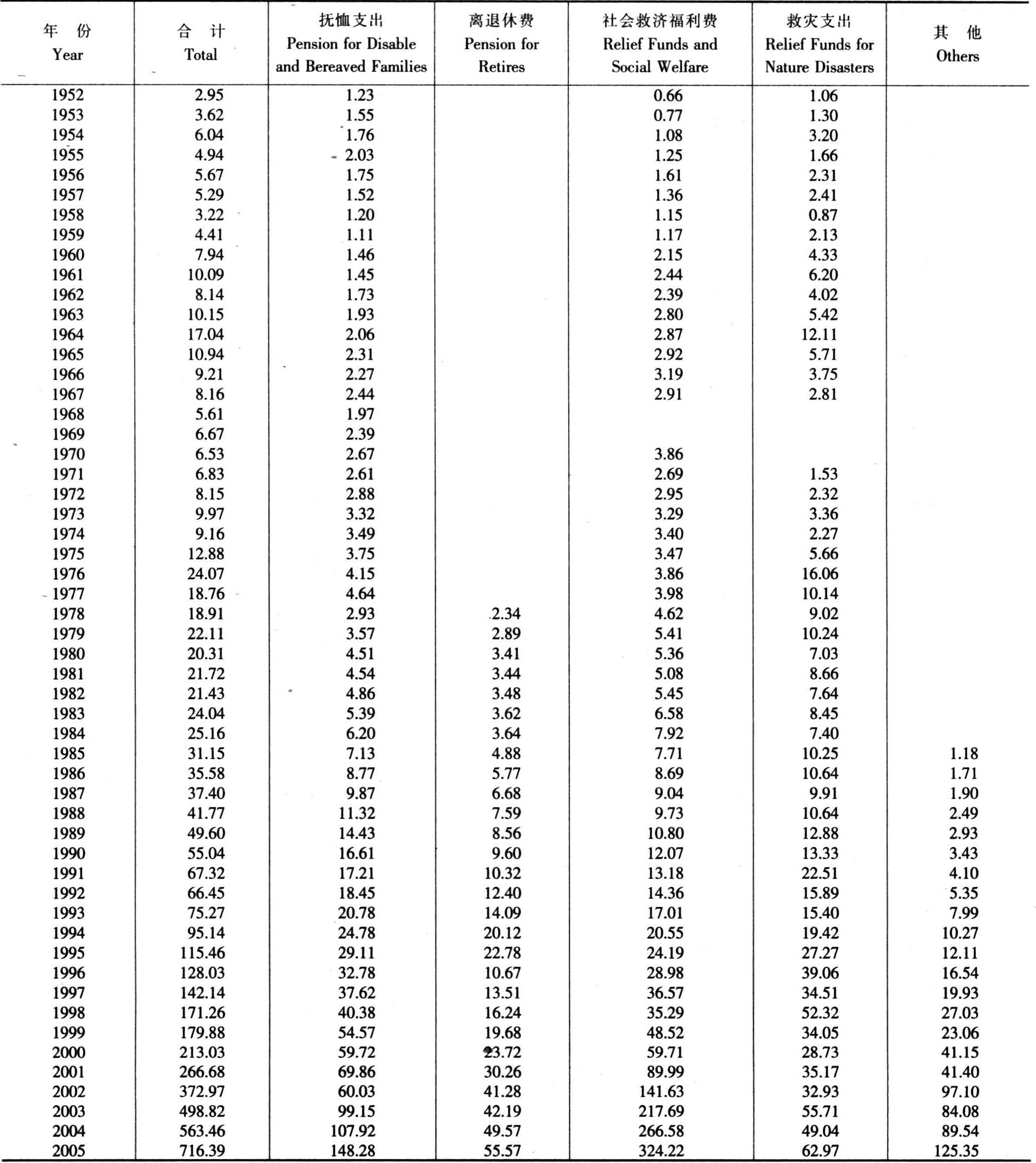

国家财政用于抚恤和社会福利的支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanBUDGETARY EXPENDITURE ON PENSION AND SOCIAL WELFARE

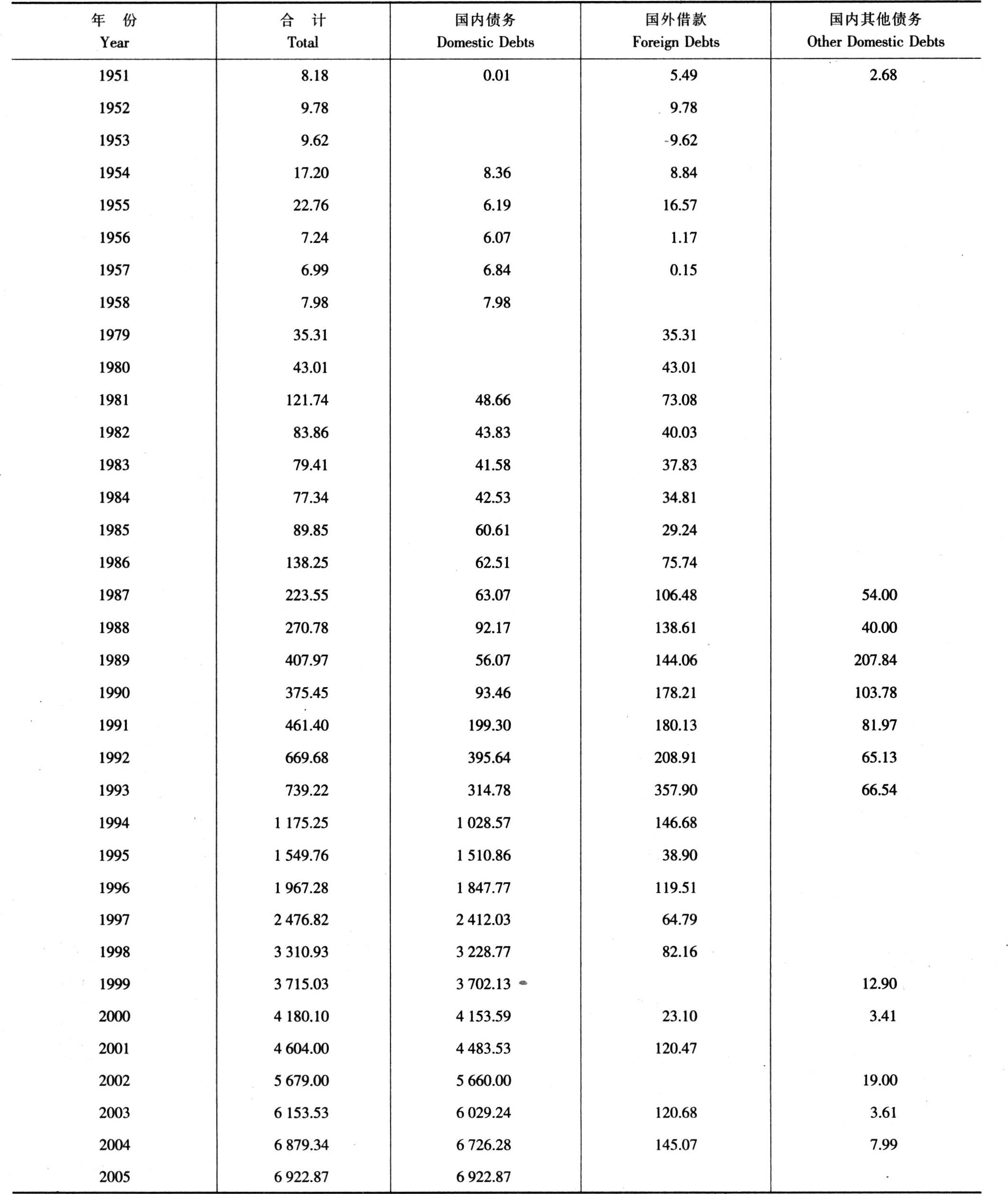

国家财政债务发行情况

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanGOVERNMENT DEBTS ISSUANCE

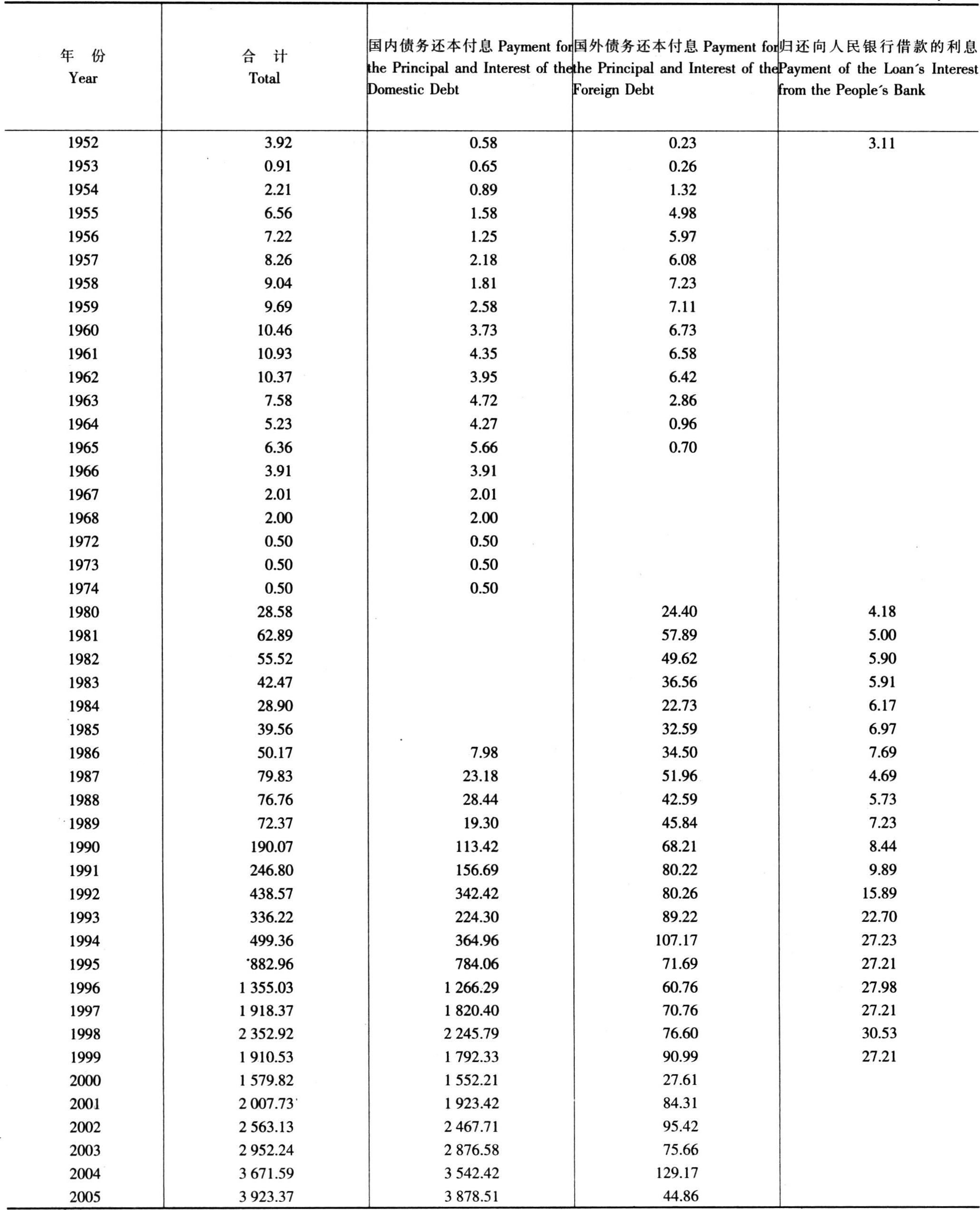

国家财政债务还本付息支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanBUDGETARY EXPENDITURE ON PAYMENT FOR THE PRINCIPAL AND INTEREST OF DEBT

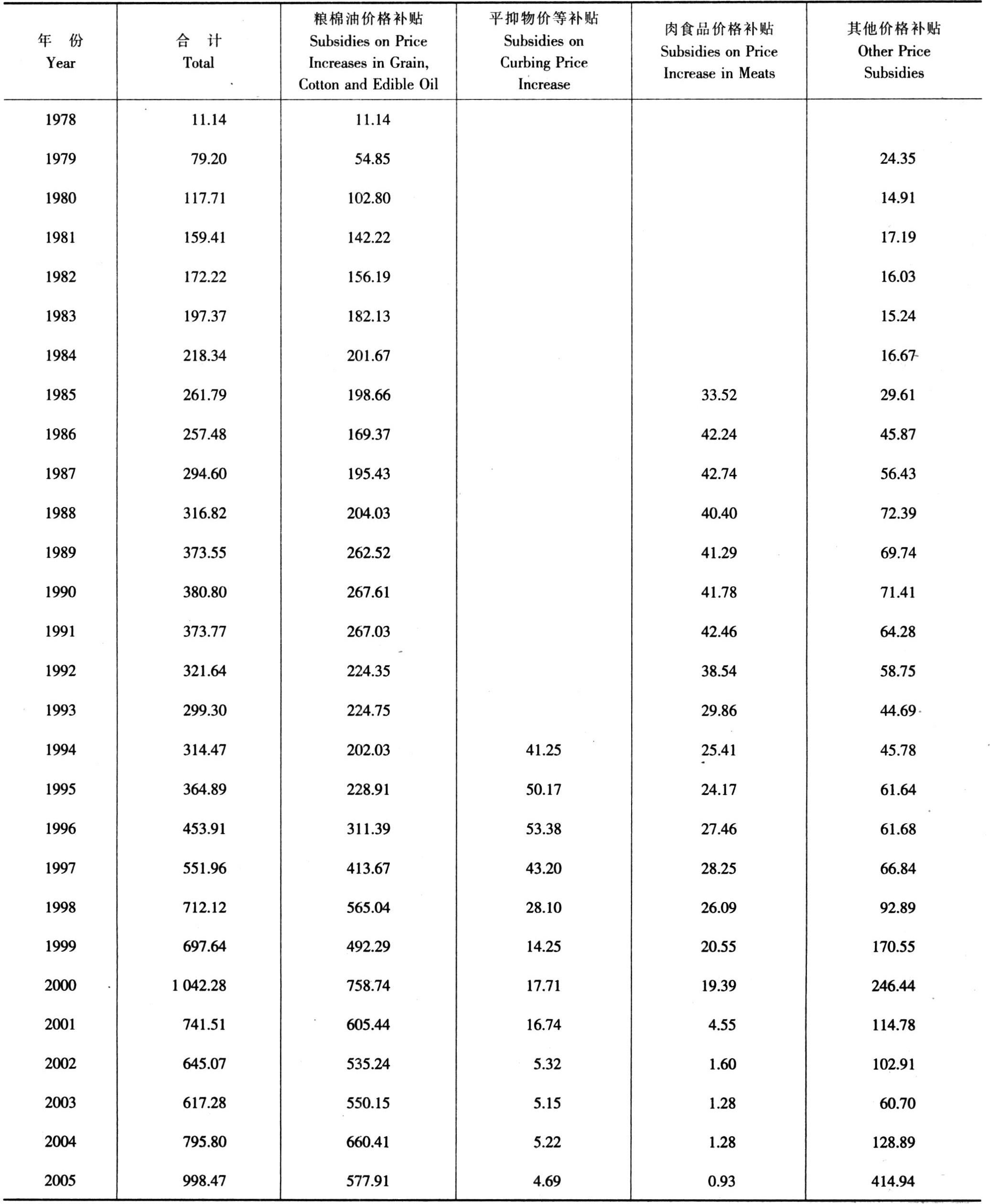

政策性补贴支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanBUDGETARY EXPENDITURE ON PRICE SUBSIDIES

外贸出口退税占全部流转税的比重

RATIO OF TAX REBATE FOR EXPORTS OVER TOTAL TURNOVER TAX

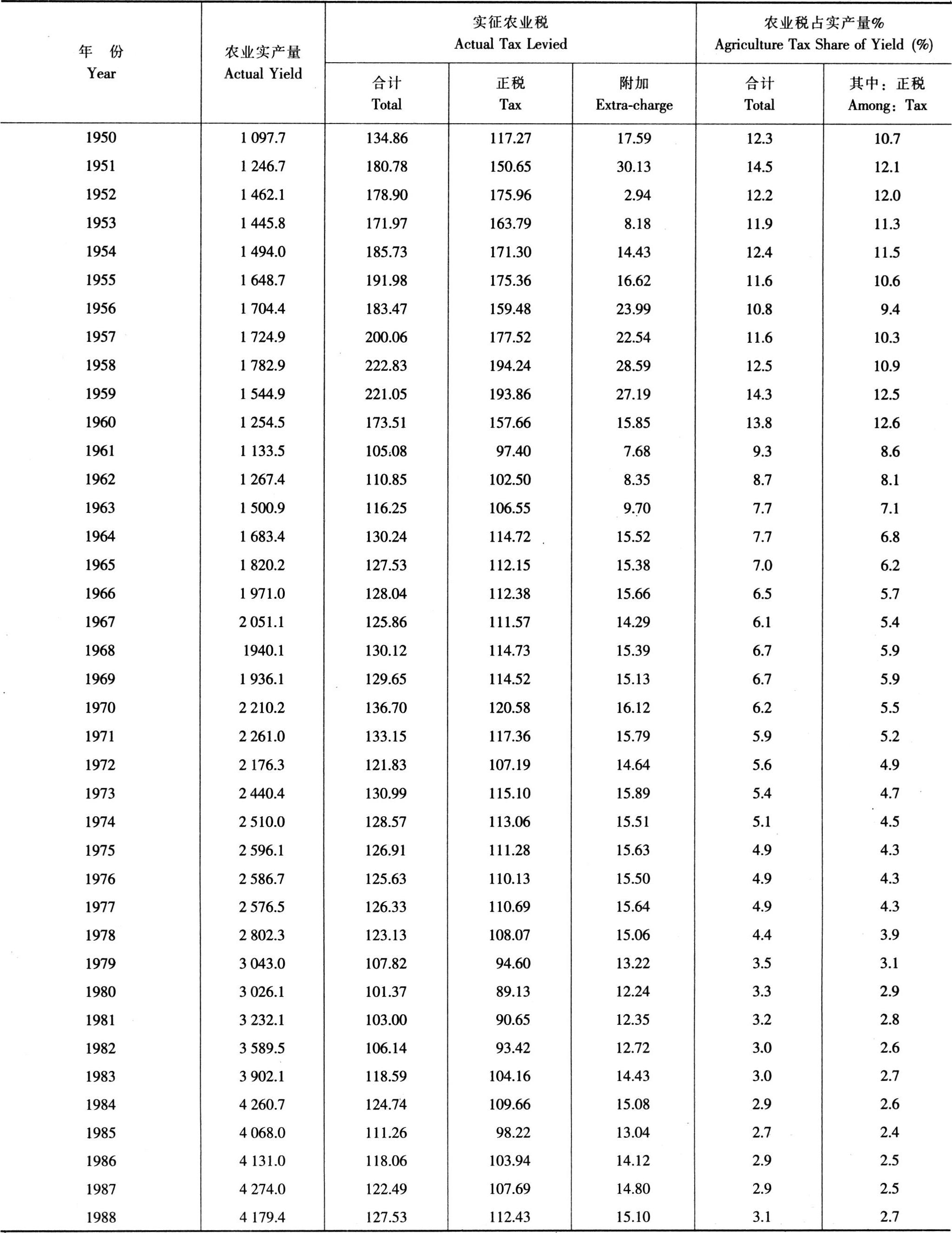

全国农业税负担情况

税额单位:细粮亿公斤 Tax unit:100 million kg flour and rice

税额单位:细粮亿公斤 Tax unit:100 million kg flour and rice 续表 Continued

续表 ContinuedAGRICULTURAL TAXES

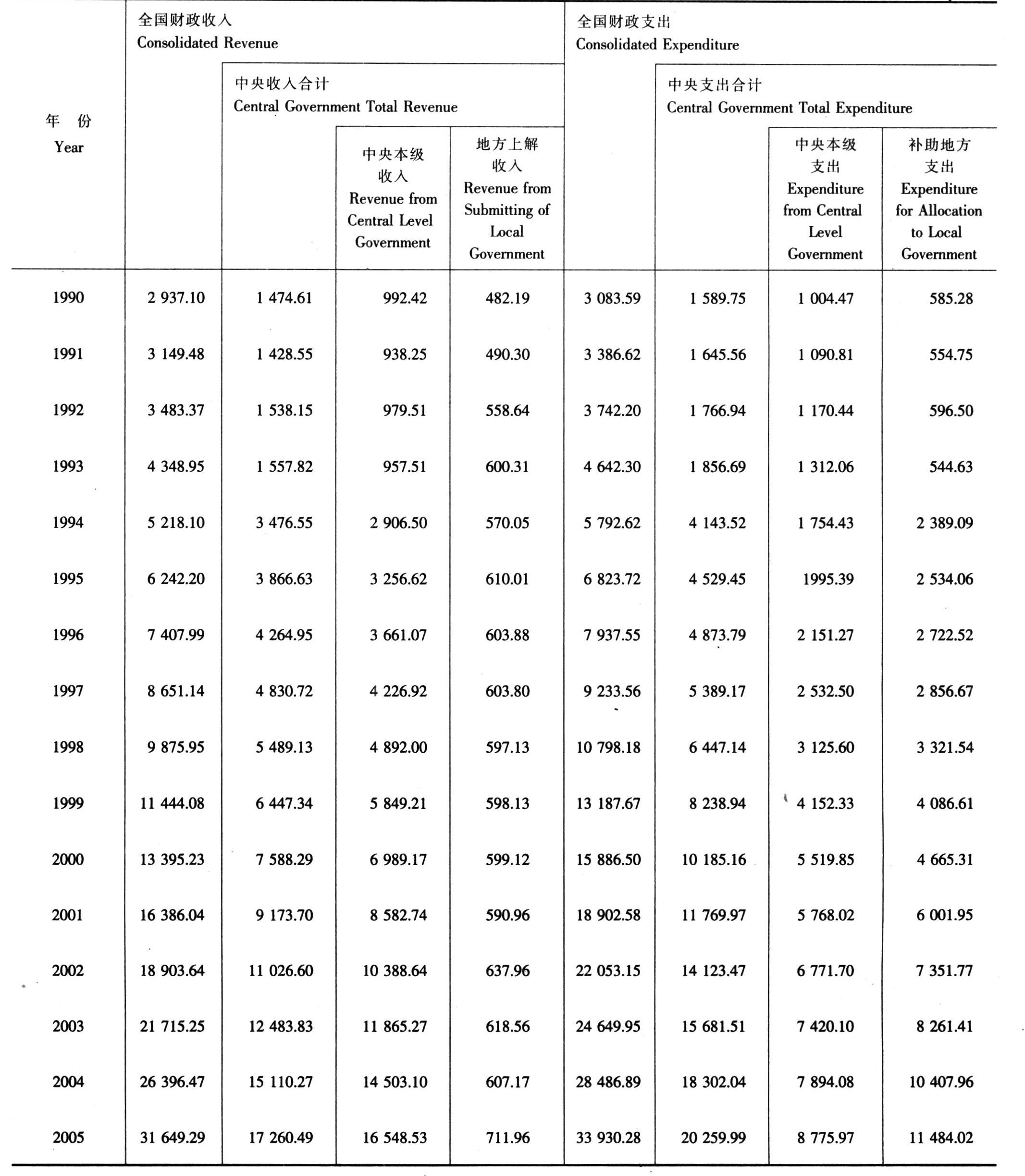

补助地方(地方上解)后的中央财政收支

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanCENTRAL BUDGETARY REVENUE AND EXPENDITURE AFTER REALLOCATION BETWEEN CENTRAL AND LOCAL GOVERNMENT

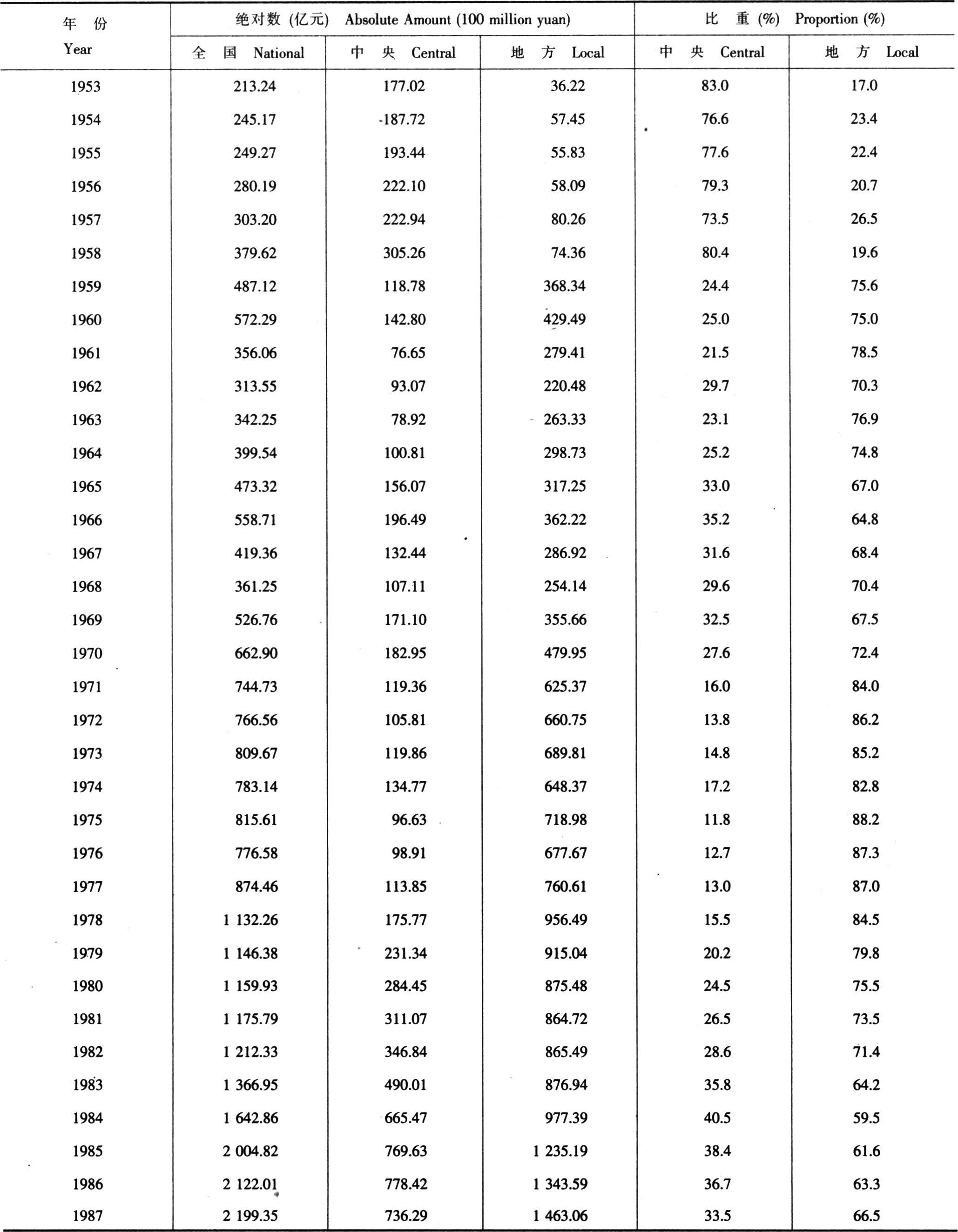

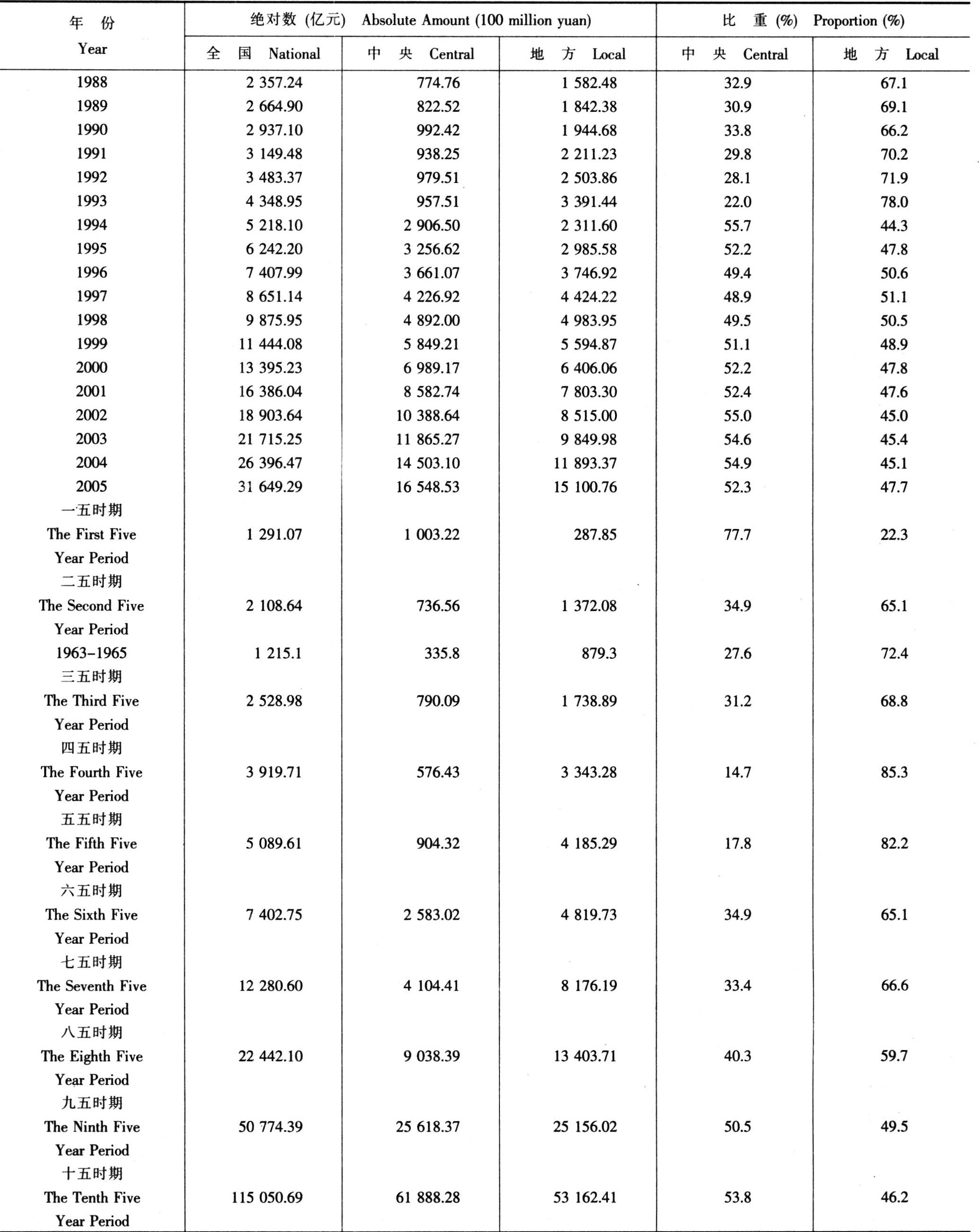

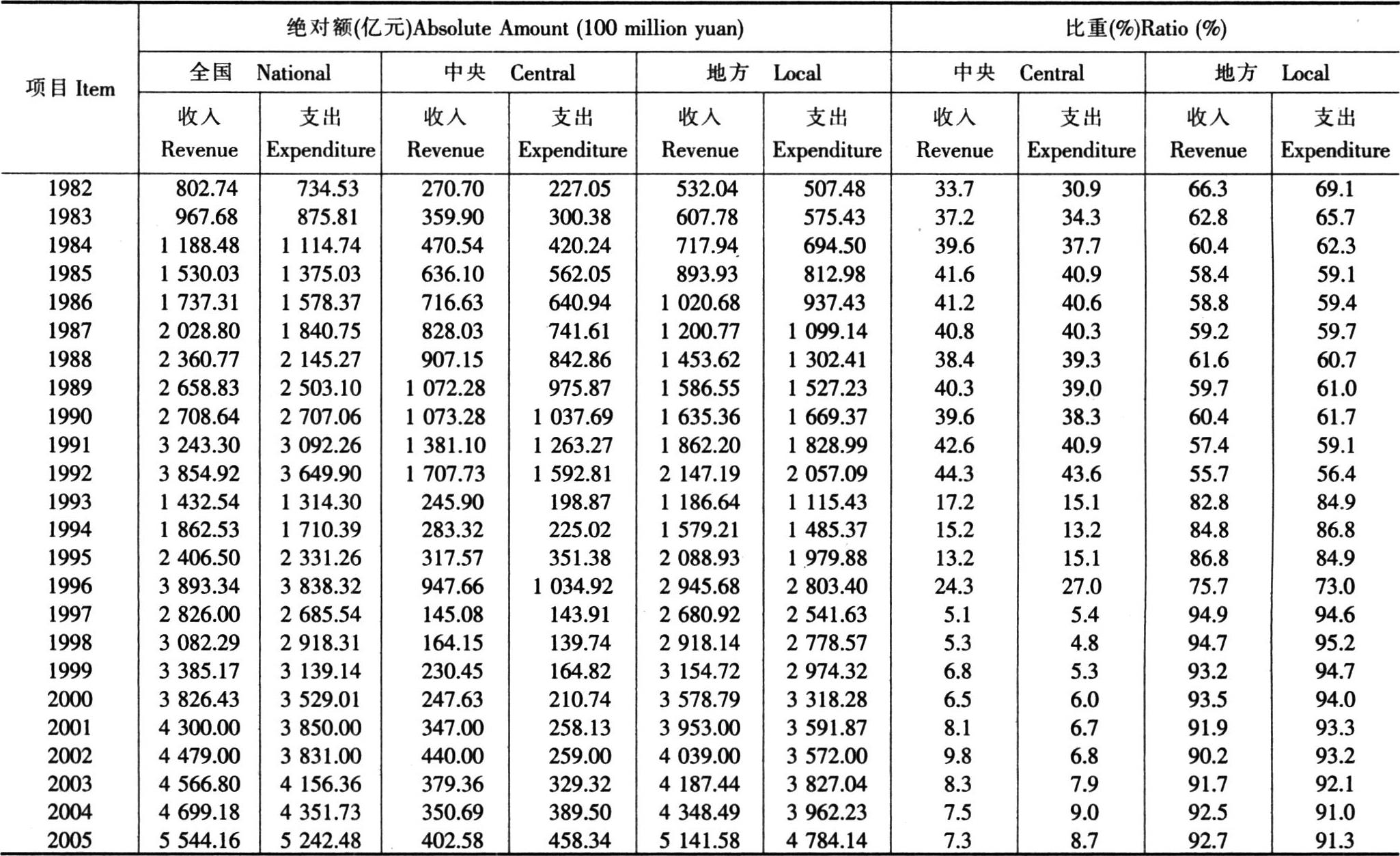

中央和地方财政收入及比重

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuan 续表 Continued

续表 ContinuedCENTRAL AND LOCAL BUDGETARY REVENUE AND THEIR PROPORTIONS

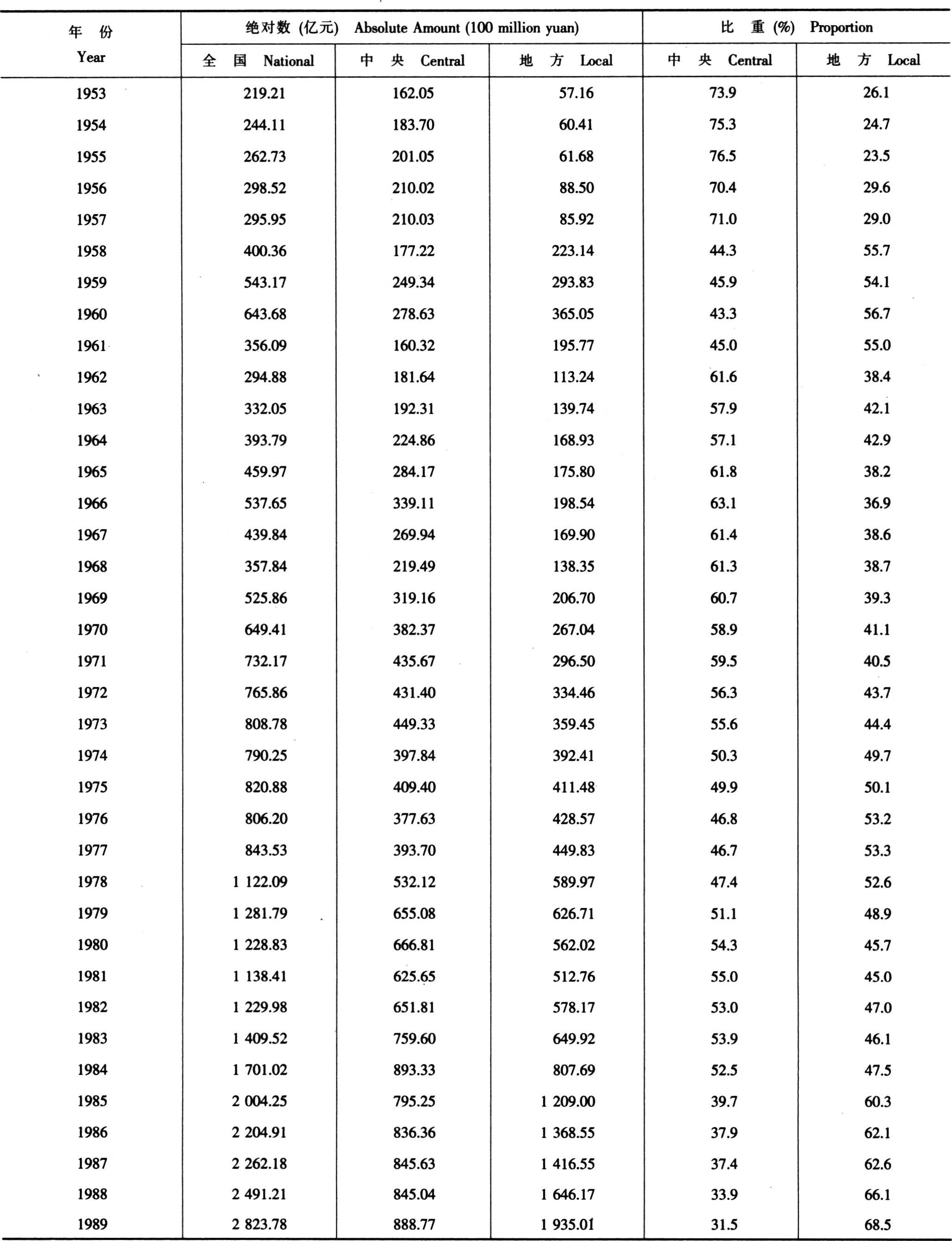

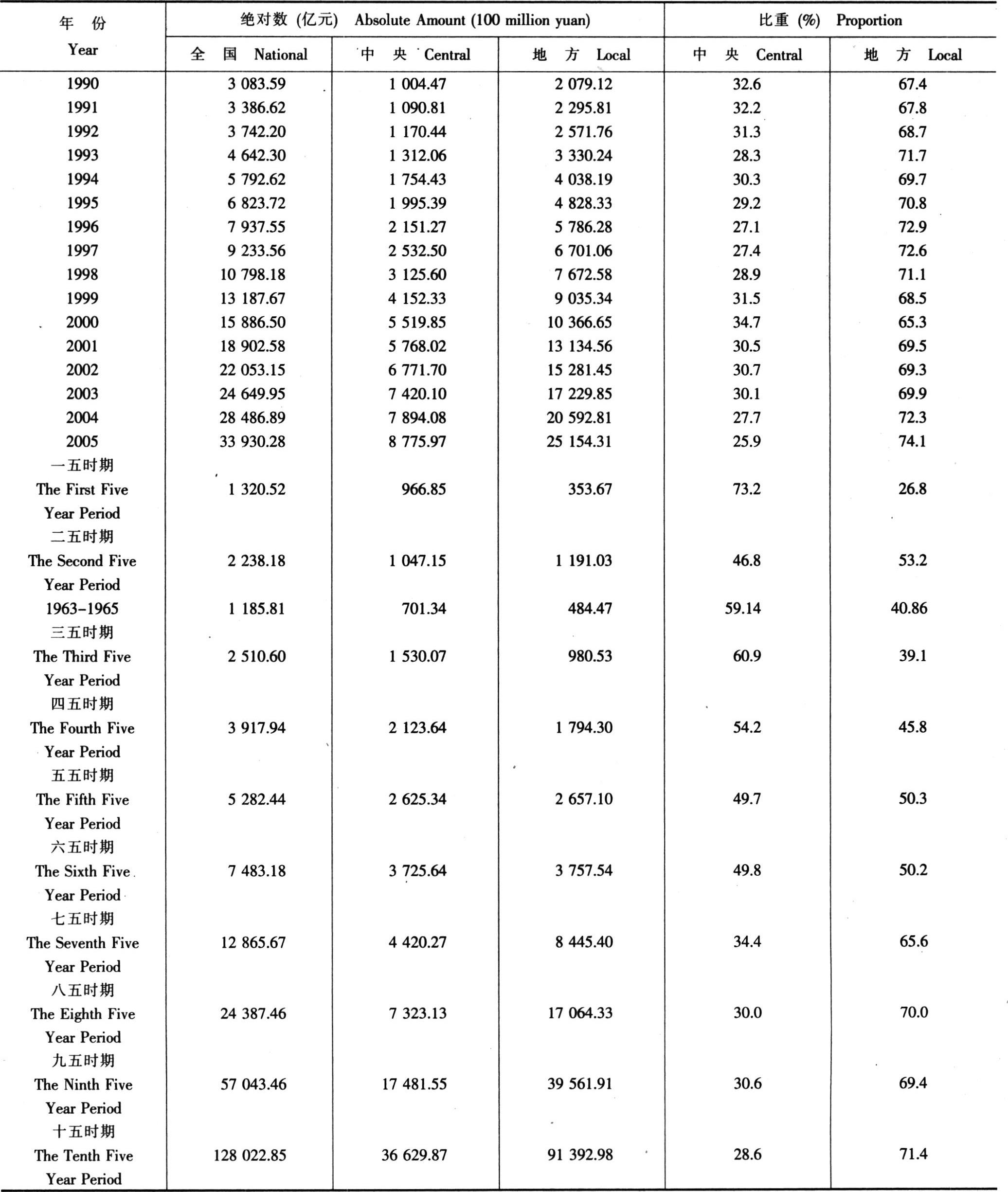

中央和地方财政支出及比重

续表 Continued

续表 ContinuedCENTRAL AND LOCAL BUDGETARY EXPENDITURE AND THEIR PROPORTIONS

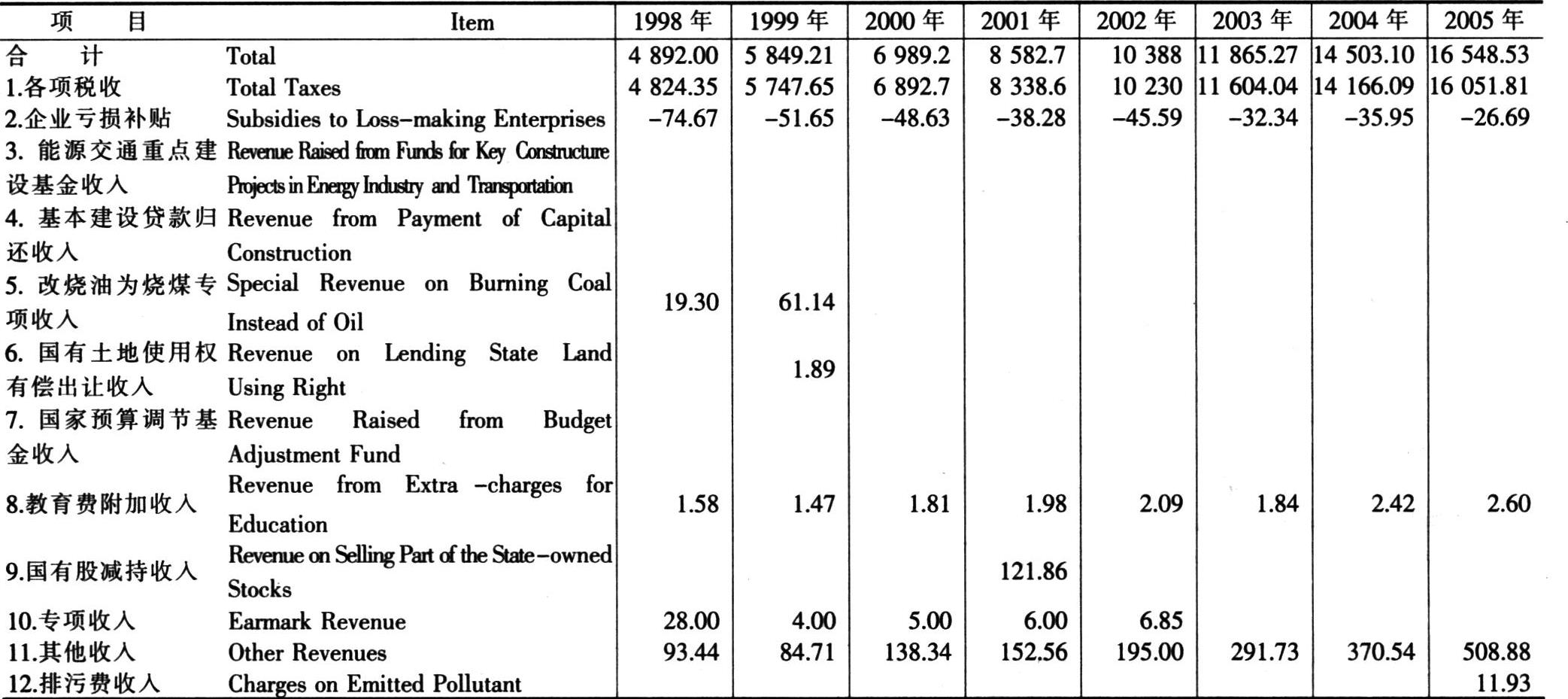

中央财政收入主要项目

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanBUDGETARY REVENUE OF CENTRAL GOVERNMENT BY ITEM

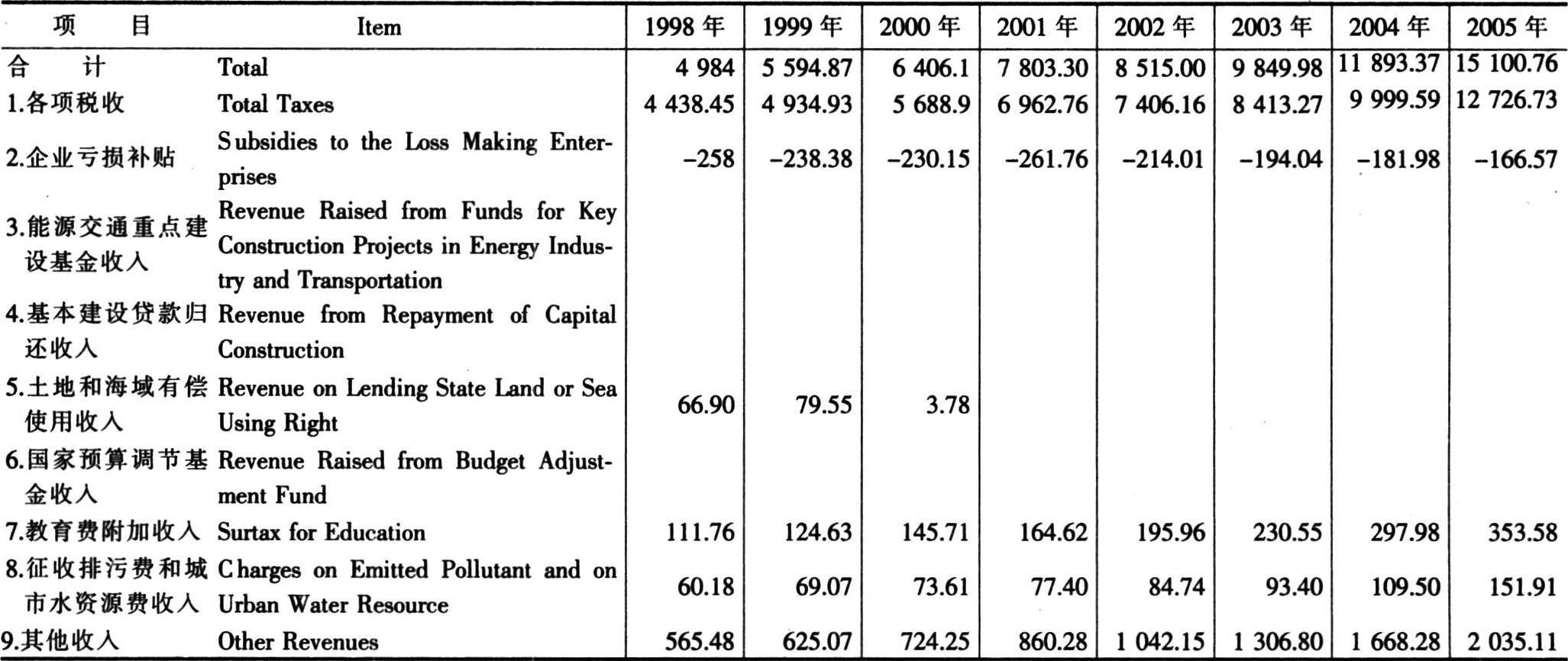

中央财政支出主要项目

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanBUDGETARY EXPENDITURE OF CENTRAL GOVERNMENT BY ITEM

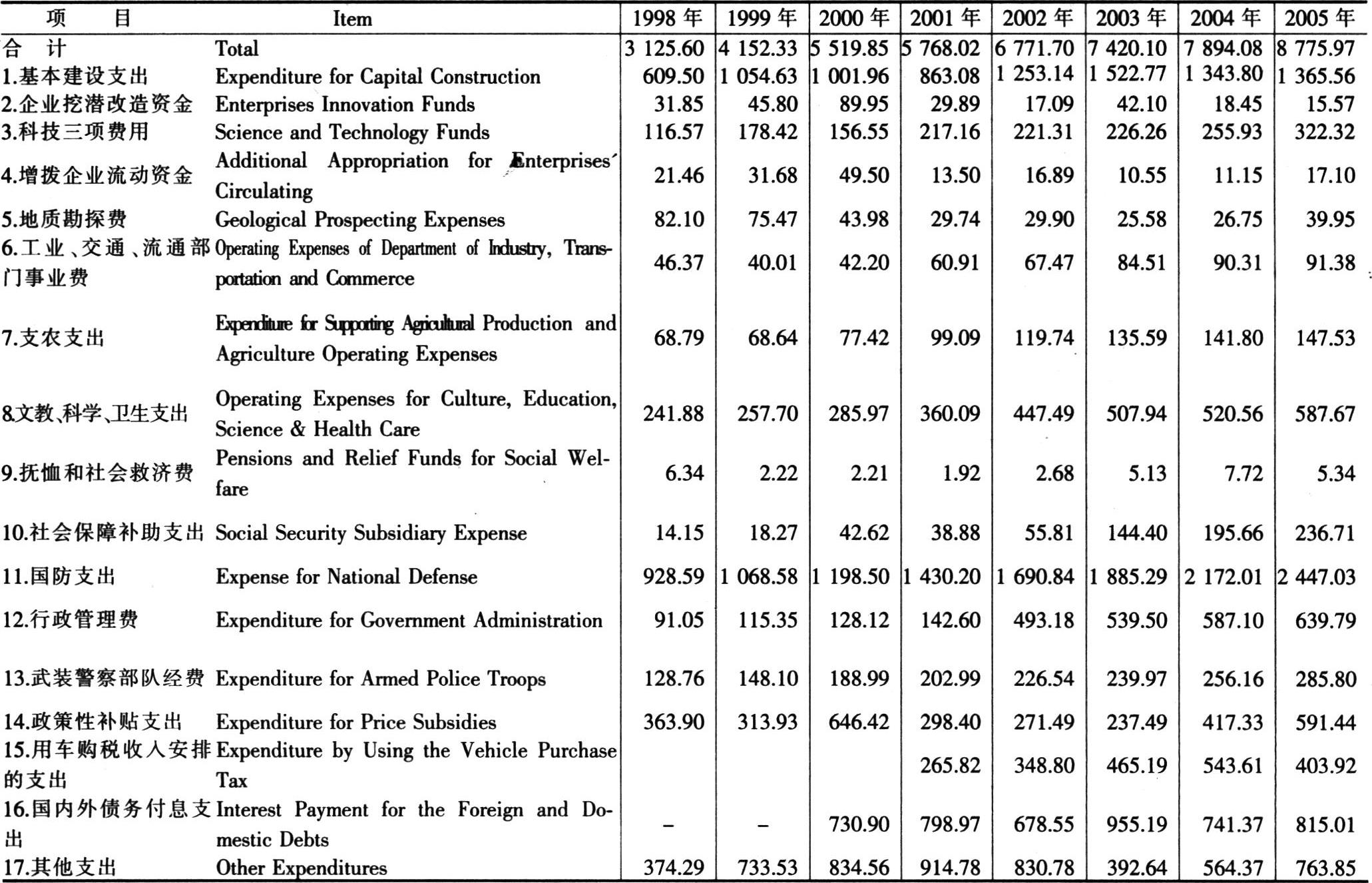

地方财政收入主要项目

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanBUDGETARY REVENUE OF LOCAL GOVERNMENT BY ITEM

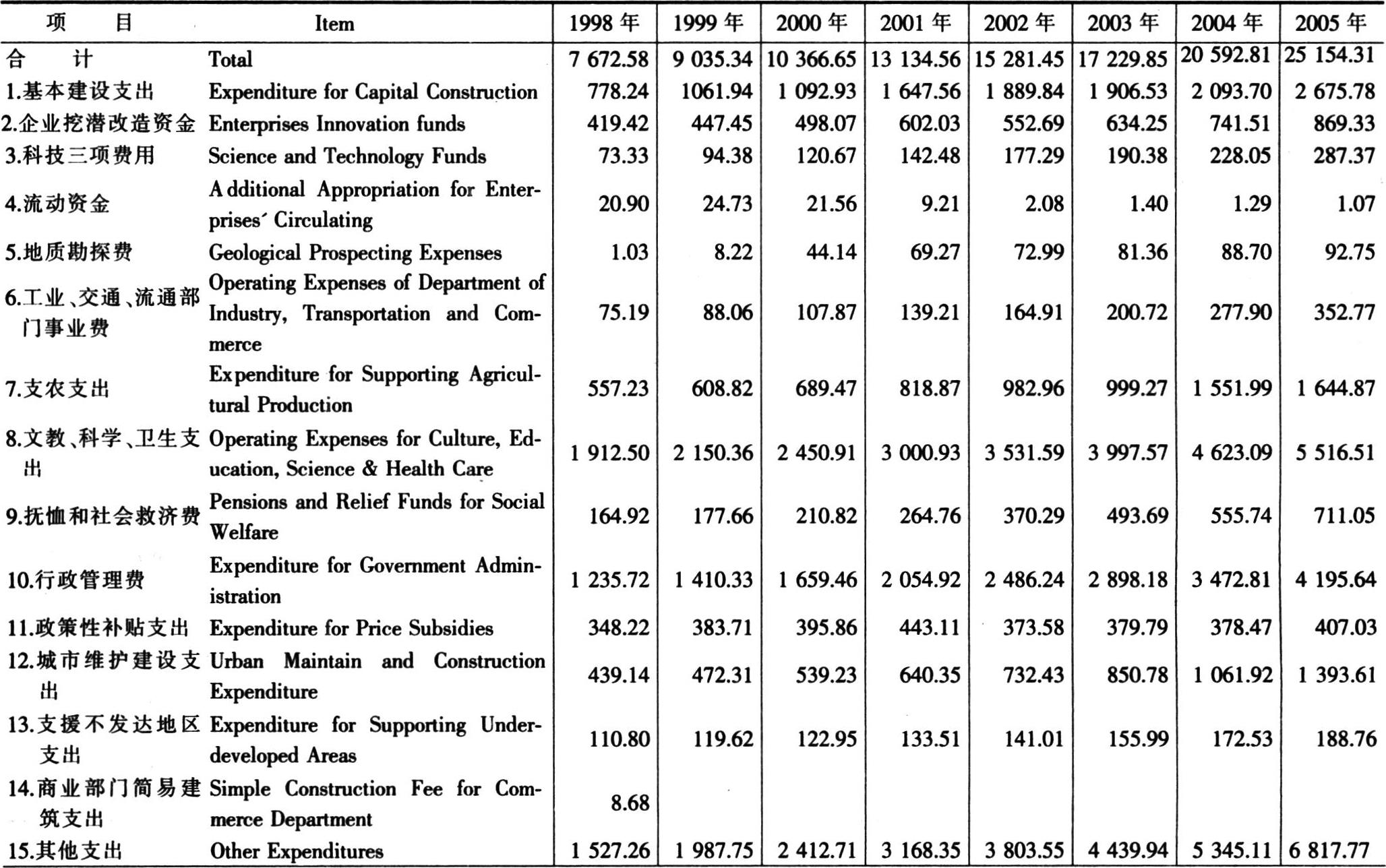

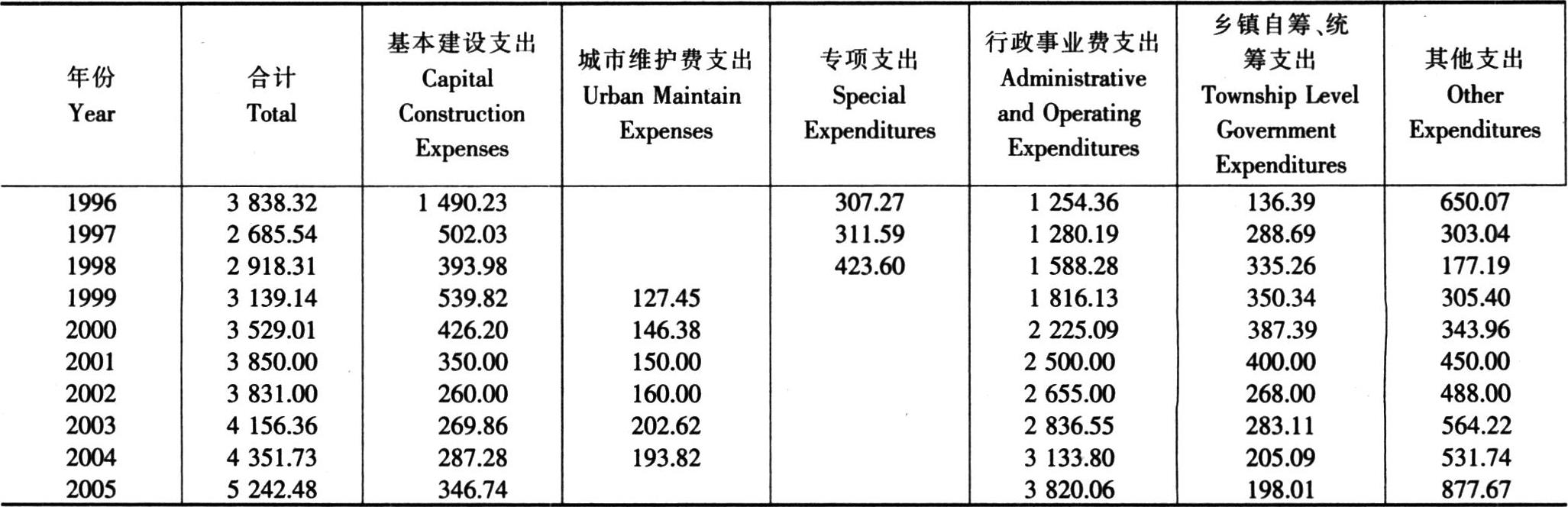

地方财政支出主要项目

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanBUDGETARY EXPENDITURE OF LOCAL GOVERNMENT BY ITEM

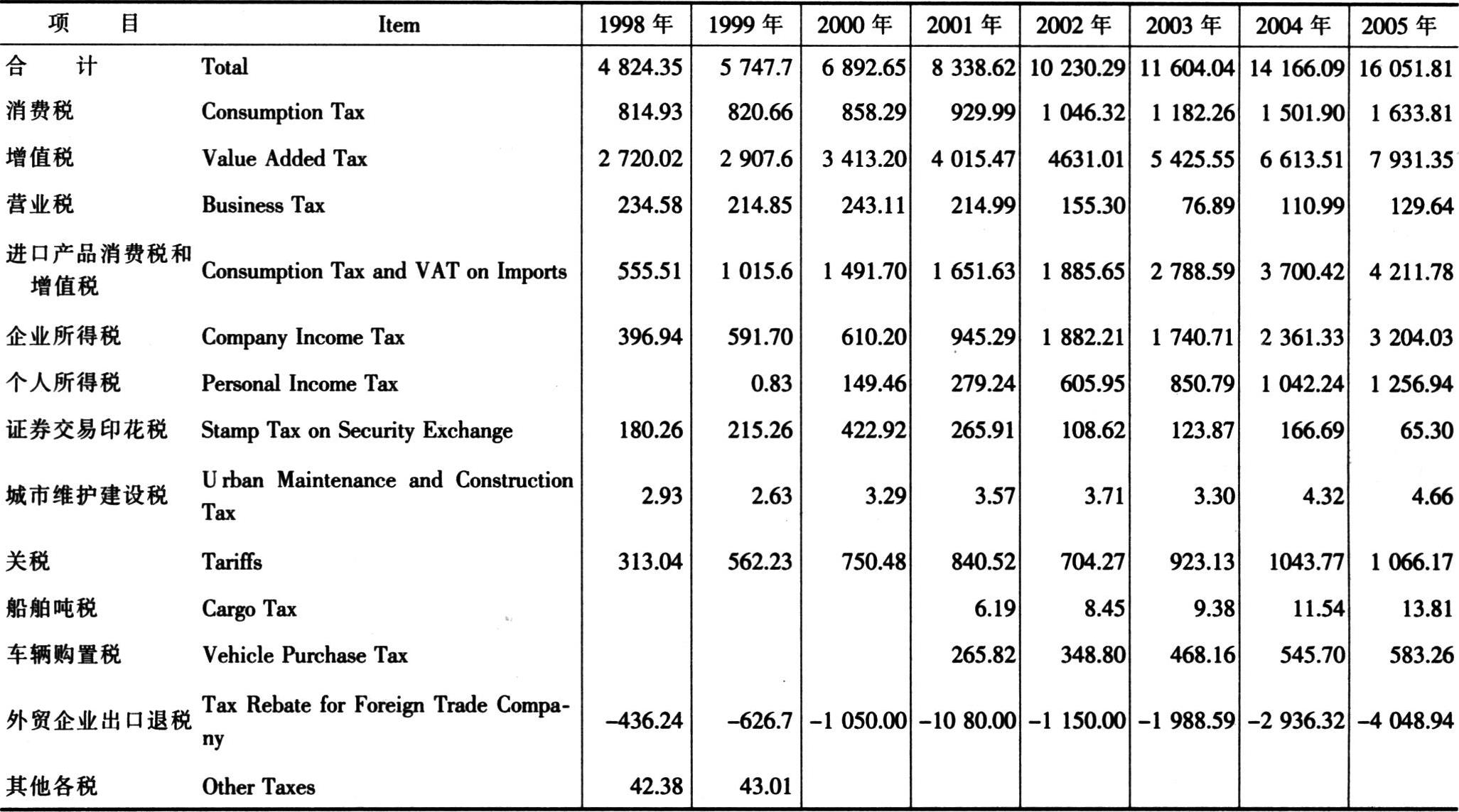

中央财政各项税收

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanCENTRAL GOVERNMENT TAXES

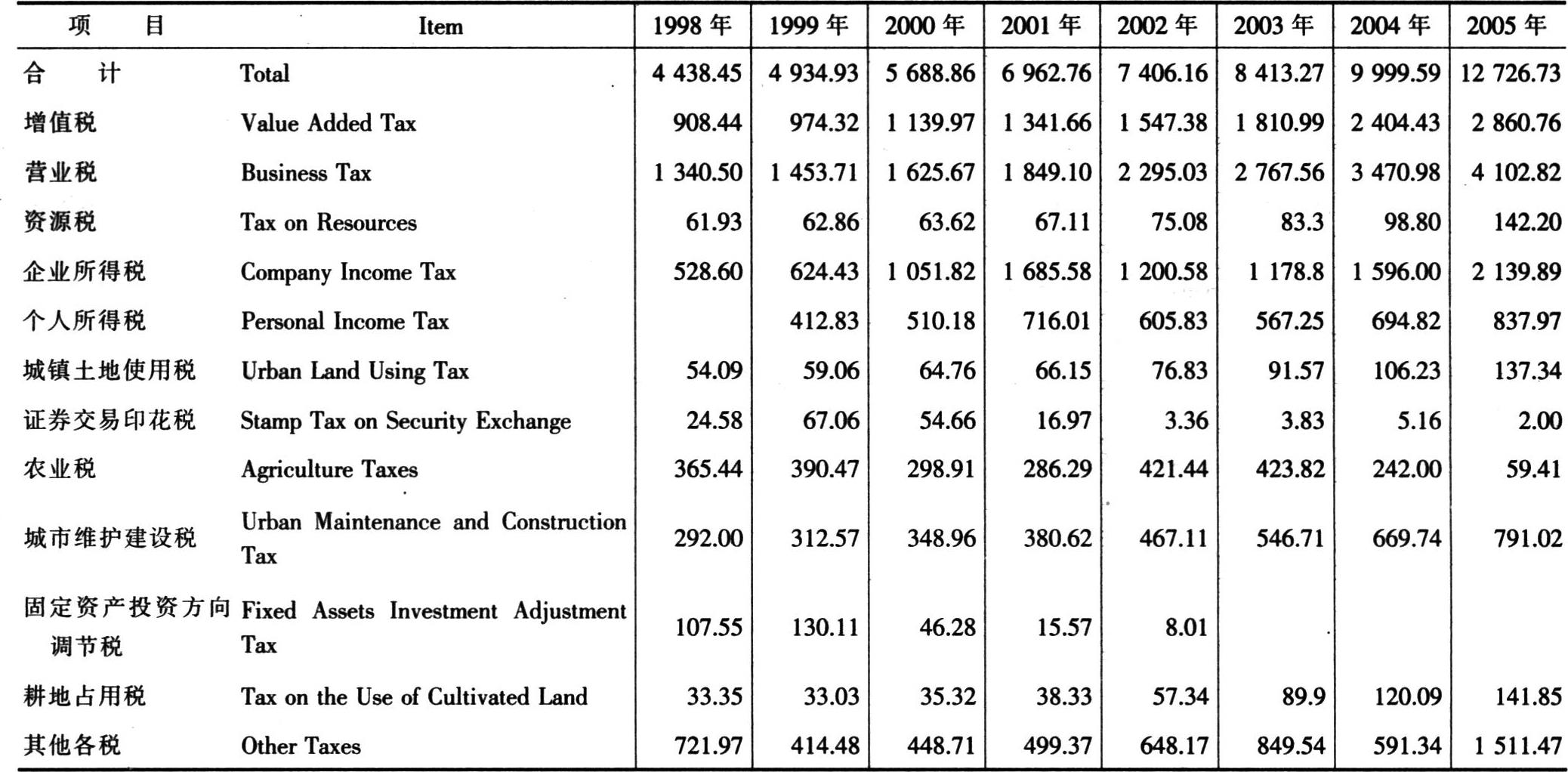

地方财政各项税收

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanLOCAL GOVERNMENT TAXES

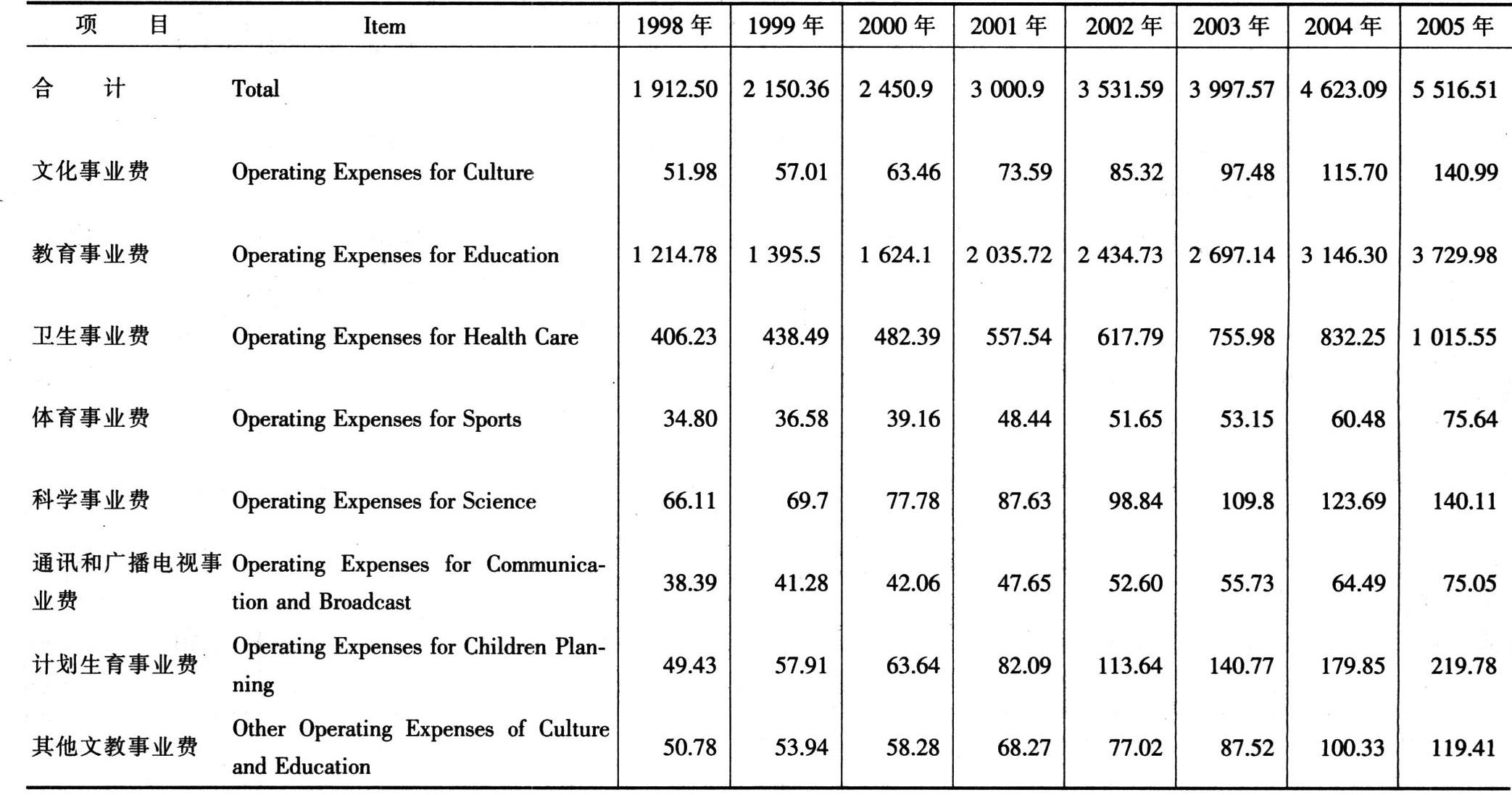

中央财政文教、科学、卫生事业费支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanCENTRAL BUDGETARY EXPENDITURE ON OPERATION OF CULTURE,EDUCATION,SCIENCE&HEALTH CARE

地方财政文教、科学、卫生事业费支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanLOCAL BUDGETARY EXPENDITURE ON OPERATION OF CULTURE,EDUCATION,SCIENCE&HEALTH CARE

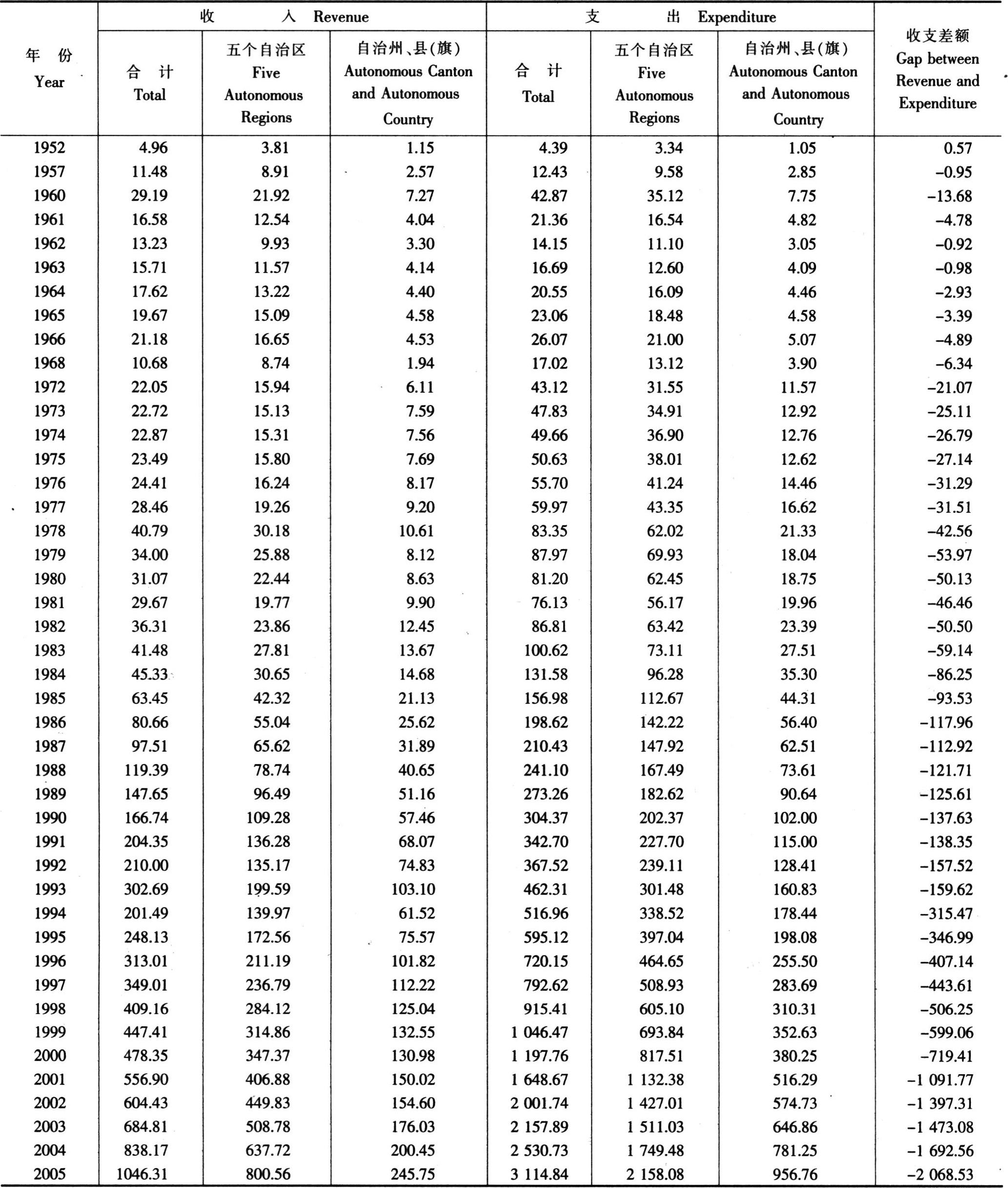

少数民族自治地区财政收支

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanBUDGETARY REVENUE AND EXPENDITURE OF ETHNIC REGIONS

预算外资金收支总额及增长速度

TOTAL REVENUE AND EXPENDITURE OF EXTRA-BUDGETARY FUND AND THEIR GROWTH RATES

预算外资金分项目收入

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanEXTRA-BUDGETARY REVENUE BY ITEM

预算外资金分项目支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanEXTRA-BUDGETARY EXPENDITURE BY ITEM

中央和地方预算外资金收支及比重

EXTRA-BUDGETARY REVENUE AND EXPENDITURE OF CENTRAL AND LOCAL GOVERNMENT AND THEIR RATIOS

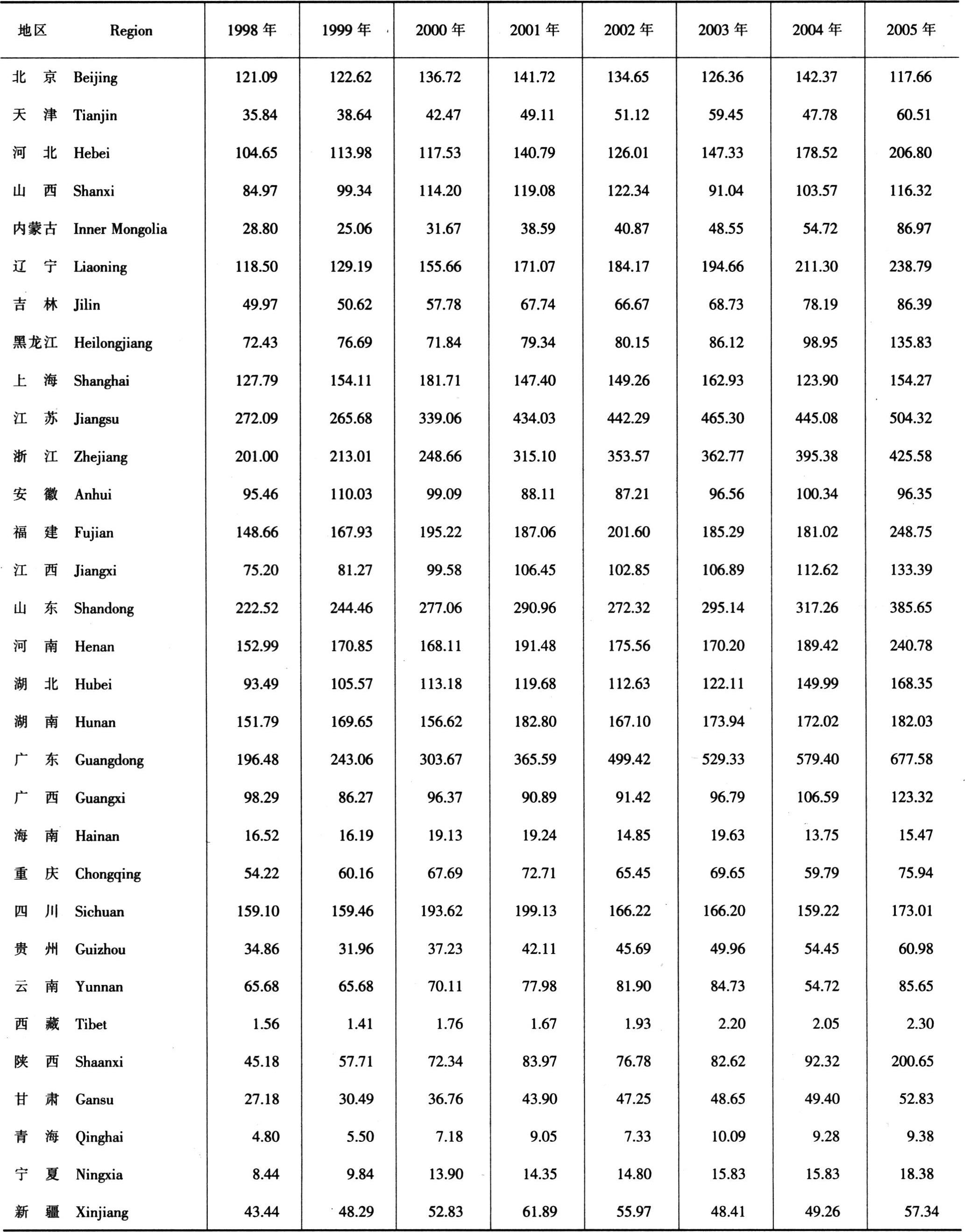

各地区预算外资金收入

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanEXTRA-BUDGETARY REVENUE BY REGION

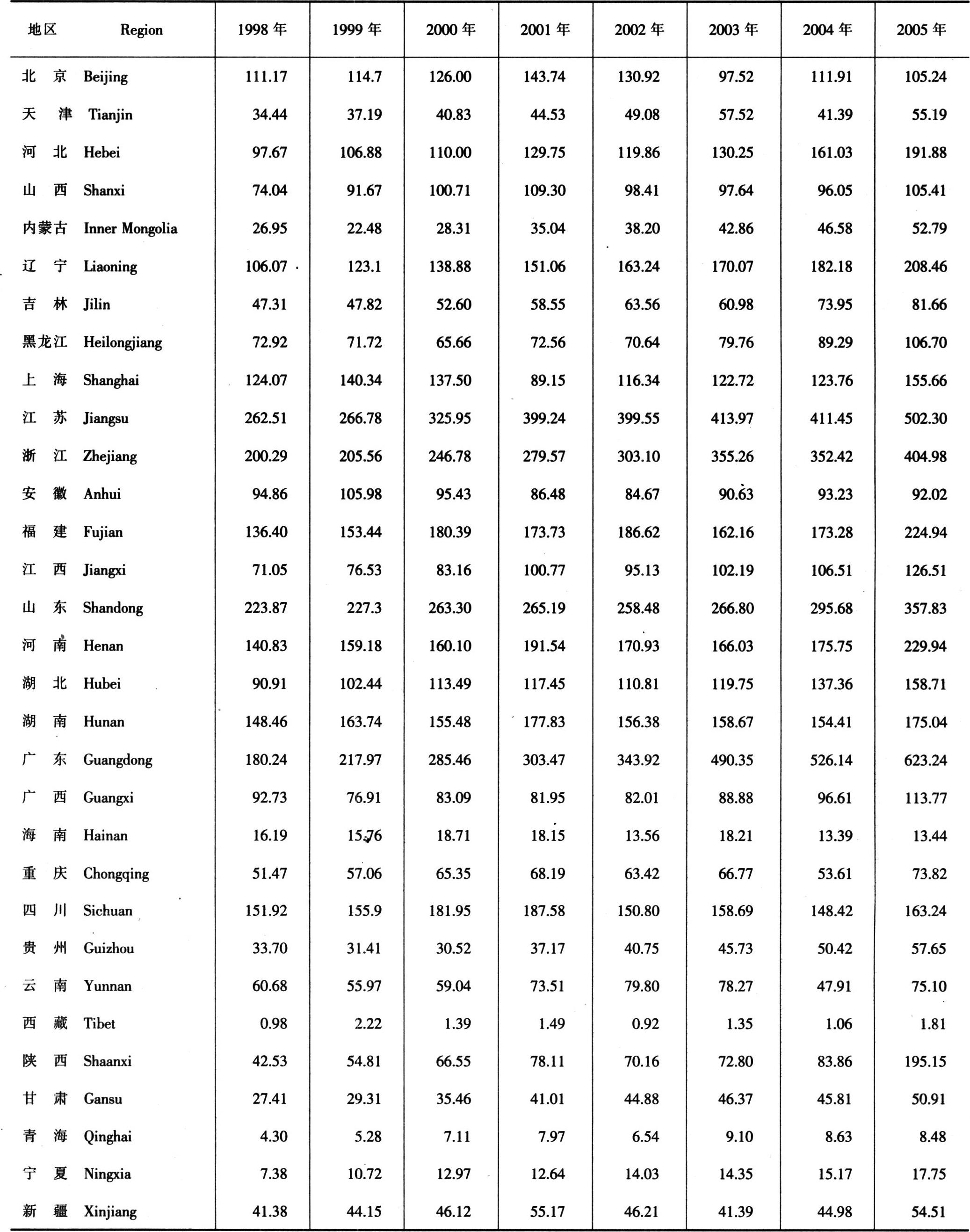

各地区预算外资金支出

单位:亿元 Unit:100 million yuan

单位:亿元 Unit:100 million yuanEXTRA-BUDGETARY EXPENDITURE BY REGION

主要统计指标解释

财政收入:指国家财政参与社会产品分配所取得的收入,是实现国家职能的财力保证。财政收入所包括的内容几经变化,目前主要包括:

(1)各项税收:包括增值税、消费税、营业税、城市维护建设税、企业所得税、个人所得税、关税、农牧业税、契税、耕地占用税、证券交易印花税和车辆购置税等。

(2)专项收入:包括征收排污费收入、征收城市水资源费收入、征收矿产资源补偿费收入、教育费附加收入等。

(3)其他收入:包括利息收入、基本建设贷款归还收入、基本建设收入、对外贷款归还收入、捐赠收入等。

(4)国有企业亏损补贴:这项为负收入,冲减财政收入。

财政支出:国家财政将筹集起来的资金进行分配使用,以满足经济建设和各项事业发展等社会公共需要,主要包括:

(1)基本建设支出:指按国家有关规定,属于基本建设范围内的基本建设有偿使用、拨款、资本金支出以及经国家批准对专项和政策性基建投资贷款,在部门的基建投资额中统筹支付的贴息支出。

(2)企业挖潜改造资金:指国家预算内拨给用于企业挖潜、革新和改造方面的资金。包括各部门企业挖潜改造资金和企业挖潜改造贷款贴息资金。

(3)地质勘探费:指国家预算用于地质勘探单位的勘探工作费用,包括地质勘探管理机构及其事业单位经费、地质勘探经费等。

(4)科技三项费用:指国家预算用于新产品试制费、中间试验费、重要科学研究补助费等方面的支出。

(5)支援农村生产支出:指国家财政支援农村集体(户)各项生产的支出。包括小型农田水利和水土保持补助费,支援农村合作生产组织资金,农村农技推广和植保补助费,农村草场和畜禽保护补助费,农村造林和林土保护补助费,农村水产补助费,以及粮食生产自给工程资金等。

(6)农林水利气象等部门的事业费:指国家财政用于农垦、农场、农业、畜牧、农机、林业、森工、水利、水产、气象、乡镇企业的技术推广、良种推广(示范)、动植物(畜牧、森林)保护、水质监测、勘探设计、农业资源调查、干部训练等项事业费。

(7)工业交通商业等部门的事业费:指国家预算支付给工交商各部门用于事业发展的人员和公用经费支出。

(8)文教科学卫生事业费:指国家预算用于文化、出版、文物、体育、档案、地震、海洋、通信、广播、电影电视、计划生育、党政群干部训练、教育、自然科学、社会科学、科协、卫生、中医、药品监督管理等项事业发展的人员和公用经费支出。

(9)抚恤和社会福利救济费:指国家预算用于抚恤和社会福利救济事业的经费。包括牺牲病故和伤残抚恤费,烈军属、复员退伍军人生活补助费,退伍军人安置费,优抚事业单位经费,烈士纪念建筑物管理、维修费,军队移交地方安置的离退休人员费用,农村社会救济费,城市居民最低生活保障,特大自然灾害救济费,特大自然灾害灾后重建补助费,自然灾害救济事业费和残疾人事业费等。

(10)国防支出:指国家预算用于国防建设和保卫国家安全的支出,包括军费、国防科研事业费、民兵建设费以及专项工程经费等。

(11)行政管理费:包括人大、政府机关、政协、共产党机关、民主党派机关、社会团体机关等单位的行政管理经费。

(12)政策性补贴支出:指经国家批准,由国家财政拨给用于粮棉油等产品的价格补贴支出。主要包括粮、棉、油差价补贴,平抑物价和储备糖补贴,农业生产资料价差补贴,粮食风险基金,副食品风险基金,地方煤炭风险基金等。

中央财政收入和地方财政收入:指按现行分税制财政体制划分的中央本级收入和地方本级收入。1994年实行分税制财政体制以后,中央财政收入主要包括关税,海关代征消费税和增值税,消费税,中央企业所得税,地方银行和外资银行及非银行金融企业所得税,铁道部门、各银行总行、各保险总公司筹集中缴纳的营业税、利润和城市维护建设税,车辆购置税,船舶吨税,增值税的75%部分,证券交易印花税的94%部分,个人所得税的利息所得税部分和海洋石油资源税。地方财政收入主要包括营业税,地方企业所得税,个人所得税(不含利息所得税部分),城镇土地使用税,固定资产投资方向调节税,城市维护建设税,房产税,车船使用牌照税,印花税,屠宰税,农牧业税,农业特产税,耕地占用税,契税,土地增值税,国有土地有偿使用收入,增值税25%部分,证券交易印花税的6%部分和除海洋石油资源税以外的其他资源税。

中央财政支出和地方财政支出:指根据各级政府在经济和社会活动的不同职责,划分中央和地方政府的事权,进而确定的中央本级财政支出和地方本级财政支出。中央财政支出主要包括国防支出,武装警察部队支出,中央级行政管理费和各项事业费,重点建设支出以及中央政府调整国民经济结构、协调地区发展、实施宏观调控等方面的支出。地方财政支出主要包括地方行政管理和各项事业费,地方统筹的基本建设、技术改造支出,支援农村生产支出,城市维护和建设经费,政策性补贴支出等。

预算外资金收支:指国家机关、事业单位和社会团体为履行或代行政府职能,依据国家法律、法规和具有法律效力的规章而收取、提取和安排使用的未纳入国家预算管理的各项财政性资金。其范围主要包括:法律、法规规定的行政事业性收费、政府性基金和附加收入等,国务院或省级人民政府及其财政、计划(物价)部门审批的行政事业性收费,国务院及财政部审批建立的政府性基金、附加收入,以及其他未纳入预算管理的财政性资金。社会保障基金在国家财政尚未建立社会保障预算制度以前,先按预算外资金管理制度进行管理,专款专用。财政部门在银行开设统一的专户,用于预算外资金收入和支出管理。部门和单位的预算外收入必须上缴同级财政专户,支出由同级财政按部门预算或预算外资金收支计划和单位财务收支计划统筹安排,从财政专户中拨付,实行收支两条线管理。

债务收入:国家以信用形式筹措的资金,包括财政部对国内商业银行和其他投资者发行的各种政府债券、财政部在国际资金市场发行的外币债券以及国家财政“统借统还”的其他政府外债。

债务还本支出:指国家财政用于偿还国内、国外债务本金支出。

中央财政赤字:指当年中央财政总支出大于中央财政总收入的差额。

Explanatory Notes on Main Statistical Indicators

Government Revenue refers to the revenue of the govern-ment finance by means of participating in the distribution of the social products,which is the financial resources for ensuring the government to function.The contents of government revenue have been changed several times.Now it includes the following main items:

(1)Various tax revenues,including value added tax,con-sumption tax,business tax,tax on city maintenance and construc-tion,resources tax,tax on use of urban land,enterprise income tax,personal income tax,tariffs,tax on agriculture and animal hus-bandry,contract tax,tax on occupancy of cultivated land,stamp tax on security exchange and vehicle purchase tax etc.

(2)Special revenues,including revenue collected from im-posing fee on sewage treatment,revenue collected from imposing fee on urban water resources,and extra-charges for education,etc.

(3)Other revenues,including revenue from the repayment of capital construction loan,revenue from capital construction Pro-jects,and donations and grants.

(4)Subsidies to the loss-making enterprises,which is an item of negative revenue used to eat up part of the government revenue.

Government Expenditure refers to the distribution and use of the funds the government finance has raised,so as to meet the needs of economic construction and various causes.It includes the following main items:

(1)Expenditure for capital construction:It refers to the non-gratuitous use and appropriation of funds for capital construction in the range of capital construction,outlay of capital as well as the loans on capital construction approved by the government for special purpose or policy purpose and the expenditure with dis-count paid in and overall way within the amount of the funds ap-propriated to the departments for capital construction.

(2)Innovation funds of the enterprisesThey refer to the funds appropriated from the government budget for the enterprises to tap the latent power,upgrade the technology and carry out inno-vation,including the innovation fund of the departments,loan of the enterprises for innovation.

(3)Geological prospecting expenses:They refer to the ex-penses appropriated from the government budget to the geological prospecting units for the expenditures of the prospecting work,including the expenditures of the administrative agencies for geo-logical prospecting and their institutional units as well as the ge-ological prospecting expenditure.

(4)Science and technology promotion funds:They refer to the expenses appropriated from the government budget for the new product developmentt expenditure,expenditure for intermedi-ate trial and subsidies on important scientific researches.

(5)Expenditure for supporting rural production:It refers to the expenditures appropriated from the government budget forsupporting the various expenditures of the rural collective units or households for production,including the subsidies to the small water conservancy projects and well drilling,sprinkling irrigation projects run by the villages;subsidies to the expenditure for popu-larization of the agricultural technologies and plant protection in the rural areas;subsidies to the expenditure for the protection of grasslands and cattle and fowls;subsidies on a forestation and for_est production in rural areas;subsidies on the rural aquatic prod-ucts industry;special fund for developing grain production.

(6)Operating expenses of the departments of farming,forestry,water conservancy and meteorology ctc.:They refer to the expenses appropriated from the government budget for the expenditures of agricultural exclamation,farms,agriculture,ani-mal husbandry,agricultural machinery,forestry,timber industry,water conservancy,aquatic products industry,meteorology,tech-nology popularization in township enterprises,popularization(demonstration)of improved vanities,plant(cattle and fowls,forest protection,water quality monitoring,prospecting and designing,resources investigation,cadres training etc.

(7)Operating expenses of the departments of industry,trans-port and commerce:They refer to the expenses appropriated from the government budget to the departments of industry,transport and commerce for the expenditure of business development etc.

(8)Operating expenses for culture,education,science and public health:They refer to the expenses appropriated from the government budget for the expenditures of the causes of culture,publication,cultural relics,free medical services,sports,archives,earthquake,ocean,communications,broadcasting,film and tele-vision,family planning;expenditure for training of cadres of gov-ernment,party and mass organization;expenditures for natural sciences,social sciences,associations for science and technology,public health,traditional Chinese medical administration etc.

(9)Pension and relief funds for social welfare:They refer to the funds appropriated from the government budget for the ex-penditures of pension for the disabled or for the families of the bereaved and relief funds for social welfare,including the lump-sum or regular pension paid by the departments of civil affairs to the members of martyrs families and families of those who died for the public interest,pension to the revolutionary disabled,sub-sidies for permanent disability of various kinds,subsidies to the military martyrs dependents and the demobilized servicemen,ex-penditure for settling down the demobilized servicemen,operating expenses of the consoling institutions,expenses for management and repair of the commemorative buildings for the martyre,the expenses managed by the departments of civil affairs for the re-tirees and those who have quitted their work,expenses for social belief in rural and urban areas,operating expenses for providing relief to the areas of natural calamity and subsidies on the recon-struction after the particularly severe natural calamities,etc.

(10)Expenditures for national defence:They refer to the funds appropriated from the government budget for the expendi-tures for building up national defence and safeguarding national security,inducing expenses of national defence,expenses of sci-entific researches on national defence,expenses for building up People’s militia and expenditure for special projects,etc.

(11)Expenses for government administration:They refer to the expenditure for administration,including the administrative expenses of the National People’s Congress,the government sec-tors,the National People’s Political Conference,the Communist Party,the democratic parties sectors and other juridical associa-tion.

(12)Expenditure for price subsidies:It refers to the expen-diture appropriated,with the approval of the government,from the governmentbudget for the policy subsidies to price adjustment,including the fund for the increase of grain prices,the subsidise to the difference between the selling prices and purchasing prices of grains,cotton and edible oil,awards in addition to the pur-chasing prices of cotton,risk fund for non_staple food.

Revenue of the central government and revenue of the local governments:In accordance with the classification of the structure of the government finance in 1994on the basis of the classification of channels for collection of tax revenues,the rev-enue of the central government and the revenue of the local gov-ernments have different coverage.The revenue of the central gov-ernment includes tariff,consumption tax and value added tax levied by the customs,consumption tax,income tax of the enter-prises subordinate to the central government,income taxes of the local banks,foreign-funded banks and non-bank financial insti-tutions,business tax,profits of railways,head offices of banks,head office of insurance company,which are handed over to the government in a centralized way,tax on city maintenance and construction,vehicle purchase tax,cargo tax,75% of the val-ueadded tax,tax on ocean petroleum resources,94% of the stamp tax on security exchange,the income tax of the interests.The rev-enue of the local governments includes business tax,income tax of the enterprises subordinate to the local government,personal income tax(excluding the income tax of interest),tax on the use of urban land,tax on the adjust of the investment in fixed assets,tax on town maintenance and construction,tax on real estates,tax on the use of vehicles and ships,stamp tax,slaughter tax,tax on a-griculture and animal husbandry,tax on special agricultural products,tax on the occupancy of cultivated land,contract tax,the value added tax of the land,the state owned land usage tax,25%of the value added tax,6% of the tax on stock dealing(stamp tax)and tax on resources other than the ocean petroleum resources.

Expenditure of the central government and expenditure of the local governments:according to the different functions of the central government and local governments in the economic and social activities,the rights of affairs administration are clas-sified between the central government and local governments;and the classification of the expenditure between the central govern-ment and local governments are made on the basis of the classifi-cation of the rightsof affairs administration between them.The expenditure of the central government includes the expenditurefor national defence,expenditure for armed police forces,the ad-minis trative expenses and various operating expenses at the level of central government,expenditure for key projects and the ex-penditure of the central government for adjusting the national e-conomic structure,coordinating the development among different regions and exercising the macro-economic regulation and con-trol.The expenditure of the local governments includes mainly the administrative expenses and various operating expenses at the level of local governments,the expenditure for capital construc-tion and technological innovation with the funds raised by the lo-cal government,expenditure for supporting rural production,ex-penditure for city maintenance and construction and expenditure for price subsidies,etc.

Extra-budgetary revenue and expenditure:Extra-bud-getary fund refers to financial fund of various types not covered by the regular government budgetary management,which is col-lected,allocated or arranged by government agencies,institutions and social organizations while performing duties delegated to them or on behalf of the government in accordance with laws,rules and regulations.It may covers following items:administrative and institutional fees,funds and extra charges that are stipulated by laws and regulations;administrative and institutional fees ap-proved by the State Council and provincial governments and their financial and planning(price management)department;funds and extra charges established by the State Council and the Ministry of Finance;funds turned over to competent departments by their subordinate institutions;self-raised and collected fundsby town-ship governments for their own expenditure and other financial funds that are not covered in budgetary management.Social secu-rity funds are treated as extra-budget fund and managed for its exclusive use,given the circumstance that separate government budgetary system for social security is yet to be designed.Special accounts are opened by the financial departments in banks for the management of revenue and expenditure of extra-budgetary fund.Extra-budgetary revenge and expenditure are managed sep-arately,namely,revenue of institutions and departments must en-ter into the special accounts of the financial departments at the same administrative level,and their extrabudgetary expenditure is arranged in line with the extra-budget plans and appropriated from these accounts.

Debt Revenue refers to the fund raised by the government in the form of credit.It includes the various kinds of government bonds issued to the domestic commercial bank and other in-vestors by the Ministry of Finance,the foreign currency bonds is-sued at the international capital market by the Ministry of finance and other“unitive borrowing and refunding”foreign debt.

Expenditure of the Principal payment for National Debts refers to the government expenditure of the principal pay-ment for the foreign and domestic debts of the fiscal year.

Central government deficit refers to the gap between the total Certrial government expenditure and the total central gov-ernment revenue of the fiscal year.

附件下载:

附件下载:相关推荐

京公网安备 11010802030967号

京公网安备 11010802030967号